HS code and updated Cosmetics import duty into Vietnam 2026

If you’re searching for Cosmetics import duty into Vietnam, read the article down here at HP Global. At this article, we list the updated Cosmetics HS code and import duty into Vietnam

Cosmetics’s HS code and import duty in Vietnam

Cosmetics’s Import duty in Vietnam Year 2026

| VAT (%) | Preferential import duty (%) | Normal import duty (**) | ||

| 2026 | 2026 | 2026 | ||

| 33030000 | Perfumes and toilet waters | 8/10% | 18% | 27% |

| 3304 | Beauty or make-up preparations and preparations for the care of the skin (other than medicaments), including sunscreen or sun tan preparations; manicure or pedicure preparations | |||

| 33041000 | – Lip make-up preparations | 8/10% | 20% | 30% |

| 33042000 | – Eye make-up preparations | 8/10% | 22% | 33% |

| 33043000 | – Manicure or pedicure preparations | 8/10% | 22% | 33% |

| – Other: | ||||

| 33049100 | – – Powders, whether or not compressed | 8/10% | 22% | 33% |

| 330499 | – – Other: | |||

| 33049920 | – – – Anti-acne preparations | 8/10% | 10% | 15% |

| 33049930 | – – – Other face or skin creams and lotions | 8/10% | 18% | 27% |

| 33049990 | – – – Other | 5/8/10% | 18% | 27% |

| 34013000 | – Organic surface-active products and preparations for washing the skin, in the form of liquid or cream and put up for retail sale, whether or not containing soap | 8/10% | 27% | 40.5% |

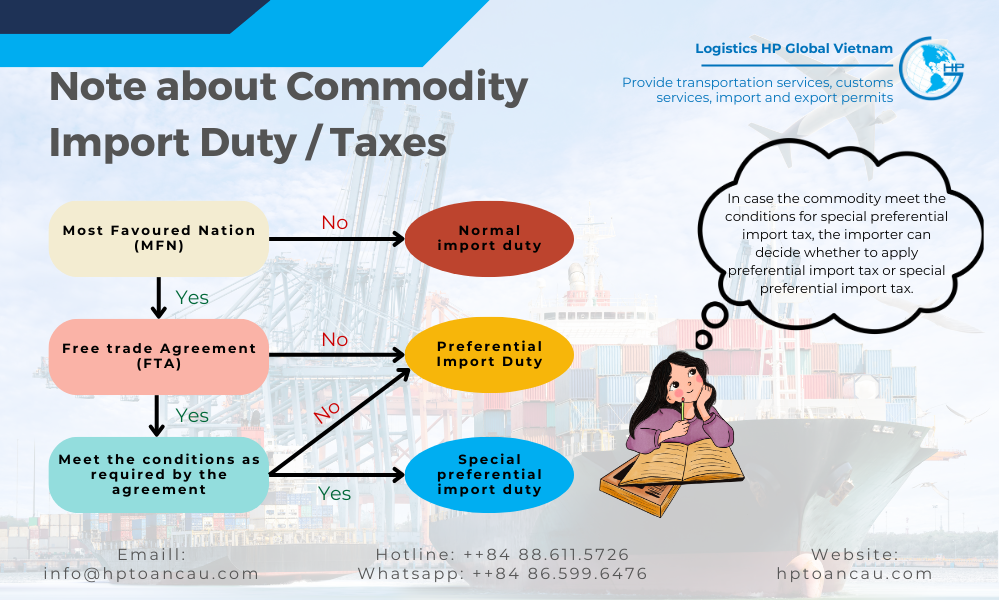

(*) Search for Special preferencial import duty as per FTA as below tables

(**) Normal Import duty applicable for cargos imported from coutries/territories those do not have MFN with Vietnam

You can check the MFN, FTA between your country and Vietnam in the article: Overview of trade relations between Vietnam and the world

