Procedures and import duty for Decal into Vietnam

Import Decal to Vietnam: Customs procedures; import duty and transportation 2024

Do you want to export Decal to Vietnam? Do you need to calculate freight from the export warehouse to Vietnam? You want to know about Vietnam’s procedure and import duties for importing Decal to Vietnam? Import procedures for Decal?

In this article, Logistics HP Global Vietnam, whose many years in providing freight and logistics services import Decal from many countries to Vietnam, will share knowledge and advice on the above issues.

HS code and import duty of Decal in Vietnam 2024

HS Code, Duties, Taxes on importing Decal to Vietnam:

Decal’s HS code in Chapter 49 – Printed books, newspapers, pictures and other products of the printing industry; manuscripts, typescripts and plans

When importing Decal to Vietnam, the importer needs to pay

- Import value-added tax (VAT)

- Import duty

| HS Code | Descriptions | VAT (%) | Preferential Import duty (%) |

| 4908 | Transfers (decalcomanias) | ||

| 49089000 | – Other | 8% | 15% |

Note: The HS code and taxes mentioned above are for reference only.

Import duty on Decal into Vietnam from Major Markets in 2024

- Decal import duty from China to Vietnam: 0% (ACFTA) or 15% (Preferential Import duty)

- Decal import duty from India to Vietnam: 0% (AIFTA)

- Decal import duty from USA to Vietnam: 15% (Preferential Import duty)

- Decal import duty from ASEAN to Vietnam: 0% (ATIGA) or 12% (RCEP)

- Decal import duty from Korea to Vietnam: 0% (AKFTA) or 0% (VKFTA) or 12% (RCEP)

- Decal import duty from Japan to Vietnam: 0% (AJCEP) or 0% (VJEPA) or 12,2% (RCEP) or 0% (CPTPP)

- Decal import duty from UK to Vietnam: 7,5% (UKVFTA)

- Decal import duty from EU countries to Vietnam: 7,5% (EVFTA)

- Decal import duty from Australia to Vietnam: 0% (AANZFTA) or 12% (RCEP)

- Decal import duty from Russia to Vietnam: 1,8% (EAEUFTA)

- Decal import duty from Canada to Vietnam: 0% (CPTPP)

- Decal import duty from Mexico to Vietnam: 0% (CPTPP)

The above list is import taxes on Decal from some major markets. Note: for countries with FTAs, goods can only enjoy Special preferential import taxes above if they meet the conditions as required by the agreement. If the conditions of the agreement are not met, they will enjoy Preferential import tax.

| If you encounter any difficulties in determining the import tax, please contact us via hotline at ++ 84 886115726 / ++ 84 984870199 or whatsapp: ++84 865996476 for free consultation. |

Governmental management on importing Decal to Vietnam

What certificates are required in importing Decal to Vietnam?

There is no special governmental management policy on importing Decal to Vietnam

-> Contact Phone: ++84 984870199, whatsapp: ++84 865996476; email info@hpgloballtd.com

Customs procedure to import Decal into Vietnam:

What documents are required for importing Decal to Vietnam? What procedures are needed for importing Decal to Vietnam?

Because there is no special sector-specific management on importing Decal to Vietnam, when importing Decal, the importer submits the import document set in accordance with standard regulations (Invoice; Bill of Lading; Packing List; Certificate of Origin if needed..).

Label for Decal imported to Vietnam:

Decal to imported into Vietnam must comply with regulations regarding labeling for imported goods (Name of goods; Name and address of the organization/individual responsible for the goods; Origin of the goods, Other contents according to the nature of each type of goods)

Freight Shipping For Decal To Vietnam

Shipping time by sea and by air

To check the specific international shipping times by port or airport, you can send a message or call the phone/Zalo number ++84 886115726 – ++84 984870199, whatsapp: ++84 865996476; email: info@hpgloballtd.com

Shipping freight

Freight charges depend on many factors, both fixed and variable over time. Therefore, please provide specific or anticipated shipment details to HP Global Vietnam to receive a complete quote on all costs for the entire import process. – Contact: ++84 886115726 or ++84 984870199, whatsapp: ++84 865996476, email: info@hpgloballtd.com

Procedures for Importing Certain Similar Products

| Commodity | Related link |

| Swimming pool pump | import duty and procedures for Swimming pool pump to Vietnam |

| UV drying light | Import duty and procedures for UV drying light to Vietnam |

| Drying machines | Import Duty And Procedures For Drying Machines To Vietnam |

| Stirring machines | Import duty and procedures for Stirring machine to Vietnam |

| Circuit breaker | Procedures and Import Duty for Circuit breaker into Vietnam |

Select HP Global as the freight forwarder/customs broker for your shipments import Decal into Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

→ Contact us for freight and inbound and outbound services for shipments to/from Vietnam – Email: info@hpgloballtd.com

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, La Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726/ Whatsapp: ++84 865996476

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

Procedures and import duty for Stirring machine into Vietnam

Import Stirring machine to Vietnam: Customs procedures; import duty and transportation 2024

Do you want to export Stirring machine to Vietnam? Do you need to calculate freight from the export warehouse to Vietnam? You want to know about Vietnam’s procedure and import duties for importing Stirring machine to Vietnam? Import procedures for Stirring machine?

In this article, Logistics HP Global Vietnam, whose many years in providing freight and logistics services import Stirring machine from many countries to Vietnam, will share knowledge and advice on the above issues.

HS code and import duty of Stirring machine in Vietnam 2024

HS Code, Duties, Taxes on importing Stirring machine to Vietnam:

Stirring machine’s HS code in Chapter 84 – Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof

When importing Stirring machine to Vietnam, the importer needs to pay

- Import value-added tax (VAT)

- Import duty

| HS Code | Descriptions | VAT (%) | Preferential Import duty (%) |

| 8479 |

Machines and mechanical appliances having individual functions, not specified or included elsewhere in this Chapter

|

||

| 84798220 | – – – Not electrically operated | 8% | 0% |

Note: The HS code and taxes mentioned above are for reference only.

Import duty on Stirring machine into Vietnam from Major Markets in 2024

- Stirring machine import duty from China to Vietnam: 0% (ACFTA) or 0% (RCEP)

- Stirring machine import duty from India to Vietnam: 0% (AIFTA)

- Stirring machine import duty from USA to Vietnam: 0% (Preferential Import duty)

- Stirring machine import duty from ASEAN to Vietnam: 0% (ATIGA) or 0% (RCEP)

- Stirring machine import duty from Korea to Vietnam: 0% (AKFTA) or 0% (VKFTA) or 0% (RCEP)

- Stirring machine import duty from Japan to Vietnam: 0% (AJCEP or VJEPA) or 0% (RCEP) or 0% (CPTPP)

- Stirring machine import duty from UK to Vietnam: 0% (UKVFTA)

- Stirring machine import duty from EU countries to Vietnam: 0% (EVFTA)

- Stirring machine import duty from Australia to Vietnam: 0% (AANZFTA) or 0% (RCEP)

- Stirring machine import duty from Russia to Vietnam: 0% (EAEUFTA)

- Stirring machine import duty from Canada to Vietnam: 0% (CPTPP)

- Stirring machine import duty from Mexico to Vietnam: 0% (CPTPP)

The above list is import taxes on Stirring machine from some major markets. Note: for countries with FTAs, goods can only enjoy Special preferential import taxes above if they meet the conditions as required by the agreement. If the conditions of the agreement are not met, they will enjoy Preferential import tax.

| If you encounter any difficulties in determining the import tax, please contact us via hotline at ++ 84 886115726 / ++ 84 984870199 or whatsapp: ++84 865996476 for free consultation. |

Governmental management on importing Stirring machine to Vietnam

What certificates are required in importing Stirring machine to Vietnam?

There is no special governmental management policy on importing Stirring machine to Vietnam

-> Contact Phone: ++84 984870199, whatsapp: ++84 865996476; email info@hpgloballtd.com

Customs procedure to import Stirring machine into Vietnam:

What documents are required for importing Stirring machine to Vietnam? What procedures are needed for importing Stirring machine to Vietnam?

Because there is no special sector-specific management on importing Stirring machine to Vietnam, when importing Stirring machine, the importer submits the import document set in accordance with standard regulations (Invoice; Bill of Lading; Packing List; Certificate of Origin if needed..).

