Import fertilizer to Vietnam: Customs procedures; import duty and transportation 2025

You want to export fertilizer to Vietnam? You need to calculate freight from export warehouse to Vietnam? You want to know about Vietnam’s procedure and import duties on importing fertilizer to Vietnam? Import procedures for fertilizer?

In this article, Logistics HP Global Vietnam, whose many years in providing freight and logistics services import fertilizer from many countries to Vietnam, will share knowledge and advise on above issues.

HS code and import duty of fertilizer in Vietnam 2025

HS Code, Duties, Taxes on importing fertilizer to Vietnam

In importing/exporting any commodity, In order to properly determine duties, policies, procedures of the commodity, one of the first thing needed to determine is the HS code of the commodity

Fertilizer under Chapter 31: FERTILISERS

| HS Code | Description | Normal import tax(%) | Preferential import tax rates (%) | VAT(%) |

| 3101 | Animal or vegetable fertilisers, whether or not mixed together or chemically treated; fertilisers produced by the mixing or chemical treatment of animal or vegetable products. | |||

| 31010010 | – Of solely vegetable origin | 5 | 0 | 5 |

| – Other: | ||||

| 31010092 | – – Of animal origin (other than guano), chemically treated | 5 | 0 | 5 |

| 31010099 | – – Other | 5 | 0 | 5 |

| 3102 | Mineral or chemical fertilisers, nitrogenous. | |||

| 31021000 | – Urea, whether or not in aqueous solution | 9 | 6 | 5 |

| – Ammonium sulphate; double salts and mixtures of ammonium sulphate and ammonium nitrate: | ||||

| 31022100 | – – Ammonium sulphate | 5 | 0 | 5 |

| 31022900 | – – Other | 5 | 0 | 5 |

| 31023000 | – Ammonium nitrate, whether or not in aqueous solution | 4.5 | 3 | 5 |

| 31024000 | – Mixtures of ammonium nitrate with calcium carbonate or other inorganic non-fertilising substances | 5 | 0 | 5 |

| 31025000 | – Sodium nitrate | 5 | 0 | 5 |

| 31026000 | – Double salts and mixtures of calcium nitrate and ammonium nitrate | 5 | 0 | 5 |

| 31028000 | – Mixtures of urea and ammonium nitrate in aqueous or ammoniacal solution | 5 | 0 | 5 |

| 31029000 | – Other, including mixtures not specified in the foregoing subheadings | 5 | 0 | 5 |

| 3103 | Mineral or chemical fertilisers, phosphatic. | |||

| – Superphosphates: | ||||

| 310311 | – – Containing by weight 35 % or more of diphosphorus pentaoxide (P2O5): | |||

| 31031110 | – – – Feed grade | 9 | 6 | 5 |

| 31031190 | – – – Other | 9 | 6 | 5 |

| 310319 | – – Other: | |||

| 31031910 | – – – Feed grade | 9 | 6 | 5 |

| 31031990 | – – – Other | 9 | 6 | 5 |

| 310390 | – Other: | |||

| 31039010 | – – Calcined phosphatic fertilisers | 9 | 6 | 5 |

| 31039090 | – – Other | 5 | 0 | 5 |

| 3104 | Mineral or chemical fertilisers, potassic. | |||

| 31042000 | – Potassium chloride | 5 | 0 | 5 |

| 31043000 | – Potassium sulphate | 5 | 0 | 5 |

| 31049000 | – Other | 5 | 0 | 5 |

| 3105 | Mineral or chemical fertilisers containing two or three of the fertilising elements nitrogen, phosphorus and potassium; other fertilisers; goods of this Chapter in tablets or similar forms or in packages of a gross weight not exceeding 10 kg. | |||

| 310510 | – Goods of this Chapter in tablets or similar forms or in packages of a gross weight not exceeding 10 kg: | |||

| 31051010 | – – Superphosphates and calcined phosphatic fertilisers | 9 | 6 | 5 |

| 31051020 | – – Mineral or chemical fertilisers containing two or three of the fertilising elements nitrogen, phosphorus and potassium | 9 | 6 | 5 |