Special preferential import duty on Cosmetics under FTAs

| HS code | AJCEP | VJEPA | AKFTA | VKFTA | ACFTA | EVFTA | UKVFTA |

| 2026 | 2026 | 2026 | 2026 | 2026 | 2026 | 2026 | |

| 33030000 | 0 | 0 | 5 | 5 | 0 (-KH, ID) | 2,2 | 2,2 |

| 3304 | |||||||

| 33041000 | 0 | 0 | 5 | 5 | 0 (-ID) | 2,7 | 2,7 |

| 33042000 | 0 | 0 | 5 | 5 | 0 (-ID) | 3,1 | 3,1 |

| 33043000 | 0 | 0 | 5 | 0 | 0 (-ID) | 2,7 | 2,7 |

| 33049100 | 0 | 0 | 5 | 0 | 0 (-ID, MY) | 3,1 | 3,1 |

| 330499 | |||||||

| 33049920 | 0 | 0 | 5 | 0 | 0 | 1,2 | 1,2 |

| 33049930 | 0 | 0 | 5 | 0 | 0 (-KH, ID) | 2,5 | 2,5 |

| 33049990 | 0 | 0 | 5 | 0 | 0 (-KH, ID) | 2,5 | 2,5 |

| 34013000 | 0 | 0 | 5 | 5 | 0 (-KH) | 3,3 | 3,3 |

| HS code | ATIGA | AANZFTA | AIFTA | VCFTA | VN-EAEU | CPTPP | AHKFTA |

| 2026 | 2026 | 2026 | 2026 | 2026 | 2026 | 2026 | |

| 33030000 | 0 | 0 | 5 | 0 | 0 | 0 | 18 |

| 3304 | |||||||

| 33041000 | 0 | 0 | 5 | 0 | 0 | 0 | 20 |

| 33042000 | 0 | 0 | 5 | 0 | 0 | 0 | 22 |

| 33043000 | 0 | 0 | 5 | 0 | 0 | 0 | 22 |

| 33049100 | 0 | 0 | 5 | 0 | 0 | 0 | 22 |

| 330499 | |||||||

| 33049920 | 0 | 0 | 5 | 0 | 0 | 0 | 10 |

| 33049930 | 0 | 0 | 5 | 0 | 0 | 0 | 20 |

| 33049990 | 0 | 0 | 5 | 0 | 0 | 0 | 20 |

| 34013000 | 0 | 0 | 5 | 0 | 0 | 0 | 27 |

| HS code | RCEP | RCEP | RCEP | RCEP | RCEP | RCEP |

| ASEAN | Australia | China | Japan | Korea | New Zealand | |

| 2026 | 2026 | 2026 | 2026 | 2026 | 2026 | |

| 33030000 | 9 | 9 | 9 | 9,8 | 9 | 9 |

| 3304 | ||||||

| 33041000 | 10 | 10 | 10 | 10,9 | 10 | 10 |

| 33042000 | 11 | 11 | 11 | 12 | 11 | 11 |

| 33043000 | 11 | 11 | 11 | 12 | 11 | 11 |

| 33049100 | 11 | 11 | 11 | 12 | 11 | 11 |

| 330499 | ||||||

| 33049920 | 5 | 5 | 5 | 5,5 | 5 | 5 |

| 33049930 | 10 | 10 | 10 | 10,9 | 10 | 10 |

| 33049990 | 10 | 10 | 10 | 10,9 | 10 | 10 |

| 34013000 | 13,5 | 13,5 | 13,5 | 14,7 | 13,5 | 13,5 |

-> To check updated articles related to special preferential import duty under FTAs that Vietnam Joined, read: List of FTA Vietnam Joined

Import Tax on Nourishing eye cream into Vietnam from Major Markets in 2026

For convenient lookup, you can see some of the articles we have compiled below:

Import duty on cosmetics from Korea to Vietnam

Import Tax of Cosmetics from Japan

Updated Import Duty On Cosmetics In Vietnam From EU

Import duty on cosmetics from ASEAN to Vietnam

Select HP Global as the freight forwarder/customs brokerage for your shipments import Cosmetics into Vietnam

HP Global is the freight forwarder with top reputation in Vietnam.

For consultation, quotation for cargo import to and export from Vietnam, contact us as below details

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

Tiếng Việt

Tiếng Việt  English

English  简体中文

简体中文