Label for Stirring machine imported to Vietnam:

Stirring machine to imported into Vietnam must comply with regulations regarding labeling for imported goods (Name of goods; Name and address of the organization/individual responsible for the goods; Origin of the goods, Other contents according to the nature of each type of goods)

Freight Shipping For Stirring machine To Vietnam

Shipping time by sea and by air

To check the specific international shipping times by port or airport, you can send a message or call the phone/Zalo number ++84 886115726 – ++84 984870199, whatsapp: ++84 865996476; email: info@hpgloballtd.com

Shipping freight

Freight charges depend on many factors, both fixed and variable over time. Therefore, please provide specific or anticipated shipment details to HP Global Vietnam to receive a complete quote on all costs for the entire import process. – Contact: ++84 886115726 or ++84 984870199, whatsapp: ++84 865996476, email: info@hpgloballtd.com

Procedures for Importing Certain Similar Products

| Commodity | Related link |

| Swimming pool pump | import duty and procedures for Swimming pool pump to Vietnam |

| UV drying light | Import duty and procedures for UV drying light to Vietnam |

| Drying machines | Import Duty And Procedures For Drying Machines To Vietnam |

| Generator | Import Procedure of Generator into Vietnam |

| Circuit breaker | Procedures and Import Duty for Circuit breaker into Vietnam |

Select HP Global as the freight forwarder/customs broker for your shipments import Stirring machine into Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

→ Contact us for freight and inbound and outbound services for shipments to/from Vietnam – Email: info@hpgloballtd.com

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, La Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726/ Whatsapp: ++84 865996476

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

Procedures and import duty for Leak detector into Vietnam

Import Leak detector to Vietnam: Customs procedures; import duty and transportation 2024

Do you want to export Leak detector to Vietnam? Do you need to calculate freight from the export warehouse to Vietnam? You want to know about Vietnam’s procedure and import duties for importing Leak detector to Vietnam? Import procedures for Leak detector?

In this article, Logistics HP Global Vietnam, whose many years in providing freight and logistics services import Leak detector from many countries to Vietnam, will share knowledge and advice on the above issues.

HS code and import duty of Leak detector in Vietnam year 2024

HS Code, Duties, Taxes on importing Leak detector to Vietnam:

Leak detector’s HS code in Chapter 90: Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof

When importing Leak detector to Vietnam, the importer needs to pay

- Import value-added tax (VAT)

- Import duty

| HS Code | Descriptions | VAT (%) | Preferential Import duty (%) | Normal import tax (%) |

| 9028 | Gas, liquid or electricity supply or production meters, including calibrating meters therefor | |||

| 90282090 | – – Other | 8% | 0% | 5% |

Note: The HS code and taxes mentioned above are for reference only.

Import duty on Leak detector into Vietnam from Major Markets in 2024

- Leak detector import duty from China to Vietnam: 0% (ACFTA) or 0% (RCEP)

- Leak detector import duty from India to Vietnam: 0% (AIFTA)

- Leak detector import duty from USA to Vietnam: 0% (Preferential Import duty)

- Leak detector import duty from ASEAN to Vietnam: 0% (ATIGA) or 0% (RCEP)

- Leak detector import duty from Korea to Vietnam: 0% (AKFTA) or 0% (VKFTA) or 0% (RCEP)

- Leak detector import duty from Japan to Vietnam: 0% (AJCEP) or 0% (VJEPA) or 0% (RCEP) or 0% (CPTPP)

- Leak detector import duty from UK to Vietnam: 0% (UKVFTA)

- Leak detector import duty from EU countries to Vietnam: 0% (EVFTA)

- Leak detector import duty from Australia to Vietnam: 0% (AANZFTA) or 0% (RCEP)

- Leak detector import duty from Russia to Vietnam: 0% (VN-EAEUFTA)

- Leak detector import duty from Canada to Vietnam: 0% (CPTPP)

- Leak detector import duty from Mexico to Vietnam: 0% (CPTPP)

The above list is import taxes on Leak detector from some major markets. Note: for countries with FTAs, goods can only enjoy Special preferential import taxes above if they meet the conditions as required by the agreement. If the conditions of the agreement are not met, they will enjoy Preferential import tax.

| If you encounter any difficulties in determining the import tax, please contact us via hotline at ++ 84 886115726 / ++ 84 984870199 or whatsapp: ++84 865996476 for free consultation. |

Governmental management on importing Leak detector to Vietnam

What certificates are required in importing Leak detector to Vietnam?

What documents are required for importing Leak detector to Vietnam? What procedures are needed for importing Leak detector to Vietnam?

Because there is no special sector-specific management on importing Leak detector to Vietnam, when importing Leak detector, the importer submits the import document set in accordance with standard regulations (Invoice; Bill of Lading; Packing List; Certificate of Origin if needed..).

Label for Leak detector imported to Vietnam:

Leak detector to imported into Vietnam must comply with regulations regarding labeling for imported goods (Name of goods; Name and address of the organization/individual responsible for the goods; Origin of the goods, Other contents according to the nature of each type of goods)

Freight Shipping For Leak detector To Vietnam

Shipping time by sea and by air

To check the specific international shipping times by port or airport, you can send a message or call the phone/Zalo number ++84 886115726 – ++84 984870199, whatsapp: ++84 865996476; email: info@hpgloballtd.com

Shipping freight

Freight charges depend on many factors, both fixed and variable over time. Therefore, please provide specific or anticipated shipment details to HP Global Vietnam to receive a complete quote on all costs for the entire import process. – Contact: ++84 886115726 or ++84 984870199, whatsapp: ++84 865996476, email: info@hpgloballtd.com

Procedures for Importing Certain Similar Products

| Commodity | Related link |

| Binoculars | Import Duty And Procedures For Binoculars To Vietnam |

| Electronic massage | Import Procedures for Electronic Massage Chairto Vietnam |

| Computer repair training kit | Import Computer repair training kit to Vietnam |

| Electric test pen | Import Procedures for Electric test pen to Vietnam |

| Fingerprint reader | Import Duty And Procedures For Fingerprint Reader To Vietnam |

Select HP Global as the freight forwarder/customs broker for your shipments import Leak detector into Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

→ Contact us for freight and inbound and outbound services for shipments to/from Vietnam – Email: info@hpgloballtd.com

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, La Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726/ Whatsapp: ++84 865996476

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

Procedures and import duty for Fiberglass mesh into Vietnam

Import Fiberglass mesh to Vietnam: Customs procedures; import duty and transportation 2024

Do you want to export Fiberglass mesh to Vietnam? Do you need to calculate freight from the export warehouse to Vietnam? You want to know about Vietnam’s procedure and import duties for importing Fiberglass mesh to Vietnam? Import procedures for Fiberglass mesh?

In this article, Logistics HP Global Vietnam, whose many years in providing freight and logistics services import Fiberglass mesh from many countries to Vietnam, will share knowledge and advice on the above issues.

HS code and import duty of Fiberglass mesh in Vietnam year 2024

HS Code, Duties, Taxes on importing Fiberglass mesh to Vietnam:

Fiberglass mesh’s HS code in Chapter 70: Glass and glass products

When importing Fiberglass mesh to Vietnam, the importer needs to pay

- Import value-added tax (VAT)

- Import duty

| HS Code | Descriptions | VAT (%) | Preferential Import duty (%) | Normal import tax (%) |

| 7019 | Glass fibres (including glass wool) and articles thereof (for example, yarn, rovings, woven fabrics) | |||

| 70199090 | – – Other | 8% | 3% | 4.5% |

Note: The HS code and taxes mentioned above are for reference only.

Import duty on Fiberglass mesh into Vietnam from Major Markets in 2024

- Fiberglass mesh import duty from China to Vietnam: 0% (ACFTA) or 0% (RCEP)

- Fiberglass mesh import duty from India to Vietnam: 0% (AIFTA)

- Fiberglass mesh import duty from USA to Vietnam: 3% (Preferential Import duty)

- Fiberglass mesh import duty from ASEAN to Vietnam: 0% (ATIGA) or 0% (RCEP)

- Fiberglass mesh import duty from Korea to Vietnam: 0% (AKFTA) or 0% (VKFTA) or 0% (RCEP)

- Fiberglass mesh import duty from Japan to Vietnam: 0% (AJCEP) or 0% (VJEPA) or 0% (RCEP) or 0% (CPTPP)

- Fiberglass mesh import duty from Australia to Vietnam: 0% (AANZFTA) or 0% (RCEP)

- Fiberglass mesh import duty from Russia to Vietnam: 0% (VN-EAEUFTA)

- Fiberglass mesh import duty from Canada to Vietnam: 0% (CPTPP)

- Fiberglass mesh import duty from Mexico to Vietnam: 0% (CPTPP)

The above list is import taxes on Fiberglass mesh from some major markets. Note: for countries with FTAs, goods can only enjoy Special preferential import taxes above if they meet the conditions as required by the agreement. If the conditions of the agreement are not met, they will enjoy Preferential import tax.

| If you encounter any difficulties in determining the import tax, please contact us via hotline at ++ 84 886115726 / ++ 84 984870199 or whatsapp: ++84 865996476 for free consultation. |

Governmental management on importing Fiberglass mesh to Vietnam

What certificates are required in importing Fiberglass mesh to Vietnam?