| 31051090 | – – Other | 5 | 0 | 5 |

| 31052000 | – Mineral or chemical fertilisers containing the three fertilising elements nitrogen, phosphorus and potassium | 9 | 6 | 5 |

| 31053000 | – Diammonium hydrogenorthophosphate (diammonium phosphate) | 9 | 6 | 5 |

| 31054000 | – Ammonium dihydrogenorthophosphate (monoammonium phosphate) and mixtures thereof with diammonium hydrogenorthophosphate (diammonium phosphate) | 5 | 0 | 5 |

| – Other mineral or chemical fertilisers containing the two fertilising elements nitrogen and phosphorus: | ||||

| 31055100 | – – Containing nitrates and phosphates | 5 | 0 | 5 |

| 31055900 | – – Other | 5 | 0 | 5 |

| 31056000 | – Mineral or chemical fertilisers containing the two fertilising elements phosphorus and potassium | 5 | 0 | 5 |

| 31059000 | – Other | 5 | 0 | 5 |

The classification of a product to a certain HS code is based on the nature, composition, …. of the actual exported commodity at the import time, based on catalogue, technical documents (if any) or /and decided by the Customs Department of Commodity Verification. The actual inspection results of the Customs and announcement by the Customs Department of Commodity Verification are legal basis for applying HS code to imported goods. Importers are ultimately responsible for ensuring that the products are correctly classified.

Our above advised HS codes are for reference only.

→ For more information about this content, please refer to the article Definition of HS code in Vietnam

Import duty on fertilizer into Vietnam from Major Markets in 2025

| HS code | China | India | USA | ASEAN | Korea | Japan | UK | EU | Australia | Russia | Canada | Mexico |

| 31010010 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(Preferential import tax rates) | 0% (CPTPP) | 0% (CPTPP) |

| 31010092 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(Preferential import tax rates) | 0% (CPTPP) | 0% (CPTPP) |

| 31010099 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(Preferential import tax rates) | 0% (CPTPP) | 0% (CPTPP) |

