Export Fruits from Vietnam: Customs procedures; export duty and transportation 2025

Do you want to import Fruits from Vietnam? Do you need to calculate freight from Vietnam to your place? Do you want to know more about Vietnam’s procedure and export duties on exporting Fruits from Vietnam?

In this article, Logistics HP Global Vietnam, whose many years in providing freight and logistics services exports Fruits from Vietnam.

HS code and export duty of Fruits in Vietnam

HS code of Fruits in Vietnam

In importing/exporting any commodity, In order to properly determine duties, policies, procedures of the commodity, one of the first thing needed to determine is the HS code of the commodity

Fruits’s HS code Chapter 8: Edible fruit and nuts; peel of citrus fruit or melons

Note:

– This chapter covers nuts or inedible fruits.

– Chilled nuts or nuts are to be classified in the same heading as the corresponding fruits and nuts.

– Dried fruit or nuts of this Chapter may be partially rehydrated or processed for the following purposes:

(a) Enhance storage or stabilization (for example, with moderate heat treatment, with sulfur, by adding sobic acid or potassium chocolate).

(b) Improve or maintain their appearance (for example, by adding vegetable oil or a small amount of syrup glucose), provided that they retain the properties of dried fruits and nuts)

VAT and preferential import duty on FRUITS to Vietnam in 2023

| HS Code | Descriptions | VAT | Preferential Import duty |

| 0801 | Coconuts, Brazil nuts and cashew nuts, fresh or dried, whether or not shelled or peeled.

|

||

| – Coconuts: | |||

| 08011100 | – – Desiccated | 0% | 0% |

| 08011200 | – – In the inner shell (endocarp) | 0% | 0% |

| 080119 | – – Other: | ||

| 08011910 | – – – Young coconut | 0% | 0% |

| 08011990 | – – – Other | 0% | 0% |

| – Brazil nuts: | |||

| 08012100 | – – In shell | 0% | 0% |

| 08012200 | – – Shelled | 0% | 0% |

| – Cashew nuts: | |||

| 08013100 | – – In shell | 0% | 0% |

| 08013200 | – – Shelled | 0% | 0% |

| 0802 | Other nuts, fresh or dried, whether or not shelled or peeled | ||

| – Almonds: | |||

| 08021100 | – – In shell | 0% | 0% |

| 080212 | – – Shelled: | ||

| 08021210 | – – – Blanched | 0% | 0% |

| 08021290 | – – – Other | 0% | 0% |

| – Hazelnuts or filberts (Corylus spp.): | |||

| 08022100 | – – In shell | 0% | 0% |

| 08022200 | – – Shelled | 0% | 0% |

| – Walnuts: | |||

| 08023100 | – – In shell | 0% | 0% |

| 08023200 | – – Shelled | 0% | 0% |

| – Chestnuts (Castanea spp.): | |||

| 08024100 | – – In shell | 0% | 0% |

| 08024200 | – – Shelled | 0% | 0% |

| – Pistachios: | |||

| 08025100 | – – In shell | 0% | 0% |

| 08025200 | – – Shelled | 0% | 0% |

| – Macadamia nuts: | |||

| 08026100 | – – In shell | 0% | 0% |

| 08026200 | – – Shelled | 0% | 0% |

| 08027000 | – Kola nuts (Cola spp.) | 0% | 0% |

| 08028000 | – Areca nuts | 0% | 0% |

| – Other: | |||

| 08029100 | – – Pine nuts, in shell | 0% | 0% |

| 08029200 | – – Pine nuts, shelled | 0% | 0% |

| 08029900 | – – Other | 0% | 0% |

| 0803 | Bananas, including plantains, fresh or dried | ||

| 080310 | – Plantains: | ||

| 08031010 | – – Fresh | 0% | 0% |

| 08031020 | – – Dried | 0% | 0% |

| 080390 | – Other: | ||

| 08039010 | – – Lady’s finger banana | 0% | 0% |

| 08039020 | – – Cavendish banana (Musa acuminata) | 0% | 0% |

| 08039030 | – – Chestnut banana (hybrid of Musa acuminata and Musa balbisiana, cultivar Berangan) | 0% | 0% |

| 08039090 | – – Other | 0% | 0% |

| 0804 | Dates, figs, pineapples, avocados, guavas, mangoes and mangosteens, fresh or dried | ||