There is no special governmental management policy on importing Fiberglass mesh to Vietnam

Customs procedure to import Fiberglass mesh into Vietnam:

What documents are required for importing Fiberglass mesh to Vietnam? What procedures are needed for importing Fiberglass mesh to Vietnam?

Because there is no special sector-specific management on importing Fiberglass mesh to Vietnam, when importing Fiberglass mesh, the importer submits the import document set in accordance with standard regulations (Invoice; Bill of Lading; Packing List; Certificate of Origin if needed..).

Label for Fiberglass mesh imported to Vietnam:

Fiberglass mesh to imported into Vietnam must comply with regulations regarding labeling for imported goods (Name of goods; Name and address of the organization/individual responsible for the goods; Origin of the goods, Other contents according to the nature of each type of goods)

Freight Shipping For Fiberglass mesh To Vietnam

Shipping time by sea and by air

To check the specific international shipping times by port or airport, you can send a message or call the phone/Zalo number ++84 886115726 – ++84 984870199, whatsapp: ++84 865996476; email: info@hpgloballtd.com

Shipping freight

Freight charges depend on many factors, both fixed and variable over time. Therefore, please provide specific or anticipated shipment details to HP Global Vietnam to receive a complete quote on all costs for the entire import process. – Contact: ++84 886115726 or ++84 984870199, whatsapp: ++84 865996476, email: info@hpgloballtd.com

Procedures for Importing Certain Similar Products

| Commodity | Related link |

| Heat absorbing glass | Import Procedures for Heat Absorbing Glass to Vietnam |

| Glass mirrors | Import Duty And Procedures For Glass mirrors (framed) To Vietnam |

| Crystal ball | Import Procedures for Crystal ball to Vietnam |

| Glass bottle | Import Procedure of Glass bottle to Vietnam |

| Glass cup | Import Procedure of glass cup to Vietnam |

Select HP Global as the freight forwarder/customs broker for your shipments import Fiberglass mesh into Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

→ Contact us for freight and inbound and outbound services for shipments to/from Vietnam – Email: info@hpgloballtd.com

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, La Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726/ Whatsapp: ++84 865996476

Procedures and import duty for Computer repair training kit into Vietnam

Import Computer repair training kit to Vietnam: Customs procedures; import duty and transportation 2024

Do you want to export Computer repair training kit to Vietnam? Do you need to calculate freight from the export warehouse to Vietnam? You want to know about Vietnam’s procedure and import duties for importing Computer repair training kit to Vietnam? Import procedures for Computer repair training kit?

In this article, Logistics HP Global Vietnam, whose many years in providing freight and logistics services import Computer repair training kit from many countries to Vietnam, will share knowledge and advice on the above issues.

HS code and import duty of Computer repair training kit in Vietnam 2024

HS Code, Duties, Taxes on importing Computer repair training kit to Vietnam:

Computer repair training kit’s HS code in Chapter 90 – Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof

When importing Computer repair training kit to Vietnam, the importer needs to pay

- Import value-added tax (VAT)

- Import duty

| HS Code | Descriptions | VAT (%) | Preferential Import duty | Normal import tax |

| 90230000 | Instruments, apparatus and models, designed for demonstrational purposes (for example, in education or exhibitions), unsuitable for other uses | 8/5; Particularly: Types used for teaching and learning in group 90.23: 5% | 0% | 5% |

Note: The HS code and taxes mentioned above are for reference only.

Import duty on Computer repair training kit into Vietnam from Major Markets in 2024

- Computer repair training kit import duty from China to Vietnam: 0% (ACFTA) or 0% (RCEP)

- Computer repair training kit import duty from India to Vietnam: 0% (AIFTA)

- Computer repair training kit import duty from USA to Vietnam: 0% (Preferential Import duty)

- Computer repair training kit import duty from ASEAN to Vietnam: 0% (ATIGA) or 0% (RCEP)

- Computer repair training kit import duty from Korea to Vietnam: 0% (AKFTA or VKFTA) or 0% (RCEP)

- Computer repair training kit import duty from Japan to Vietnam: 0% (AJCEP or VJEPA) or 0% (RCEP) or 0% (CPTPP)

- Computer repair training kit import duty from UK to Vietnam: 0% (UKVFTA)

- Computer repair training kit import duty from EU countries to Vietnam: 0% (EVFTA)

- Computer repair training kit import duty from Australia to Vietnam: 0% (AANZFTA) or 0% (RCEP)

- Computer repair training kit import duty from Russia to Vietnam: 0% (EAEUFTA)

- Computer repair training kit import duty from Canada to Vietnam: 0% (CPTPP)

- Computer repair training kit import duty from Mexico to Vietnam: 0% (CPTPP)

The above list is import taxes on Computer repair training kit from some major markets. Note: for countries with FTAs, goods can only enjoy Special preferential import taxes above if they meet the conditions as required by the agreement. If the conditions of the agreement are not met, they will enjoy Preferential import tax.

| If you encounter any difficulties in determining the import tax, please contact us via hotline at ++ 84 886115726 / ++ 84 984870199 or whatsapp: ++84 865996476 for free consultation. |

Governmental management on importing Computer repair training kit to Vietnam

What certificates are required in importing Computer repair training kit to Vietnam?

There is no special governmental management policy on importing Computer repair training kit to Vietnam

-> Contact Phone: ++84 984870199, whatsapp: ++84 865996476; email info@hpgloballtd.com

Customs procedure to import Computer repair training kit into Vietnam:

What documents are required for importing Computer repair training kit to Vietnam? What procedures are needed for importing Computer repair training kit to Vietnam?

Because there is no special sector-specific management on importing Computer repair training kit to Vietnam, when importing Computer repair training kit, the importer submits the import document set in accordance with standard regulations (Invoice; Bill of Lading; Packing List; Certificate of Origin if needed..).

Label for Computer repair training kit imported to Vietnam:

Computer repair training kit to imported into Vietnam must comply with regulations regarding labeling for imported goods (Name of goods; Name and address of the organization/individual responsible for the goods; Origin of the goods, Other contents according to the nature of each type of goods)

Freight Shipping For Computer repair training kit To Vietnam

Shipping time by sea and by air

To check the specific international shipping times by port or airport, you can send a message or call the phone/Zalo number ++84 886115726 – ++84 984870199, whatsapp: ++84 865996476; email: info@hpgloballtd.com

Shipping freight

Freight charges depend on many factors, both fixed and variable over time. Therefore, please provide specific or anticipated shipment details to HP Global Vietnam to receive a complete quote on all costs for the entire import process. – Contact: ++84 886115726 or ++84 984870199, whatsapp: ++84 865996476, email: info@hpgloballtd.com

Procedures for Importing Certain Similar Products

| Commodity | Related link |

| Tape | Import Procedures for Tape to Vietnam |

| A4 paper | Import Procedures for A4 Paper to Vietnam |

| Certificate printing paper | Import Procedures for Certificate printing paper to Vietnam |

| Stapler | Import Procedure of Stapler into Vietnam |

| Writing Brushes | Import Procedures for Writing Brushes to Vietnam |

Select HP Global as the freight forwarder/customs broker for your shipments import Computer repair training kit into Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

→ Contact us for freight and inbound and outbound services for shipments to/from Vietnam – Email: info@hpgloballtd.com

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, La Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726/ Whatsapp: ++84 865996476

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

Procedures and import duty for Lead lined door of x-ray room into Vietnam

Import Lead lined door of x-ray to Vietnam: Customs procedures; import duty and transportation 2024

Do you want to export Lead lined door of x-ray to Vietnam? Do you need to calculate freight from the export warehouse to Vietnam? You want to know about Vietnam’s procedure and import duties for importing Lead lined door of x-ray to Vietnam? Import procedures for Lead lined door of x-ray?

In this article, Logistics HP Global Vietnam, whose many years in providing freight and logistics services import Lead lined door of x-ray from many countries to Vietnam, will share knowledge and advice on the above issues.

