Import Used plate punch machine to Vietnam: Customs procedures; import duty and transportation 2026

Do you want to export Used plate punch machine to Vietnam? Do you need to calculate freight from the export warehouse to Vietnam? You want to know about Vietnam’s procedure and import duties for importing Used plate punch machine to Vietnam? Import procedures for Used plate punch machine?

In this article, Logistics HP Global Vietnam, whose many years in providing freight and logistics services import Used plate punch machine from many countries to Vietnam, will share knowledge and advice on the above issues.

HS code and import duty of Used plate punch machine in Vietnam year 2026

HS Code, Duties, Taxes on importing Used plate punch machine to Vietnam:

Used plate punch machine’s HS code in Chapter 84: Nuclear reactors, boilers, machinery and mechanical equipment; parts of them

When importing Used plate punch machine to Vietnam, the importer needs to pay

- Import value-added tax (VAT)

- Import duty

VAT and preferential import duty on Used plate punch machine to Vietnam in 2026

| HS Code | Descriptions | VAT (%) | Preferential Import duty (%) | Normal import tax (%) |

| 8448 | Auxiliary machinery for use with machines of heading 84.44, 84.45, 84.46 or 84.47 (for example, dobbies, Jacquards, automatic stop motions, shuttle changing mechanisms); parts and accessories suitable for use solely or principally with the machines of this heading or of heading 84.44, 84.45, 84.46 or 84.47 (for example, spindles and spindle flyers, card clothing, combs, extruding nipples, shuttles, healds and heald-frames, hosiery needles) | |||

| 84481110 | – – – Electrically operated | 8/10% | 0% | 5% |

Note: The HS code and taxes mentioned above are for reference only.

Import duty on Used plate punch machine into Vietnam from Major Markets in 2026

- Used plate punch machine import duty from China to Vietnam: 0% (ACFTA) or 0% (RCEP)

- Used plate punch machine import duty from India to Vietnam: 0% (AIFTA)

- Used plate punch machine import duty from USA to Vietnam: 0% (Preferential Import duty)

- Used plate punch machine import duty from ASEAN to Vietnam: 0% (ATIGA) or 0% (RCEP)

- Used plate punch machine import duty from Korea to Vietnam: 0% (AKFTA) or 0% (VKFTA) or 0% (RCEP)

- Used plate punch machine import duty from Japan to Vietnam: 0% (AJCEP) or 0% (VJEPA) or 0% (RCEP) or 0% (CPTPP)

- Used plate punch machine import duty from UK to Vietnam: 0% (UKVFTA)

- Used plate punch machine import duty from EU countries to Vietnam: 0% (EVFTA)

- Used plate punch machine import duty from Australia to Vietnam: 0% (AANZFTA) or 0% (RCEP)

- Used plate punch machine import duty from Russia to Vietnam: 0% (VN-EAEUFTA)

- Used plate punch machine import duty from Canada to Vietnam: 0% (CPTPP)

- Used plate punch machine import duty from Mexico to Vietnam: 0% (CPTPP)

The above list is import taxes on Used plate punch machine from some major markets. Note: for countries with FTAs, goods can only enjoy Special preferential import taxes above if they meet the conditions as required by the agreement. If the conditions of the agreement are not met, they will enjoy Preferential import tax.

| If you encounter any difficulties in determining the import tax, please contact us via hotline at ++ 84 886115726 / ++ 84 984870199 or whatsapp: ++84 865996476 for free consultation. |

Governmental management on importing Used plate punch machine to Vietnam

What certificates are required in importing Used plate punch machine to Vietnam?

Used plate punch machine is under management of Ministry of Science and Technology, when importing, inspection of old machines must be carried out according to the provisions of Decision 18/2019/QD-TTg.

Customs procedure to import Used plate punch machine into Vietnam:

What documents are required for importing Used plate punch machine to Vietnam? What procedures are needed for importing Used plate punch machine to Vietnam?

When importing Used plate punch machine, the importer submits the import document set in accordance with standard regulations (Invoice; Bill of Lading; Packing List; Certificate of Origin if needed..).