| 08041000 | – Dates | 0% | 0% |

| 08042000 | – Figs | 0% | 0% |

| 08043000 | – Pineapples | 0% | 0% |

| 08044000 | – Avocados | 0% | 0% |

| 080450 | – Guavas, mangoes and mangosteens: | ||

| 08045010 | – – Guavas | 0% | 0% |

| – – Mangoes: | |||

| 08045021 | – – – Fresh | 0% | 0% |

| 08045022 | – – – Dried | 0% | 0% |

| 08045030 | – – Mangosteens | 0% | 0% |

| 0805 | Citrus fruit, fresh or dried | ||

| 080510 | – Oranges: | ||

| 08051010 | – – Fresh | 0% | 0% |

| 08051020 | – – Dried | 0% | 0% |

| – Mandarins (including tangerines and satsumas); clementines, wilkings and similar citrus hybrids: | |||

| 08052100 | – – Mandarins (including tangerines and satsumas) | 0% | 0% |

| 08052200 | – – Clementines | 0% | 0% |

| 08052900 | – – Other | 0% | 0% |

| 08054000 | – Grapefruit and pomelos | 0% | 0% |

| 080550 | – Lemons (Citrus limon, Citrus limonum) and limes (Citrus aurantifolia, Citrus latifolia): | ||

| 08055010 | – – Lemons (Citrus limon, Citrus limonum) | 0% | 0% |

| 08055020 | – – Limes (Citrus aurantifolia, Citrus latifolia) | 0% | 0% |

| 08059000 | – Other | 0% | 0% |

| 0806 | Grapes, fresh or dried | ||

| 08061000 | – Fresh | 0% | 0% |

| 08062000 | – Dried | 0% | 0% |

| 0807 | Melons (including watermelons) and papaws (papayas), fresh | ||

| – Melons (including watermelons): | |||

| 08071100 | – – Watermelons | 0% | 0% |

| 08071900 | – – Other | 0% | 0% |

| 08072000 | – Papaws (papayas) | 0% | 0% |

| 0808 | Apples, pears and quinces, fresh | ||

| 08081000 | – Apples | 0% | 0% |

| 08083000 | – Pears | 0% | 0% |

| 08084000 | – Quinces | 0% | 0% |

| 0809 | Apricots, cherries, peaches (including nectarines), plums and sloes, fresh | ||

| 08091000 | – Apricots | 0% | 0% |

| – Cherries: | |||

| 08092100 | – – Sour cherries (Prunus cerasus) | 0% | 0% |

| 08092900 | – – Other | 0% | 0% |

| 08093000 | – Peaches, including nectarines | 0% | 0% |

| 080940 | – Plums and sloes: | ||

| 08094010 | – – Plums | 0% | 0% |

| 08094020 | – – Sloes | 0% | 0% |

| 0810 | Other fruit, fresh | ||

| 08101000 | – Strawberries | 0% | 0% |

| 08102000 | – Raspberries, blackberries, mulberries and loganberries | 0% | 0% |

| 08103000 | – Black, white or red currants and gooseberries | 0% | 0% |

| 08104000 | – Cranberries, bilberries and other fruits of the genus Vaccinium | 0% | 0% |

| 08105000 | – Kiwifruit | 0% | 0% |

| 08106000 | – Durians | 0% | 0% |

| 08107000 | – Persimmons | 0% | 0% |

| 081090 | – Other: | ||

| 08109010 | – – Longans; Mata Kucing | 0% | 0% |

| 08109020 | – – Lychees | 0% | 0% |

| 08109030 | – – Rambutan | 0% | 0% |

| 08109040 | – – Langsat (Lanzones) | 0% | 0% |

| 08109050 | – – Jackfruit (including Cempedak and Nangka) | 0% | 0% |

| 08109060 | – – Tamarinds | 0% | 0% |

| 08109070 | – – Starfruit | 0% | 0% |

| – – Other: | |||

| 08109091 | – – – Salacca (snake fruit) | 0% | 0% |

| 08109092 | – – – Dragon fruit | 0% | 0% |

| 08109093 | – – – Sapodilla (ciku fruit) | 0% | 0% |

| 08109094 | – – – Pomegranate (Punica spp.), soursop or sweetsops (Annona spp.), bell fruit (Syzygium spp., Eugenia spp.), marian plum (Bouea spp.), passion fruit (Passiflora spp.), cottonfruit (Sandoricum spp.), jujube (Ziziphus spp.) and tampoi or rambai (Baccaurea spp.) | 0% | 0% |

| 08109099 | – – – Other | 0% | 0% |

| 0811 | Fruit and nuts, uncooked or cooked by steaming or boiling in water, frozen, whether or not containing added sugar or other sweetening matter | ||

| 08111000 | – Strawberries | 0% | 0% |

| 08112000 | – Raspberries, blackberries, mulberries, loganberries, black, white or red currants and gooseberries | 0% | 0% |

| 08119000 | – Other | 0% | 0% |

| 0812 | Fruit and nuts provisionally preserved, but unsuitable in that state for immediate consumption | ||

| 08121000 | – Cherries | 0% | 0% |

| 081290 | – Other: | ||

| 08129010 | – – Strawberries | 0% | 0% |

| 08129090 | – – Other | 0% | 0% |

The classification of a product to a certain HS code is based on the nature, composition, …. of the actual exported commodity at the import time, based on catalogue, technical documents (if any) or /and decided by the Customs Department of Commodity Verification. The actual inspection results of the Customs and announcement by the Customs Department of Commodity Verification are legal basis for applying HS code to imported goods. Importers are ultimately responsible for ensuring that the products are correctly classified.