HS code and import duty of Lead lined door of x-ray in Vietnam 2024

HS Code, Duties, Taxes on importing Lead lined door of x-ray to Vietnam:

Lead lined door of x-ray’s HS code in Chapter 94: Furniture; bedding, mattresses, mattress supports, cushions and similar stuffed furnishings; luminaires and lighting fittings, not elsewhere specified or included; illuminated signs, illuminated name-plates and the like; prefabricated buildings

When importing Lead lined door of x-ray to Vietnam, the importer needs to pay

- Import value-added tax (VAT)

- Import duty

| HS Code | Descriptions | VAT (%) | Preferential Import duty (%) | Normal import tax (%) |

| 9402 | Medical, surgical, dental or veterinary furniture (for example, operating tables, examination tables, hospital beds with mechanical fittings, dentists’ chairs); barbers’ chairs and similar chairs, having rotating as well as both reclining and elevating movements; parts of the foregoing articles | |||

| 94029090 | – – Other | 8% | 0% | 5% |

Note: The HS code and taxes mentioned above are for reference only.

Import duty on Lead lined door of x-ray into Vietnam from Major Markets in 2024

- Lead lined door of x-ray import duty from China to Vietnam: 0% (ACFTA) or 0% (RCEP)

- Lead lined door of x-ray import duty from India to Vietnam: 5% (AIFTA)

- Lead lined door of x-ray import duty from USA to Vietnam: 0% (Preferential Import duty)

- Lead lined door of x-ray import duty from ASEAN to Vietnam: 0% (ATIGA) or 0% (RCEP)

- Lead lined door of x-ray import duty from Korea to Vietnam: 0% (AKFTA) or 0% (VKFTA) or 0% (RCEP)

- Lead lined door of x-ray import duty from Japan to Vietnam: 0% (AJCEP) or 0% (VJEPA) or 0% (RCEP) or 0% (CPTPP)

- Lead lined door of x-ray import duty from UK to Vietnam: 0% (UKVFTA)

- Lead lined door of x-ray import duty from EU countries to Vietnam: 0% (EVFTA)

- Lead lined door of x-ray import duty from Australia to Vietnam: 0% (AANZFTA) or 0% (RCEP)

- Lead lined door of x-ray import duty from Russia to Vietnam: 0% (EAEUFTA)

- Lead lined door of x-ray import duty from Canada to Vietnam: 0% (CPTPP)

- Lead lined door of x-ray import duty from Mexico to Vietnam: 0% (CPTPP)

The above list is import taxes on Lead lined door of x-ray from some major markets. Note: for countries with FTAs, goods can only enjoy Special preferential import taxes above if they meet the conditions as required by the agreement. If the conditions of the agreement are not met, they will enjoy Preferential import tax.

| If you encounter any difficulties in determining the import tax, please contact us via hotline at ++ 84 886115726 / ++ 84 984870199 or whatsapp: ++84 865996476 for free consultation. |

Governmental management on importing Lead lined door of x-ray to Vietnam

What certificates are required in importing Lead lined door of x-ray to Vietnam?

There is no special governmental management policy on importing Lead lined door of x-ray to Vietnam

-> Contact Phone: ++84 984870199, whatsapp: ++84 865996476; email info@hpgloballtd.com

Customs procedure to import Lead lined door of x-ray into Vietnam:

What documents are required for importing Lead lined door of x-ray to Vietnam? What procedures are needed for importing Lead lined door of x-ray to Vietnam?

Because there is no special sector-specific management on importing Lead lined door of x-ray to Vietnam, when importing Lead lined door of x-ray, the importer submits the import document set in accordance with standard regulations (Invoice; Bill of Lading; Packing List; Certificate of Origin if needed..).

Label for Lead lined door of x-ray imported to Vietnam:

Lead lined door of x-ray to imported into Vietnam must comply with regulations regarding labeling for imported goods (Name of goods; Name and address of the organization/individual responsible for the goods; Origin of the goods, Other contents according to the nature of each type of goods)

Freight Shipping For Lead line door of x-ray To Vietnam

Shipping time by sea and by air

To check the specific international shipping times by port or airport, you can send a message or call the phone/Zalo number ++84 886115726 – ++84 984870199, whatsapp: ++84 865996476; email: info@hpgloballtd.com

Shipping freight

Freight charges depend on many factors, both fixed and variable over time. Therefore, please provide specific or anticipated shipment details to HP Global Vietnam to receive a complete quote on all costs for the entire import process. – Contact: ++84 886115726 or ++84 984870199, whatsapp: ++84 865996476, email: info@hpgloballtd.com

Procedures for Importing Certain Similar Products

| Commodity | Related link |

| Hammers | Import Procedures for Hammers to Vietnam |

| Pilers | Import Duty And Procedures For Pliers To Vietnam |

| Countersink | Import duty and procedures for Countersink to Vietnam |

| Aliminium frame | Import Procedures for Aluminum frame to Vietnam |

| Metal shaping molds | Import duty and procedures for Metal shaping molds to Vietnam |

Select HP Global as the freight forwarder/customs broker for your shipments import Lead lined door of x-ray into Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

→ Contact us for freight and inbound and outbound services for shipments to/from Vietnam – Email: info@hpgloballtd.com

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, La Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726/ Whatsapp: ++84 865996476

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

Import Duty And Procedures For Electric welding machines To Vietnam

Import Electric welding machines to Vietnam: Customs procedures; import duty and transportation 2024

Do you want to export Electric welding machines to Vietnam? Do you need to calculate freight from the export warehouse to Vietnam? You want to know about Vietnam’s procedure and import duties for importing Electric welding machines to Vietnam? Import procedures for Electric welding machines?

In this article, Logistics HP Global Vietnam, whose many years in providing freight and logistics services import Electric welding machines from many countries to Vietnam, will share knowledge and advice on the above issues.

HS code and import duty of Electric welding machines in Vietnam year 2024

HS Code, Duties, Taxes on importing Electric welding machines to Vietnam:

Electric welding machines ‘s HS code Chapter 85: ELECTRICAL MACHINERY AND EQUIPMENT AND PARTS THEREOF; SOUND RECORDERS AND REPRODUCERS, TELEVISION IMAGE AND SOUND RECORDERS AND REPRODUCERS, AND PARTS AND ACCESSORIES OF SUCH ARTICLES

When importing Electric welding machines to Vietnam, the importer needs to pay

- Import value-added tax (VAT)

- Import duty

| HS Code | Descriptions | VAT | Preferential Import duty | Normal import tax |

| 8515 | Electric (including electrically heated gas), laser or other light or photon beam, ultrasonic, electron beam, magnetic pulse or plasma arc soldering, brazing or welding machines and apparatus, whether or not capable of cutting; electric machines and apparatus for hot spraying of metals or cermets. | |||

| 85158090 | – – Other | 8% | 0% | 5% |

Note: The HS code and taxes mentioned above are for reference only.

Import duty on Electric welding machines into Vietnam from Major Markets in 2024

- Electric welding machines import duty from China to Vietnam: 0% (ACFTA or RCEP)

- Electric welding machines import duty from India to Vietnam: 0% (AIFTA)

- Electric welding machines import duty from USA to Vietnam: 0% (Preferential Import duty)

- Electric welding machines import duty from ASEAN to Vietnam: 0% (ATIGA or RCEP)

- Electric welding machines import duty from Korea to Vietnam: 0% (AKFTA or VKFTA or RCEP)

- Electric welding machines import duty from Japan to Vietnam: 0% (AJCEP or VJEPA or RCEP or CPTPP)

- Electric welding machines import duty from UK to Vietnam: 0% (UKVFTA)

- Electric welding machines import duty from EU countries to Vietnam: 0% (EVFTA)

- Electric welding machines import duty from Australia to Vietnam: 0% (AANZFTA or RCEP)

- Electric welding machines import duty from Russia to Vietnam: 0% (EAEUFTA)

- Electric welding machines import duty from Canada to Vietnam: 0% (CPTPP)

- Electric welding machines import duty from Mexico to Vietnam: 0% (CPTPP)

The above list are import taxes on Electric welding machines from some major markets. Note: for countries with FTAs, goods can only enjoy Special preferential import taxes above if they meet the conditions as required by the agreement. If the conditions of the agreement are not met, they will enjoy Preferential import tax.

| If you encounter any difficulties in determining the import tax, please contact us via hotline at ++ 84 886115726 / ++ 84 984870199 or whatsapp: ++84 865996476 for free consultation. |

Governmental management on importing Electric welding machines to Vietnam

What certificates are required in importing Electric welding machines to Vietnam?