| 31021000 | 5%(ACFTA) or 3% (RCEP) | 0%(AIFTA) | 6%(Preferential import tax rates) | 0% (ATIGA) or 2.2% RCEP) | 0%(AKFTA or VKFTA) or 2.2%(RCEP) | 0%(AJCEP or VJCEP or CPTPP) or 2.3% (RCEP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA) or 2.2%( RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31022100 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31022900 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31023000 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 3%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31024000 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31025000 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31026000 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31028000 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31029000 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31031110 | 5%(ACFTA) or 6% (RCEP) | 0%(AIFTA) | 6%(Preferential import tax rates) | 0% (ATIGA) or 6% (RCEP) | 5%(AKFTA or VKFTA) | 0%(VJCEP or CPTPP) | 1,5% (UKVFTA) | 1,5% (EVFTA) | 0% (AANZFTA) or 6%( RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31031190 | 5%(ACFTA) or 6% (RCEP) | 0%(AIFTA) | 6%(Preferential import tax rates) | 0% (ATIGA) or 6% (RCEP) | 5%(AKFTA or VKFTA) | 0%(VJCEP or CPTPP) | 1,5% (UKVFTA) | 1,5% (EVFTA) | 0% (AANZFTA) or 6%( RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31031910 | 5%(ACFTA) or 6% (RCEP) | 0%(AIFTA) | 6%(Preferential import tax rates) | 0% (ATIGA) or 6% (RCEP) | 5%(AKFTA or VKFTA) | 0%(VJCEP or CPTPP) | 1,5% (UKVFTA) | 1,5% (EVFTA) | 0% (AANZFTA) or 6%( RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31031990 | 5%(ACFTA) or 6% (RCEP) | 0%(AIFTA) | 6%(Preferential import tax rates) | 0% (ATIGA) or 6% (RCEP) | 5%(AKFTA or VKFTA) | 0%(VJCEP or CPTPP) | 1,5% (UKVFTA) | 1,5% (EVFTA) | 0% (AANZFTA) or 6%( RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31039010 | 5%(ACFTA) or 6% (RCEP) | 0%(AIFTA) | 6%(Preferential import tax rates) | 0% (ATIGA) or 6% (RCEP) | 5%(AKFTA or VKFTA) | 0%(VJCEP or CPTPP) | 1,5% (UKVFTA) | 1,5% (EVFTA) | 0% (AANZFTA) or 6%( RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31039090 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31042000 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31043000 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31049000 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31051010 | 0%(ACFTA) or 3.6% (RCEP) | 0%(AIFTA) | 6%(Preferential import tax rates) | 0% (ATIGA) or 3.6% (RCEP) | 5%(AKFTA or VKFTA) or 3.6%(RCEP) | 0%(AJCEP or VJCEP or CPTPP) or 3.8% (RCEP) | 1,5% (UKVFTA) | 1,5% (EVFTA) | 0% (AANZFTA) or 3.6%( RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31051020 | 0%(ACFTA) or 3.6% (RCEP) | 0%(AIFTA) | 6%(Preferential import tax rates) | 0% (ATIGA) or 3.6% (RCEP) | 5%(AKFTA or VKFTA) or 3.6%(RCEP) | 0%(AJCEP or VJCEP or CPTPP) or 3.8% (RCEP) | 1.5% (UKVFTA) | 1.5% (EVFTA) | 0% (AANZFTA) or 3.6%( RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31051090 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 5%(AKFTA or VKFTA) or 0%(RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31052000 | 6%(Preferential import tax rates) | 0%(AIFTA) | 6%(Preferential import tax rates) | 0% (ATIGA) or 4.4% (RCEP) | 3%(AKFTA or VKFTA) or 4.4%(RCEP) | 0%(AJCEP or VJCEP or CPTPP) or 4.5% (RCEP) | 1.5% (UKVFTA) | 1.5% (EVFTA) | 0% (AANZFTA) or 4.4%( RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31053000 | 5%(ACFTA) or 3% (RCEP) | 0%(AIFTA) | 6%(Preferential import tax rates) | 0% (ATIGA) or 2.2% (RCEP) | 0%(AKFTA or VKFTA) or 2.2%(RCEP) | 0%(AJCEP or VJCEP or CPTPP) or 2.3% (RCEP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA) or 2.2%( RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31054000 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31055100 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31055900 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31056000 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

| 31059000 | 0%(ACFTA or RCEP) | 0%(AIFTA) | 0%(Preferential import tax rates) | 0% (ATIGA or RCEP) | 0%(AKFTA or VKFTA or RCEP) | 0%(AJCEP or VJCEP or RCEP or CPTPP) | 0% (UKVFTA) | 0% (EVFTA) | 0% (AANZFTA or RCEP) | 0%(VN- EAEUFTA) | 0% (CPTPP) | 0% (CPTPP) |

The above list is import taxes on fertilizer from some major markets. Note: for countries with FTAs, goods can only enjoy Special preferential import taxes above if they meet the conditions as required by the agreement. If the conditions of the agreement are not met, they will enjoy Preferential import tax.

| If you encounter any difficulties in determining the import tax, please contact us via hotline at ++ 84 886115726 / ++ 84 984870199 or whatsapp: ++84 865996476 for free consultation. |

Are fertilizer banned from importing to Vietnam?

According to the current regulation, fertilizer commodity is not in the List of prohibited imports into Vietnam, so the enterprise can do the import procedure pursuant to current stipulations.

→ For more information, read the article List of prohibited imports into Vietnam

Governmental management on importing fertilizer to Vietnam

What certificates are required in importing fertilizer to Vietnam?

Fertilizers are goods subject to conditional trading and need to be recognized by the Plant Protection Department for circulation in Vietnam; and quality inspection + declaration of conformity upon import.

=> Therefore, for fertilizer importers for the first time, they need to apply for a circulation permit for the type of fertilizer they want to import at the Plant Protection Department.

*Note: Domestic or foreign organizations and individuals (Having representative offices, companies, and branches of companies currently licensed to operate in Vietnam) are allowed to register for fertilizer recognition in their names.

