Updated Import Duty on functional food from ASEAN to Vietnam 2025

If you’re searching for functional food import duty into Vietnam from ASEAN, please read the article here at HP Global. In this article, we list the updated functional food HS code and import duty into Vietnam from ASEAN

Updated Import Duty of functional food from ASEAN to Vietnam year 2025

HP Global – Provide shipping services, customs declaration services and export/import permits in Vietnam – Contact for advice: ++84 984870199

Vietnam and ASEAN countries grant each other most-favored nation treatment on MFN trade.

Vietnam and ASEAN countries are members of the the ASEAN Trade In Goods Agreement (ATIGA) and the Regional Comprehensive Economic Partnership (RCEP).

When importing functional food from ASEAN countries to Vietnam, the importer needs to pay:

- Value-added tax (VAT)

- Special preferential import Duty under FTA or Preferential Import Duty

=> For more details about VAT and Preferential import Duty, please read more in the following article: Import Procedure Of Food Supplement Into Vietnam

Special preferential import duty on functional food from ASEAN – ATIGA

| HS Code | Description of comodity | Special preferential import duty – ATIGA (%) | ||

| 2025 | 2026 | 2027 | ||

| 21069071 | – – – Food supplements based on ginseng | 0 | 0 | 0 |

| 21069072 | – – – Other food supplements | 0 | 0 | 0 |

| 21069073 | – – – Fortificant premixes | 0 | 0 | 0 |

| 21069081 | – – – Food preparations for lactase deficient infants or young children | 0 | 0 | 0 |

| 21069089 | – – – Other | 0 | 0 | 0 |

| 21069091 | – – – Other, mixtures of chemicals with foodstuffs or other substances with nutritive value, of a kind used for food processing | 0 | 0 | 0 |

| 21069092 | – – – Flavoured or coloured syrups | 0 | 0 | 0 |

| 21069095 | – – – Seri kaya | 0 | 0 | 0 |

| 21069096 | – – – Other medical foods | 0 | 0 | 0 |

| 21069097 | – – – Tempeh | 0 | 0 | 0 |

| 21069098 | – – – Other flavouring preparations | 0 | 0 | 0 |

| 21069099 | – – – Other | 0 | 0 | 0 |

| 22029950 | – – – Other non-aerated beverages ready for immediate consumption without dilution | 0 | 0 | 0 |

Special preferential import duty on functional food from ASEAN – RCEP

| HS Code | Description of comodity | Special preferential import duty – RCEP (%) |

||

| 2025 | 2026 | 2027 | ||

| 21069071 | – – – Food supplements based on ginseng | 9 | 7,5 | 6 |

| 21069072 | – – – Other food supplements | 9 | 7,5 | 6 |

| 21069073 | – – – Fortificant premixes | 9 | 7,5 | 6 |

| 21069081 | – – – Food preparations for lactase deficient infants or young children | 9 | 7,5 | 6 |

| 21069089 | – – – Other | 9 | 7,5 | 6 |

| 21069091 | – – – Other, mixtures of chemicals with foodstuffs or other substances with nutritive value, of a kind used for food processing | 9 | 7,5 | 6 |

| 21069092 | – – – Flavoured or coloured syrups | 12 | 10 | 8 |

| 21069095 | – – – Seri kaya | 9 | 7,5 | 6 |

| 21069096 | – – – Other medical foods | 6 | 5 | 4 |

| 21069097 | – – – Tempeh | 9 | 7,5 | 6 |

| 21069098 | – – – Other flavouring preparations | 4,2 | 3,5 | 2,8 |

| 21069099 | – – – Other | 9 | 7,5 | 6 |

| 22029950 | – – – Other non-aerated beverages ready for immediate consumption without dilution | 18 | 15 | 12 |

In addition, ASEAN countries also jointly signed some trade agreements with some countries and territories as a whole or as individual countries, for example ACFTA: ASEAN – China; AKFTA: ASEAN – Korea; AJCEP: ASEAN – Japan; AIFTA: ASEAN – India; AANZFTA: ASEAN – Australia – New Zealand; AHFTA: ASEAN – Hong Kong; RCEP; CPTTP (ASEAN countries participating in CPTTP include: Vietnam, Malaysia, Singapore, Brunei)

Currently, ASEAN includes 10 countries: Vietnam, Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand.

Note:

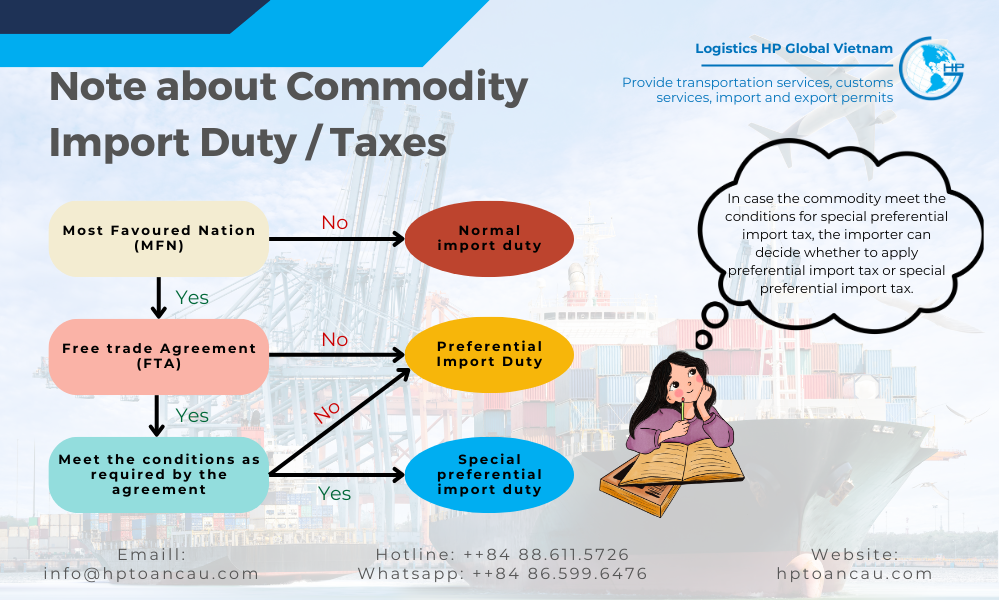

When importing functional food from ASEAN to Vietnam:

+ If functional food meet the conditions as required by the Free Trade Agreement (FTA), goods can enjoy Special preferential import taxes above.

+ If the conditions of the agreement are not met, they will enjoy Preferential import tax.

Select HP Global as the freight forwarder/customs brokerage for your shipments import functional food into Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

For functional food products, we can provide a full service including transportation, customs clearance and functional food notification.

→ Contact us for freight and inbound and outbound services for shipments to/from Vietnam – Email: info@hpgloballtd.com

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 886115726

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

Tiếng Việt

Tiếng Việt  English

English  简体中文

简体中文