There is no special governmental management policy on importing Electric welding machines to Vietnam

Customs procedure to import Electric welding machines into Vietnam:

What documents are required for importing Electric welding machines to Vietnam? What procedures are needed for importing Electric welding machines to Vietnam?

Because there is no special sector-specific management on importing Electric welding machines to Vietnam, when importing Electric welding machines, the importer submits the import document set in accordance with standard regulations (Invoice; Bill of Lading; Packing List; Certificate of Origin if needed..).

Label for Electric welding machines imported to Vietnam:

Electric welding machines tobe imported into Vietnam must comply with regulations regarding labeling for imported goods (Name of goods; Name and address of the organization/individual responsible for the goods; Origin of the goods, Other contents according to the nature of each type of goods)

Freight Shipping For Electric welding machines To Vietnam

Shipping time by sea and by air

To check the specific international shipping times by port or airport, you can send a message or call the phone/Zalo number ++84 886115726 – ++84 984870199, whatsapp: ++84 865996476; email: info@hpgloballtd.com

Shipping freight

Freight charges depend on many factors, both fixed and variable over time. Therefore, please provide specific or anticipated shipment details to HP Global Vietnam to receive a complete quote on all costs for the entire import process. – Contact: ++84 886115726 or ++84 984870199, whatsapp: ++84 865996476, email: info@hpgloballtd.com

Procedures for Importing Certain Similar Products

| Commodity | Related link |

| Apparatus for protecting electrical circuits | Procedures and Tax Import Apparatus For Protecting Electrical Circuits |

| Electric oven | Procedures and Tax Import Electric Oven |

| Receiver equipment | Procedures and Tax Import Receiver Equipment |

| Electric test pen | Procedures and Tax Import Electric Test Pen |

| Power stocket | Procedures and Tax Import Power Stocket |

Select HP Global as the freight forwarder/customs broker for your shipments import Electric welding machines into Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

→ Contact us for freight and inbound and outbound services for shipments to/from Vietnam – Email: info@hpgloballtd.com

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, La Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726/ Whatsapp: ++84 865996476

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

Procedures and Import Duty for Car floor mat into Vietnam

Import Car floor mat to Vietnam: Customs procedures; import duty and transportation 2024

Do you want to export Car floor mat to Vietnam? Do you need to calculate freight from the export warehouse to Vietnam? You want to know about Vietnam’s procedure and import duties for importing Car floor mat to Vietnam? Import procedures for Car floor mat?

In this article, Logistics HP Global Vietnam, whose many years in providing freight and logistics services import Car floor mat from many countries to Vietnam, will share knowledge and advice on the above issues.

HS code and import duty of Car floor mat in Vietnam year 2024

HS Code, Duties, Taxes on importing Car floor mat to Vietnam:

Car floor mat’s HS code in Chapter 57: Carpets and other textile floor coverings

When importing Car floor mat to Vietnam, the importer needs to pay

- Import value-added tax (VAT)

- Import duty

| HS Code | Descriptions | VAT (%) | Preferential Import duty (%) | Normal import tax (%) |

| 5705 | Other carpets and other textile floor coverings, whether or not made up | |||

| 57050021 | – – Non-woven floor coverings, of a kind used for motor vehicles of headings 87.02, 87.03 or 87.04 | 5/5; Specifically: Types made from ropes, bamboo, rattan, reeds, wicker, straw, grass, rush, leaves, palm leaves, coconut shells, coconut husks, and water hyacinth belong to group 57.05: 5% | 12% | 18% |

Note: The HS code and taxes mentioned above are for reference only.

Import duty on Car floor mat into Vietnam from Major Markets in 2024

- Car floor mat import duty from China to Vietnam: 0% (ACFTA or RCEP)

- Car floor mat import duty from India to Vietnam: 0% (AIFTA)

- Car floor mat import duty from USA to Vietnam: 12% (Preferential Import duty)

- Car floor mat import duty from ASEAN to Vietnam: 0% (ATIGA or RCEP)

- Car floor mat import duty from Korea to Vietnam: 0% (AKFTA or VKFTA or RCEP)

- Car floor mat import duty from Japan to Vietnam: 0% (AJCEP or VJEPA or RCEP or CPTPP)

- Car floor mat import duty from UK to Vietnam: 0% (UKVFTA)

- Car floor mat import duty from EU countries to Vietnam: 0% (EVFTA)

- Car floor mat import duty from Australia to Vietnam: 0% (AANZFTA or RCEP)

- Car floor mat import duty from Russia to Vietnam: 0% (EAEUFTA)

- Car floor mat import duty from Canada to Vietnam: 0% (CPTPP)

- Car floor mat import duty from Mexico to Vietnam: 0% (CPTPP)

The above list are import taxes on Car floor mat from some major markets. Note: for countries with FTAs, goods can only enjoy Special preferential import taxes above if they meet the conditions as required by the agreement. If the conditions of the agreement are not met, they will enjoy Preferential import tax.

| If you encounter any difficulties in determining the import tax, please contact us via hotline at ++ 84 886115726 / ++ 84 984870199 or whatsapp: ++84 865996476 for free consultation. |

Governmental management on importing Car floor mat to Vietnam

What certificates are required in importing Car floor mat to Vietnam?

There is no special governmental management policy on importing Car floor mat to Vietnam

Customs procedure to import Car floor mat into Vietnam:

What documents are required for importing Car floor mat to Vietnam? What procedures are needed for importing Car floor mat to Vietnam?

Because there is no special sector-specific management on importing Car floor mat to Vietnam, when importing Car floor mat, the importer submits the import document set in accordance with standard regulations (Invoice; Bill of Lading; Packing List; Certificate of Origin if needed..).

Label for Car floor mat imported to Vietnam:

Car floor mat tobe imported into Vietnam must comply with regulations regarding labeling for imported goods (Name of goods; Name and address of the organization/individual responsible for the goods; Origin of the goods, Other contents according to the nature of each type of goods)

Freight Shipping For Car floor mat To Vietnam

Shipping time by sea and by air

To check the specific international shipping times by port or airport, you can send a message or call the phone/Zalo number ++84 886115726 – ++84 984870199, whatsapp: ++84 865996476; email: info@hpgloballtd.com

Shipping freight

Freight charges depend on many factors, both fixed and variable over time. Therefore, please provide specific or anticipated shipment details to HP Global Vietnam to receive a complete quote on all costs for the entire import process. – Contact: ++84 886115726 or ++84 984870199, whatsapp: ++84 865996476, email: info@hpgloballtd.com

Procedures for Importing Certain Similar Products

| Commodity | Related link |

| Rubber gasket | Procedures and Tax Import Rubber Gasket |

| Wire rope | Procedures and Tax Import Wire Rope |

| Wheels | Procedures and Tax Import Wheels |

| lifts | Procedures and Tax Import Lifts |

| Fog light cover | Procedures and Tax Import Fog Lights Cover |

Select HP Global as the freight forwarder/customs broker for your shipments import Car floor mat into Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

→ Contact us for freight and inbound and outbound services for shipments to/from Vietnam – Email: info@hpgloballtd.com

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, La Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726/ Whatsapp: ++84 865996476

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

- Published in Import - Auto Parts and accessories

Cargo shipping Vietnam – Mauritius

Shipping Vietnam – Mauritius: Types of shipping, transit time, Import/export duty and procedure

When transporting goods between Vietnam and Mauritius, you may face one or more of the following issues:

- Do not clearly understand state regulations on conditions and required documents when importing goods to Vietnam or exporting goods to Mauritius to benefit businesses/individuals?

- The need to calculate taxes and the time and costs involved in shipping goods from Mauritius to Vietnam or vice versa.

- Are you looking for a reputable, professional freight forwarder / customs broker for your shipment from Mauritius to Vietnam or from Vietnam to Mauritius?

With our extensive experience in transporting goods between Vietnam and Mauritius, this article by HP Global aims to provide guidance and general answers to these questions.

Methods of Cargo Transportation between Vietnam and Mauritius

Common methods of cargo transportation between Vietnam and Mauritius include:

- Sea Transportation (FCL/LCL): Transporting goods by sea, most common methods are Full Container Load (FCL) and Less than Container Load (LCL) options.

- Air Transportation

- Express Delivery Services (Courier)

-> Contact us if you need advice on suitable transportation solutions for your shipments. Hotline: ++84 984.870.199 WhatsApp: +8486 5996476 – Email: info@hpgloballtd.com / info@hptoancau.com.