Recognition of circulation of imported fertilizers for the first time

- For fertilizers that are imported for the first time, they must be recognized for circulation with the Plant Protection Department before being imported into Vietnam.

- The condition to be recognized for circulation of fertilizers is to conduct fertilizer testing.

→ Contact us for inbound and outbound shipment to / from Vietnam – Email: info@hpgloballtd.com

Customs procedure to import fertilizer into Vietnam

What procedure of importing fertilizer to Vietnam? What documents are needed when importing fertilizer to Vietnam?

Customs dossier for importing fertilizer commodity normally are as below:

- Commercial Invoice (Commercial Invoice)

- Bill of lading (Bill of Lading)

- Certificate of origin (Certificate of origin – in case the importer wants to enjoy special preferential import tax)

- In some cases: Packing List (Goods packing slip)

- Accreditation of fertilizer circulation

- Certificate of quality and conformity certification

→ Contact us for inbound and outbound shipment to / from Vietnam – Email: info@hpgloballtd.com

Label for fertilizer commodity imported to Vietnam

According to current stipulation, cargo imported into Vietnam need to have sufficient label

Imported goods need to be fully labeled according to current regulations.

Goods labels must show the following contents:

a) Name of goods;

b) Name and address of the organization or individual responsible for the goods;

c) Origin of goods;

| In addition, with fertilizers, the product labels require the following information:

a) Type of fertilizer; c) Method of use; d) Quantitative; d) Date of manufacture; e) Expiry date; g) Ingredient or ingredient quantity; h) Warning information; i) Instructions for use, instructions for preservation; k) For foliar fertilizers, the phrase “Foliar fertilizer” must be clearly stated. |

Duties, Taxes on importing fertilizer to Vietnam

When importing fertilizer to Vietnam, the importer needs to pay import duty and value added tax (VAT).

VAT on fertilizer importing to Vietnam: 5%

Preferential import duty on fertilizer: 0-6% (depending on HS code of items)

Currently, Vietnam have signed FTA with more than 50 countries in the world. In case fertilizer commodity is imported from countries with free trade agreements with Vietnam, they may enjoy special preferential import duties if they meet the conditions set by the agreement.

→ To check whether your country and Vietnam have MFN (Most favoured nation) and FTA (Free Trade Agreement), you can check at the article: Overview Of Trade Relations Between Vietnam And The World

Freight Shipping For fertilizer To Vietnam

| HP Global Vietnam – Freight Fowarder provide sea, air freight and customs brokerage, import – export license service for cargo transportation from Vietnam to the world and vice versa |

Shipping time by sea and by air

Currently, major markets that export fertilizer to Vietnam are: China, Russian Federation, Israel, Korea (Republic), Canada, ….

To check the time and freight for specific point to point, you can email to info@hpgloballtd.com or call/Zalo to ++8488-611-5726;++84 984870199

