Updated Import Duty on Cosmetics from Australia to Vietnam

If you’re searching for Cosmetics import duty into Vietnam from Australia, please read the article here at HP Global. In this article, we list the updated Cosmetics HS code and import duty into Vietnam from Australia

Updated Import Duty of Cosmetics from Australia to Vietnam

HP Global – Provide shipping services, customs declaration services, and export/import license in Vietnam – Hotline ++84 984870199, Whatsapp: ++84 865996476

Vietnam and Australia grant each other most-favored nation treatment on MFN trade.

Vietnam and Australia are members of:

- The Agreement Establishing the ASEAN – Australia – New Zealand Free Trade Area (AANZFTA)

- Regional Comprehensive Economic Partnership (RCEP)

- The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

When importing Cosmetics from Australia to Vietnam, the importer needs to pay

- Value-added tax (VAT)

- Special preferential import duty under FTA or Preferential Import Duty

- For more details about VAT and Preferential import Duty, please read more in the following article: Import procedures of cosmetics into Vietnam

Special preferential import duty on Cosmetics from Australia – AANZFTA

| HS Code | Description of comodity | Special preferential import duty – AANZFTA (%) |

| 33030000 | Perfumes and toilet waters | 0 |

| 3304 | Beauty or make-up preparations and preparations for the care of the skin (other than medicaments), including sunscreen or sun tan preparations; manicure or pedicure preparations | |

| 33041000 | – Lip make-up preparations | 0 |

| 33042000 | – Eye make-up preparations | 0 |

| 33043000 | – Manicure or pedicure preparations | 0 |

| – Other: | ||

| 33049100 | – – Powders, whether or not compressed | 0 |

| 330499 | – – Other: | |

| 33049920 | – – – Anti-acne preparations | 0 |

| 33049930 | – – – Other face or skin creams and lotions | 0 |

| 33049990 | – – – Other | 0 |

| 34013000 | – Organic surface-active products and preparations for washing the skin, in the form of liquid or cream and put up for retail sale, whether or not containing soap | 0 |

Special preferential import duty on Cosmetics from Australia – RCEP

| HS Code | Description of comodity | Special preferential import duty – RCEP (%) | ||

| 2025 | 2026 | 2027 | ||

| 33030000 | Perfumes and toilet waters | 10,8 | 9 | 7,2 |

| 3304 | Beauty or make-up preparations and preparations for the care of the skin (other than medicaments), including sunscreen or sun tan preparations; manicure or pedicure preparations | |||

| 33041000 | – Lip make-up preparations | 12 | 10 | 8 |

| 33042000 | – Eye make-up preparations | 13,2 | 11 | 8,8 |

| 33043000 | – Manicure or pedicure preparations | 13,2 | 11 | 8,8 |

| – Other: | ||||

| 33049100 | – – Powders, whether or not compressed | 13,2 | 11 | 8,8 |

| 330499 | – – Other: | |||

| 33049920 | – – – Anti-acne preparations | 6 | 5 | 4 |

| 33049930 | – – – Other face or skin creams and lotions | 12 | 10 | 8 |

| 33049990 | – – – Other | 12 | 10 | 8 |

| 34013000 | – Organic surface-active products and preparations for washing the skin, in the form of liquid or cream and put up for retail sale, whether or not containing soap | 16,2 | 13,5 | 10,8 |

Special preferential import duty on Cosmetics from Australia – CPTPP

| HS Code | Description of comodity |

Special preferential import duty – CPTPP (%) |

||||||

| (I) | (II) | (III) | (IV) | (V) | (VI) | (VII) | ||

| 33030000 | Perfumes and toilet waters | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 3304 | Beauty or make-up preparations and preparations for the care of the skin (other than medicaments), including sunscreen or sun tan preparations; manicure or pedicure preparations | |||||||

| 33041000 | – Lip make-up preparations | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 33042000 | – Eye make-up preparations | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 33043000 | – Manicure or pedicure preparations | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| – Other: | ||||||||

| 33049100 | – – Powders, whether or not compressed | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 330499 | – – Other: | |||||||

| 33049920 | – – – Anti-acne preparations | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 33049930 | – – – Other face or skin creams and lotions | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 33049990 | – – – Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 34013000 | – Organic surface-active products and preparations for washing the skin, in the form of liquid or cream and put up for retail sale, whether or not containing soap | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

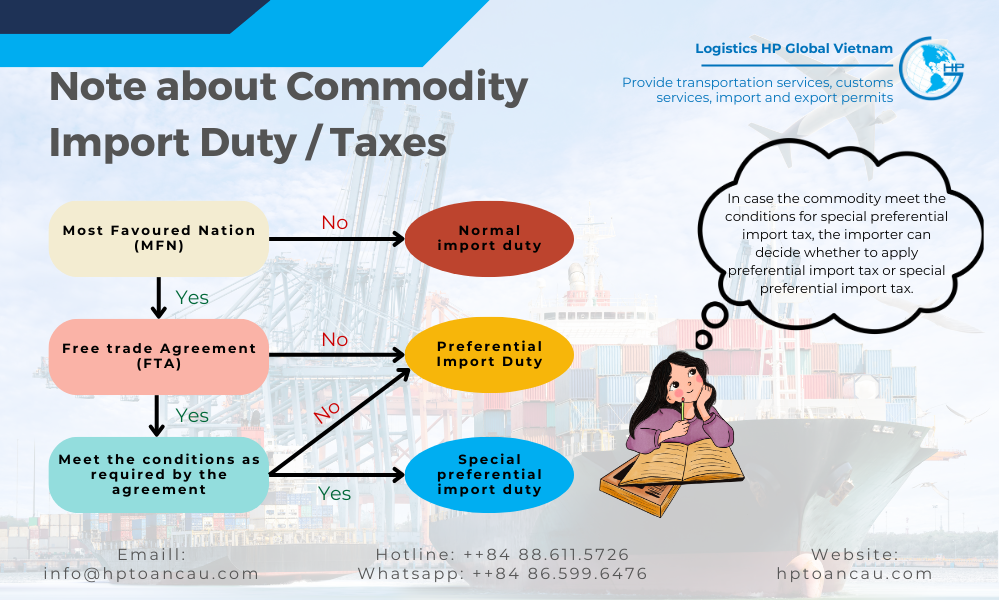

Note:

When importing Cosmetics from Australia to Vietnam:

+ If Cosmetics meets the conditions as required by the Free Trade Agreement (FTA), goods can enjoy Special preferential import duty above.

+ If the conditions of the agreement are not met, they will enjoy Preferential import duty.

Select HP Global as the freight forwarder/customs brokerage for your shipments importing Cosmetics into Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

For Cosmetics products, we can provide a full service including transportation, customs clearance and Notification of Cosmetic Product.

→ Contact us for freight and inbound and outbound services for shipments to/from Vietnam – Email: info@hpgloballtd.com

Logistics HP Global Vietnam

Freight forwarder, Customs Broker, and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726 / whatsapp: ++84 865996476

Note:

– The article is for reference only, before using the content, it is suggested that you should contact HP Global for any update

– HP Global keeps its full copyright of the article. No copy for commercial purposes is approved.

– Any copy without approval by HP Global (even note the quote from the website hpgloballtd.com/hptoancau.com) can cause our claim to Google and related agencies.

Tiếng Việt

Tiếng Việt  English

English  简体中文

简体中文