Ocean freight shipping time Vietnam – Mauritius

Logistics HP Global provide sea freight from all ports in Vietnam to various ports in Mauritius and vice versal – Hotline: ++84 984.870.199 WhatsApp: +8486 5996476 – Email: info@hpgloballtd.com

Which ports in Mauritius do goods commonly arrive at for imports from Vietnam? Similarly, which ports in Vietnam do goods usually arrive at for imports from Mauritius?

Major International Ports in Vietnam and Mauritius:

| Mauritius main sea ports | Vietnam’s main sea ports |

|

Port Louis (Mauritius, Port code: MUPLU) |

Ho Chi Minh Area (VNSGN HO CHI MINH; VNVUT VUNG TAU; VNCLI CAT LAI; VNCMT CAI MEP) |

| Hai Phong Area (VNHPH HAIPHONG, VNCLH LACH HUYEN…) | |

| Da Nang (VNDAD DANANG) | |

| Quy Nhon (VNUIH) |

Shipping Containers Between Vietnam and Mauritius

The table below lists common shipping times for containers between several major international ports in Mauritius and Vietnam. For more specific information about corresponding services or from other ports in Mauritius, please contact HP Global’s advisory team at Hotline: ++84 984.870.199 / ++84 886115726 WhatsApp: +8486 5996476 – Email: info@hpgloballtd.com.

| Port name and port code | Sea freight shipping time from Vietnam to Mauritius

(Export from Vietnam to Mauritius) |

Sea freight shipping time from Mauritius to Vietnam

(Export from Mauritius to Vietnam) |

||||

| Hai phong Area | Da Nang | Ho Chi Minh Area | Hai phong Area | Da Nang | Ho Chi Minh Area | |

| Port Louis (Mauritius, Port code: MUPLU) | 19 – 41 days | 17 – 30 days | 12 – 16 days | 21 – 50 days | 12 – 28 days | 16 – 43 days |

In case you do not find the seaport information you need in the table above or want to have the most update information, please do not hesitate to contact us for up-to-date information on shipping times, schedules and shipping quotes from Vietnam to Mauritius and vice versal – Email: info@hpgloballtd.com

Air cargo transit time: Vietnam – Mauritius

Transportation time by air from Vietnam to Mauritius and from Mauritius to Vietnam?

Which airports in Mauritius do goods commonly arrive at for imports from Vietnam? Similarly, which airports in Vietnam do goods usually arrive at for imports from Mauritius?

Logistics HP Global provide air freight from all major airports in Vietnam to various airports in Mauritius and vice versal – Hotline: ++84 984870199 / ++ 84 86115726

Major International Air Ports in Vietnam and Mauritius

| Major International Airports in Mauritius | Major International Airports in Vietnam |

| Sir Seewoosagur Ramgoolam International Airport (Mauritius, IATA airport code: MRU) | Noi Bai – Ha Noi (IATA Code: VNHAN) |

| Da Nang (IATA Code: VNDAD) | |

| Tan Son Nhat – Ho Chi Minh City (IATA Code: VNSGN) |

| For air cargo transportation, if it’s a direct service between Mauritius airports and Vietnam, the transit time is usually within the day. For transit services (through one or several airports), the duration typically ranges from 3 to 10 days. |

-> See more information about Vietnam’s main airports: Overview of International Airports in Vietnam

In case you do not find the airport information you need in the table above or want to have the most update information, please do not hesitate to contact us for up-to-date information on shipping times, schedules and shipping quotes from Vietnam to Mauritius and vice versal – Email: info@hpgloballtd.com

Trade relations between Vietnam and Mauritius

Vietnam and Mauritius have the mutual most-favored nation (MFN) agreement, however, until now, there is no Free Trade Agreement between the two Countries. Cargo imported from Mauritius to Vietnam can enjoy preferential import duty.

→ To check the updated trade relations (MFN, FTAs) between Vietnam and Mauritius at the article: Overview Of Trade Relations Between Vietnam And The World

- Trade turnover between Vietnam and Mauritius -> see at: Cargo Transportation Vietnam – Mauritius

Noticeable Commodities Exported from Vietnam to Mauritius

HP Global Logistics – Providing International Shipping, Customs Declaration, and Import-Export Licensing Services for Goods between Vietnam & Mauritius– For specific consultation, feel free to contact our hotline: ++84 886.115.726 or ++84 984.870.199!

List of Noticeable Commodities Exported from Vietnam to Mauritius

| Commodities | Related Articles |

For Updated Export Turnover among Commodities From Vietnam to Mauritius -> See more at link: Cargo Transportation Vietnam – Mauritius

>> See more “List of taxable export commodity in Vietnam”

Noticeable Commodities Imported into Vietnam from Mauritius

List of Noticeable Commodities Imported from Mauritius to Vietnam

| Commodities | Related Articles |

For Updated Import Turnover among Commodities From Mauritius to Vietnam -> See more at link: Cargo Transportation Vietnam – Mauritius

Import Export Duty in Vietnam

Quick search import export duty for every HS code in Vietnam

To check the update import duty / export duty for cargo import to / export from Vietnam to Mauritius, you can contact HP Global via email info@hpgloballtd.com or hotline ++84 886115726 / ++84 984870199 or search on website hptoancau.com as instructed in the image below

The Procedure for Cargo Transporting Between Vietnam and Mauritius

Once the goods are ready for delivery at the exporter’s warehouse, the standard process for transporting a shipment includes the following steps:

Step 1: Transport from the exporter’s warehouse to the export port.

Step 2: Export customs clearance.

Step 3: Cargo loading and unloading at the port.

Step 4: International transportation.

Step 5: Import customs clearance (note: certain items require permits, declarations, quality inspections, etc., to meet the customs clearance criteria).

Step 6: Cargo handling at the import port.

Step 7: Transporting goods from the warehouse/port to the importer’s warehouse.

HP Global Provides Shipping Services for Goods between Vietnam and Mauritius

With years of experience in shipping goods between Vietnam and Mauritius, handling thousands of shipments annually, we confidently deliver professional and optimal management to you. We are committed to advising and providing you with transportation solutions that match the best market prices.

We provide the following services:

- Sea freight from Vietnam seaports to all over the world and vice versa.

- Air freight from Vietnam Airports to all over the world and vice versa

- Customs clearance service in Vietnam: Ha Noi, Hai Phong, Da Nang, Ho Chi Minh …

- Inland transportation in Vietnam: road, waterway, railway

- Certificate of Origin (C/O) services

- Consultation on the following contents: HS code, import tax, payment, product import policy, effective shipping solutions,…

- Other services: quality inspection, machinery inspection, cosmetic announcement, food supplement announcement, import, and export license in Vietnam ….

HP Global is a freight forwarder with a top reputation in Vietnam.

- A certified customs broker by the Vietnam Customs department

- Registered with the US Federal Maritime Commission (FMC)

- Member of GAA – WCA (top network for independent forwarders in the world); SCN (Security Cargo Network); AON (AerOceanNetwork); G7N

You may concern:

For consultation and quotation for cargo import to and export from Vietnam, contact us as below details

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, La Khe, Ha Dong, Hanoi, Viet Nam

Website: hpgloballtd.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purposes is approved.

– Any copy without approval by HP Global (even note the quote from website hpgloballtd.com/hptoancau.com) can cause our claim to Google and related agencies.

- Published in Shipping Vietnam – Africa

Procedures and Import Duty for Coronary stent into Vietnam

Import Coronary stent to Vietnam: Customs procedures; import duty and transportation 2024

Do you want to export Coronary stent to Vietnam? Do you need to calculate freight from the export warehouse to Vietnam? You want to know about Vietnam’s procedure and import duties for importing Coronary stent to Vietnam? Import procedures for Coronary stent?

In this article, Logistics HP Global Vietnam, whose many years in providing freight and logistics services import Coronary stent from many countries to Vietnam, will share knowledge and advice on the above issues.

HS code and import duty of Coronary stent in Vietnam

HS code of Coronary stent in Vietnam

In importing/exporting any commodity, In order to properly determine duties, policies, procedures of the commodity, one of the first thing needed to determine is the HS code of the commodity

Coronary stent under Chapter 90: Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof

VAT and preferential import duty on Coronary stent to Vietnam in 2023

| HS Code | Descriptions | VAT (%) | Preferential Import duty (%) | Normal import tax (%) |

| 9021 | Orthopaedic appliances, including crutches, surgical belts and trusses; splints and other fracture appliances; artificial parts of the body; hearing aids and other appliances which are worn or carried, or implanted in the body, to compensate for a defect or disability | |||

| 90219000 | – Other | */5; Particularly: Bandages, splints (except splints attached to the human body), orthopedic devices belong to group 90.21: 5% | 0 | 5 |

Note: The HS code and taxes mentioned above are for reference only.