Due to the specialized management policies mentioned above, when importing used Used plate punch machine, in addition to normal customs documents, the importer needs to submit:

– Copy of Business Registration Certificate with the company’s stamp. In case of import under entrustment, there must be an import authorization document;

– Original confirmation from the machinery and equipment manufacturer on the year of manufacture and standards of the machinery and equipment that meet the criteria specified in Article 6 of this Decision in case the machinery and equipment are purchased. Made in G7 country, Korea. The certificate must be consularly legalized and accompanied by a translation into Vietnamese;

– Inspection certificate issued by a designated inspection organization that meets regulatory requirements.

Label for Used plate punch machine imported to Vietnam:

Used plate punch machine to imported into Vietnam must comply with regulations regarding labeling for imported goods (Name of goods; Name and address of the organization/individual responsible for the goods; Origin of the goods, Other contents according to the nature of each type of goods)

*Note: Labels/stamps of used machinery must retain the original manufacturer’s stamps, and must not be modified or chiseled to make new ones.

Freight Shipping For Used plate punch machine To Vietnam

Shipping time by sea and by air

To check the specific international shipping times by port or airport, you can send a message or call the phone/Zalo number ++84 886115726 – ++84 984870199, whatsapp: ++84 865996476; email: info@hpgloballtd.com

Shipping freight

Freight charges depend on many factors, both fixed and variable over time. Therefore, please provide specific or anticipated shipment details to HP Global Vietnam to receive a complete quote on all costs for the entire import process. – Contact: ++84 886115726 or ++84984870199, whatsapp: ++84 865996476, email: info@hpgloballtd.com

Procedures for Importing Certain Similar Products

| Commodity | Related link |

| Hot stamping machine (used) | Import Duty And Procedures For Hot stamping machine(used) To Vietnam |

| Used molds | Import procedures Used molds into Vietnam |

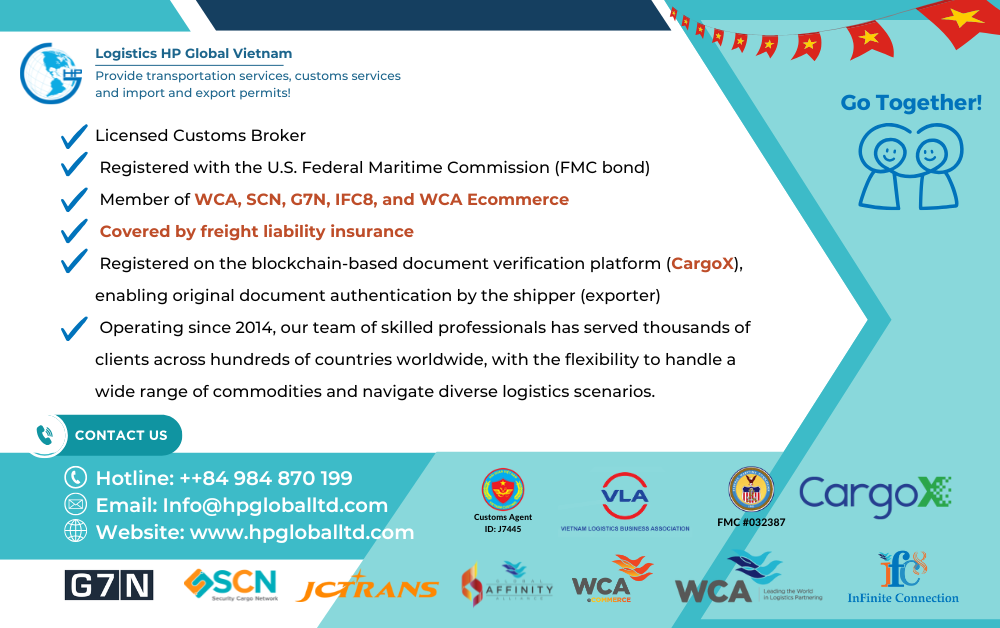

Select HP Global as the freight forwarder/customs broker for your shipments import Used plate punch machine into Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

→ Contact us for freight and inbound and outbound services for shipments to/from Vietnam – Email: info@hpgloballtd.com

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726/ Whatsapp: ++84 865996476

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

Tiếng Việt

Tiếng Việt  English

English  简体中文

简体中文