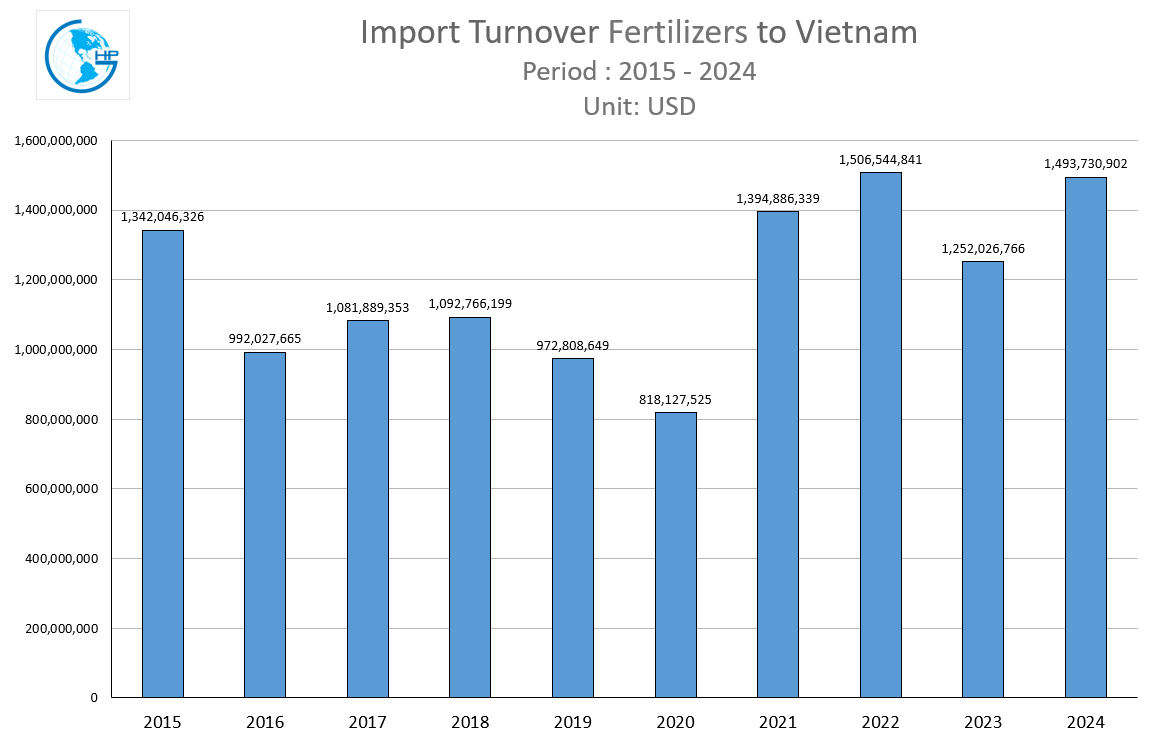

Vietnam’s fertilizer Import Turnover

Vietnam’s Import Turnover for fertilizer annually

Updated Vietnam’s Import value of fertilizer per territories/countries:

| Market | Unit | December – 2024 | 2024 | ||

| Volume | Value (USD) | Volume | Value (USD) | ||

| India | Ton | 338 | 264.224 | 2.989 | 3.194.271 |

| Saudi Arabia | Ton | 4.711 | 2.897.265 | 7.737 | 4.692.412 |

| Belgium | Ton | 6.401 | 2.267.283 | 110.024 | 40.487.075 |

| Canada | Ton | 15.362 | 4.531.790 | 164.955 | 52.249.719 |

| Taiwan | Ton | 5.527 | 1.630.523 | 103.176 | 23.923.466 |

| Germany | Ton | 617 | 544.894 | 23.213 | 14.657.614 |

| Korea (Republic) | Ton | 31.637 | 14.558.028 | 230.346 | 87.392.185 |

| United States of America | Ton | 475 | 1.055.578 | 8.714 | 10.988.853 |

| Indonesia | Ton | 13.592 | 2.081.450 | 138.095 | 43.150.236 |

| Israel | Ton | 621 | 745.601 | 81.850 | 32.817.736 |

| Laos | Ton | 18.215 | 4.739.262 | 333.300 | 86.273.866 |

| Malaysia | Ton | 8.493 | 2.894.447 | 85.055 | 29.977.568 |

| Norway | Ton | 3.853 | 2.501.797 | 70.361 | 39.939.218 |

| Russian Federation | Ton | 2.085 | 815.355 | 547.705 | 228.601.977 |

| Japan | Ton | 35.081 | 3.182.851 | 395.419 | 36.433.849 |

| Philippines | Ton | 4.524 | 2.144.478 | 27.701 | 12.866.709 |

| Thailand | Ton | 786 | 496.260 | 18.267 | 6.430.228 |

| China | Ton | 253.687 | 66.529.476 | 2.357.337 | 739.653.920 |

Source: Synthesized data from statistics of the General Department of Customs Vietnam

Select HP Global as the freight forwarder/customs brokerage for your shipments import fertilizer into Vietnam

HP Global is the logistics company with top reputation in Vietnam, we provide following services:

→ Contact us for freight and inbound and outbound services for shipments to / from Vietnam – Email: info@hpgloballtd.com

You may concern:

For consultation and quotation for cargo import to and export from Vietnam, contact us as below details

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

Tiếng Việt

Tiếng Việt  English

English  简体中文

简体中文