Import duty on Coronary stent into Vietnam from Major Markets in 2024

- Coronary stent import duty from China to Vietnam: 0% (ACFTA or RCEP)

- Coronary stent import duty from India to Vietnam: 0% (AIFTA)

- Coronary stent import duty from USA to Vietnam: 0% (Preferential Import duty)

- Coronary stent import duty from ASEAN to Vietnam: 0% (ATIGA or RCEP)

- Coronary stent import duty from Korea to Vietnam: 0% (AKFTA) or VKFTA or RCEP)

- Coronary stent import duty from Japan to Vietnam: 0% (AJCEP or VJEPA or RCEP or CPTPP)

- Coronary stent import duty from UK to Vietnam: 0% (UKVFTA)

- Coronary stent import duty from EU countries to Vietnam:0% (EVFTA)

- Coronary stent import duty from Australia to Vietnam: 0% (AANZFTA or RCEP)

- Coronary stent import duty from Russia to Vietnam: 0% (EAEUFTA)

- Coronary stent import duty from Canada to Vietnam: 0% (CPTPP)

- Coronary stent import duty from Mexico to Vietnam: 0% (CPTPP)

The above list is import taxes on Coronary stent from some major markets. Note: for countries with FTAs, goods can only enjoy Special preferential import taxes above if they meet the conditions as required by the agreement. If the conditions of the agreement are not met, they will enjoy Preferential import tax.

| If you encounter any difficulties in determining the import tax, please contact us via hotline at ++ 84 886115726 / ++ 84 984870199 or whatsapp: ++84 865996476 for free consultation. |

Governmental management on importing Coronary stent to Vietnam

What certificates are required in importing Coronary stent to Vietnam?

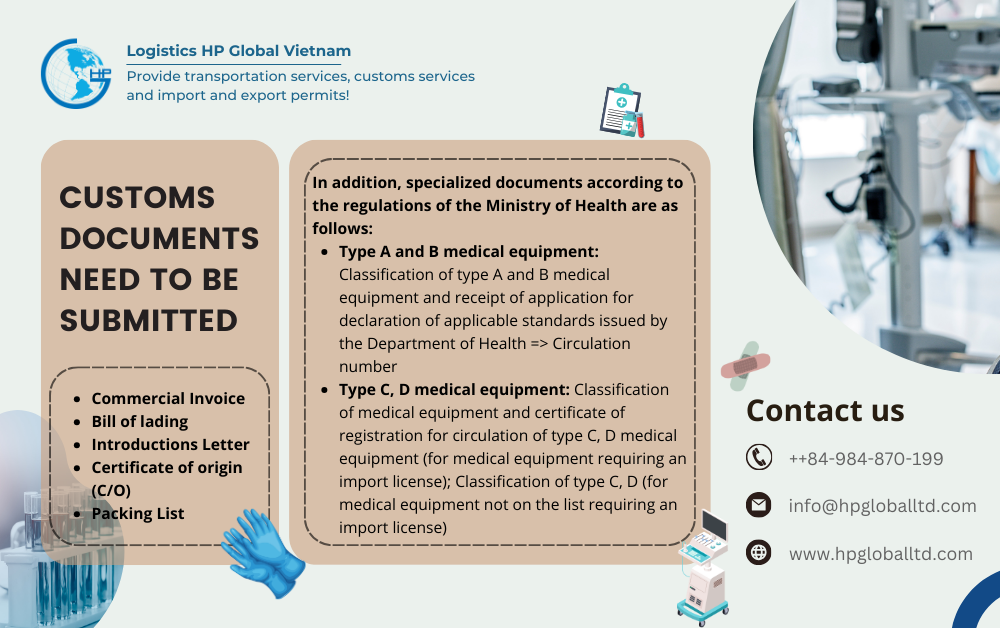

Coronary stent falls under the management of the Ministry of Health. When importing it into Vietnam, it must undergo the classification of Medical Devices. Depending on the result of the medical equipment classification, the following procedures are applied:

- For type A and B medical equipment: Announcement of standards applicable to type A and B medical equipment => Grant of circulation number.

- For medical equipment types C and D: Classification of types C and D + registration for circulation (for items on the list requiring an import license); Just need to do classification C, D (for items not on the list requiring an import license)

In working process, Coronary stent are typically classified as Type D.

Customs procedure to import Coronary stent into Vietnam:

Because of the above management policy, when importing Coronary stent into Vietnam, in addition to the standard customs paperwork (Invoice, Bill, Packinglist, Certificate of origin if needed) , Specialized licenses depend on the medical device classification required as follows:

- Type A and B medical equipment: Classification of type A and B medical equipment and receipt of application for declaration of applicable standards issued by the Department of Health => Circulation number

- Type C, D medical equipment: Classification of medical equipment and certificate of registration for circulation of type C, D medical equipment (for medical equipment requiring an import license); Classification of type C, D (for medical equipment not on the list requiring an import license)

Label for Coronary stent imported to Vietnam:

Coronary stent to imported into Vietnam must comply with regulations regarding labeling for imported goods (Name of goods; Name and address of the organization/individual responsible for the goods; Origin of the goods, Other contents according to the nature of each type of goods)

Labeling requirements for medical devices include:

- Circulation number or import license number of the medical device.

- Lot number or serial number of the medical device.

- Date of manufacture and expiration date: For sterilized medical devices, single-use devices, test kits, standards, control materials, and chemicals, the expiration date must be specified. For other cases, the date of manufacture or expiration date should be provided. For medical devices that are machinery or equipment, the year of manufacture or month and year of manufacture should be stated.

- Warning information, instructions for use, storage instructions, warranty information: This information can be directly displayed on the label of the medical device or clearly indicate how to access this information on the label of the medical device.

Freight Shipping For Coronary stent To Vietnam

Shipping time by sea and by air

To check the specific international shipping times by port or airport, you can send a message or call the phone/Zalo number ++84 886115726 – ++84 984870199, whatsapp: ++84 865996476; email: info@hpgloballtd.com

Shipping freight

Freight charges depend on many factors, both fixed and variable over time. Therefore, please provide specific or anticipated shipment details to HP Global Vietnam to receive a complete quote on all costs for the entire import process. – Contact: ++84 886115726 or ++84984870199, whatsapp: ++84 865996476, email: info@hpgloballtd.com

Procedures for Importing Certain Similar Products

| Commodity | Related link |

| Vascular clamp | Import duty and procedures for Vascular clamp to Vietnam |

| Biopsy forceps | Import duty and procedures for Biopsy forceps to Vietnam |

| Infusion pump | Import duty and procedures for Infusion pump to Vietnam |

| Disposable Injection Needle | Import Procedures for Disposable Injection Needle to Vietnam |

| Electric pulse therapy device | Import procedures for Electric pulse therapy device to Vietnam |

Select HP Global as the freight forwarder/customs broker for your shipments import Coronary stent into Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

→ Contact us for freight and inbound and outbound services for shipments to/from Vietnam – Email: info@hpgloballtd.com

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, La Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726/ Whatsapp: ++84 865996476

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

- Published in Recruitment, Recruitment, Recruitment, Recruitment, Recruitment, Recruitment, Recruitment, Recruitment, Recruitment, Recruitment, Recruitment, Recruitment

Cargo shipping Vietnam – United Arab Emirates (UAE)

Shipping Vietnam – United Arab Emirates (UAE): Types of shipping, transit time, Import/export duty and procedure

When transporting goods between Vietnam and United Arab Emirates (UAE), you may face one or more of the following issues:

- Do not clearly understand state regulations on conditions and required documents when importing goods to Vietnam or exporting goods to United Arab Emirates (UAE) to benefit businesses/individuals?

- The need to calculate taxes and the time and costs involved in shipping goods from United Arab Emirates (UAE) to Vietnam or vice versa.

- Are you looking for a reputable, professional freight forwarder / customs broker for your shipment from United Arab Emirates (UAE) to Vietnam or from Vietnam to United Arab Emirates (UAE)?

With our extensive experience in transporting goods between Vietnam and United Arab Emirates (UAE), this article by HP Global aims to provide guidance and general answers to these questions.

Methods of Cargo Transportation between Vietnam and United Arab Emirates (UAE)

Common methods of cargo transportation between Vietnam and United Arab Emirates (UAE) include:

- Sea Transportation (FCL/LCL): Transporting goods by sea, most common methods are Full Container Load (FCL) and Less than Container Load (LCL) options.

- Air Transportation

- Express Delivery Services (Courier)

-> Contact us if you need advice on suitable transportation solutions for your shipments. Hotline: ++84 984.870.199 WhatsApp: +8486 5996476 – Email: info@hpgloballtd.com / info@hptoancau.com.

Ocean freight shipping time Vietnam – United Arab Emirates (UAE)

Logistics HP Global provide sea freight from all ports in Vietnam to various ports in United Arab Emirates (UAE) and vice versal – Hotline: ++84 984.870.199 WhatsApp: +8486 5996476 – Email: info@hpgloballtd.com

Which ports in United Arab Emirates (UAE) do goods commonly arrive at for imports from Vietnam? Similarly, which ports in Vietnam do goods usually arrive at for imports from United Arab Emirates (UAE)?

Major International Ports in Vietnam and United Arab Emirates (UAE):

| United Arab Emirates (UAE) main sea ports | Vietnam’s main sea ports |

| Khalifa Port, Abu Dhabi ,United Arab Emirates ( Port code:AEKHL) | Ho Chi Minh (Cat Lai, Cai Mep …) |

| Ajman Port ,United Arab Emirates ( Port code:AEAJM) | Hai Phong |

| Dubai Port ,United Arab Emirates ( Port code:AEDXB) | Da Nang |

| Jebel Ali ,United Arab Emirates ( Port code:AEJEA) | Quy Nhon |

| Fujairah Port ,United Arab Emirates ( Port code:AEFJR) |

In addition, there are other seaports in United Arab Emirates (UAE) that engage in cargo import-export with Vietnam, such as:

- DAS ISLAND ( United Arab Emirates, Port code:AEDAS)

- KHOR FAKKAN ( United Arab Emirates, Port code:AEKLF)

- MINA SAQR ( United Arab Emirates, Port code:AEMSA)

- MINA ZAYED ( United Arab Emirates, Port code:AEMZD)

- AD DAFRAH ( United Arab Emirates, Port code:AEDHF)

Shipping Containers Between Vietnam and United Arab Emirates (UAE)

The table below lists common shipping times for containers between several major international ports in United Arab Emirates (UAE) and Vietnam. For more specific information about corresponding services or from other ports in United Arab Emirates (UAE), please contact HP Global’s advisory team at Hotline: ++84 984.870.199 / ++84 886115726 WhatsApp: +8486 5996476 – Email: info@hpgloballtd.com.

| Port name and port code | Sea freight shipping time from Vietnam to United Arab Emirates (UAE)

(Export from Vietnam to United Arab Emirates (UAE)) |

Sea freight shipping time from United Arab Emirates (UAE) to Vietnam

(Export from United Arab Emirates (UAE) to Vietnam) |

||||

| VNHPH – Hai phong | VNDAD – Da Nang | VNSGN – Ho Chi Minh | VNHPH – Hai phong | VNDAD – Da Nang | VNSGN – Ho Chi Minh | |

| Khalifa Port, Abu Dhabi ,United Arab Emirates ( Port code:AEKHL) | 18 – 33 days | 22 – 30 days | 17 – 25 days | 15 – 29 days | 25 – 35 days | 15 – 27 days |

| Ajman Port ,United Arab Emirates ( Port code:AEAJM) | 20 – 30 days | 18 – 23 days | 17 – 23 days | 23 – 33 days | 15 – 30 days | 24 – 32 days |

| Dubai Port ,United Arab Emirates ( Port code:AEDXB) | 20 – 28 days | 18 – 26 days | 23 – 35 days | 20 – 32 days | 18 – 29 days | 18 – 30 days |

| Jebel Ali ,United Arab Emirates ( Port code:AEJEA) | 18 – 25 days | 17 – 31 days | 15 – 20 days | 15 – 31 days | 28 – 42 days | 15 – 26 days |

| Fujairah Port ,United Arab Emirates ( Port code:AEFJR) | 20 – 31 days | 20 – 34 days | 20 – 31 days | 23 – 35 days | 22 – 32 days | 18 – 28 days |

In case you do not find the seaport information you need in the table above or want to have the most update information, please do not hesitate to contact us for up-to-date information on shipping times, schedules and shipping quotes from Vietnam to United Arab Emirates (UAE) and vice versal – Email: info@hpgloballtd.com

Air cargo transit time: Vietnam – United Arab Emirates (UAE)

Transportation time by air from Vietnam to United Arab Emirates (UAE) and from United Arab Emirates (UAE) to Vietnam?

Which airports in United Arab Emirates (UAE) do goods commonly arrive at for imports from Vietnam? Similarly, which airports in Vietnam do goods usually arrive at for imports from United Arab Emirates (UAE)?

Logistics HP Global provide air freight from all major airports in Vietnam to various airports in United Arab Emirates (UAE) and vice versal – Hotline: ++84 984870199 / ++ 84 86115726

Major International Air Ports in Vietnam and United Arab Emirates (UAE)

| Major International Airports in United Arab Emirates (UAE) | Major International Airports in Vietnam |

| International Airport Dubai, United Arab Emirates ( IATA code: DXB) | Noi Bai – Ha Noi (IATA Code: VNHAN) |

| International Airport Abu Dhabi, United Arab Emirates ( IATA code: AUH) | Da Nang (IATA Code: VNDAD) |

| Tan Son Nhat – Ho Chi Minh City (IATA Code: VNSGN) |

In addition, there are other airports in United Arab Emirates (UAE) that engage in cargo import-export with Vietnam, such as:

- AI AIN ( United Arab Emirates, Port code:MAN)

- King Fahd ( United Arab Emirates, Port code:DMM)

- King Abdulaziz ( United Arab Emirates, Port code:JED)

- King Khalid ( United Arab Emirates, Port code:RUH)

- Prince Mohammad Bin Abdulaziz ( United Arab Emirates, Port code:MED)

- Al-Ahsa ( United Arab Emirates, Port code:HOF)

- Prince Abdul Mohsin bin Abdulaziz ( United Arab Emirates, Port code:YNB)

- Prince Nayef Bin Abdulaziz ( United Arab Emirates, Port code:ELQ)

- Dubai World Central – AI Maktoum ( United Arab Emirates, Port code:DWC)

- Fujairah ( United Arab Emirates, Port code:FJR)

- Ras AI Khaimah ( United Arab Emirates, Port code:RKT)

- Sharijah ( United Arab Emirates, Port code:SHJ)

| For air cargo transportation, if it’s a direct service between United Arab Emirates (UAE) airports and Vietnam, the transit time is usually within the day. For transit services (through one or several airports), the duration typically ranges from 3 – 5 days. |

-> See more information about Vietnam’s main airports: Overview of International Airports in Vietnam

In case you do not find the airport information you need in the table above or want to have the most update information, please do not hesitate to contact us for up-to-date information on shipping times, schedules and shipping quotes from Vietnam to United Arab Emirates (UAE) and vice versal – Email: info@hpgloballtd.com

Trade relations between Vietnam and United Arab Emirates (UAE)

Vietnam and United Arab Emirates (UAE) have the mutual most-favored nation (MFN) agreement, however, until now, there is no Free Trade Agreement between the two Countries. Cargo imported from United Arab Emirates (UAE) to Vietnam can enjoy preferential import duty.

→ To check the updated trade relations (MFN, FTAs) between Vietnam and United Arab Emirates (UAE) at the article: Overview Of Trade Relations Between Vietnam And The World

Trade turnover between Vietnam and United Arab Emirates (UAE) -> see at: Cargo Transportation Vietnam – United Arab Emirates (UAE)

Noticeable Commodities Exported from Vietnam to United Arab Emirates (UAE)

HP Global Logistics – Providing International Shipping, Customs Declaration, and Import-Export Licensing Services for Goods between Vietnam & United Arab Emirates (UAE)– For specific consultation, feel free to contact our hotline: ++84 886.115.726 or ++84 984.870.199!

List of Noticeable Commodities Exported from Vietnam to United Arab Emirates (UAE)

| Commodities | Related Articles |

| Export… Gắn link | |

For Updated Export Turnover among Commodities From Vietnam to United Arab Emirates (UAE) -> See more at link: Cargo Transportation Vietnam – United Arab Emirates (UAE)

>> See more “List of taxable export commodity in Vietnam”

Noticeable Commodities Imported into Vietnam from United Arab Emirates (UAE)

List of Noticeable Commodities Imported from United Arab Emirates (UAE) to Vietnam

| Commodities | Related Articles |

| Import… Gắn link | |