Our above advised HS codes are for reference only.

→ For more information about this content, please refer to the article Definition of HS code in Vietnam

Customs Duties on exporting Fruits in Vietnam

When exporting Fruits from Vietnam, the exporter has to pay:

Do not have to pay VAT (pursuant to current stipulations, VAT on exported commodities in Vietnam is 0%)

Export duty: as per the above table

For taxable commodities with a tariff of more than 0%, please note that cargo exported to EU, UK, or members of CPTTP, cargos can enjoy special preferential export duty under such FTAs

→ To check whether your country and Vietnam have MFN (Most favored nation) and FTA (Free Trade Agreement), you can check the article: Overview Of Trade Relations Between Vietnam And The World

→ See List of taxable export commodities in Vietnam Here

Governmental management and export procedure of Fruits in Vietnam

What license does Fruits commodity need to export?

To import fresh fruits into Vietnam, businesses must meet the following conditions:

(i) The exporter must be from a country/territory that has registered the export of plant-origin products to Vietnam.

To check which countries/territories are allowed to export fruits to Vietnam, you can refer to the article: List of countries/territories registered to export plant-origin products to Vietnam.

(ii) The type of fresh fruit to be imported must be included in the list of fresh fruits imported from the country/territory registered in (i).

Currently, this list is updated online on the website https://ppd.gov.vn/ and directly by the Plant Protection Department. To check whether a specific type of fresh fruit is allowed for import into Vietnam, you can access the website of the Plant Protection Department or contact them directly. Alternatively, you can contact HP Global for assistance and consultation.

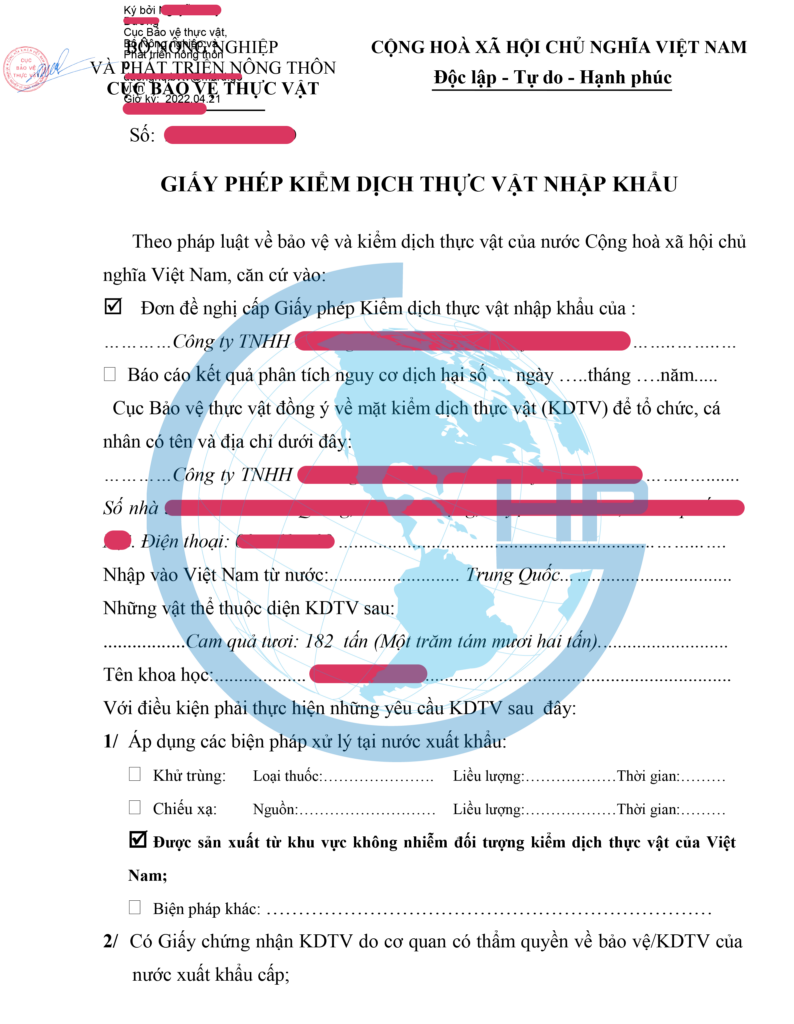

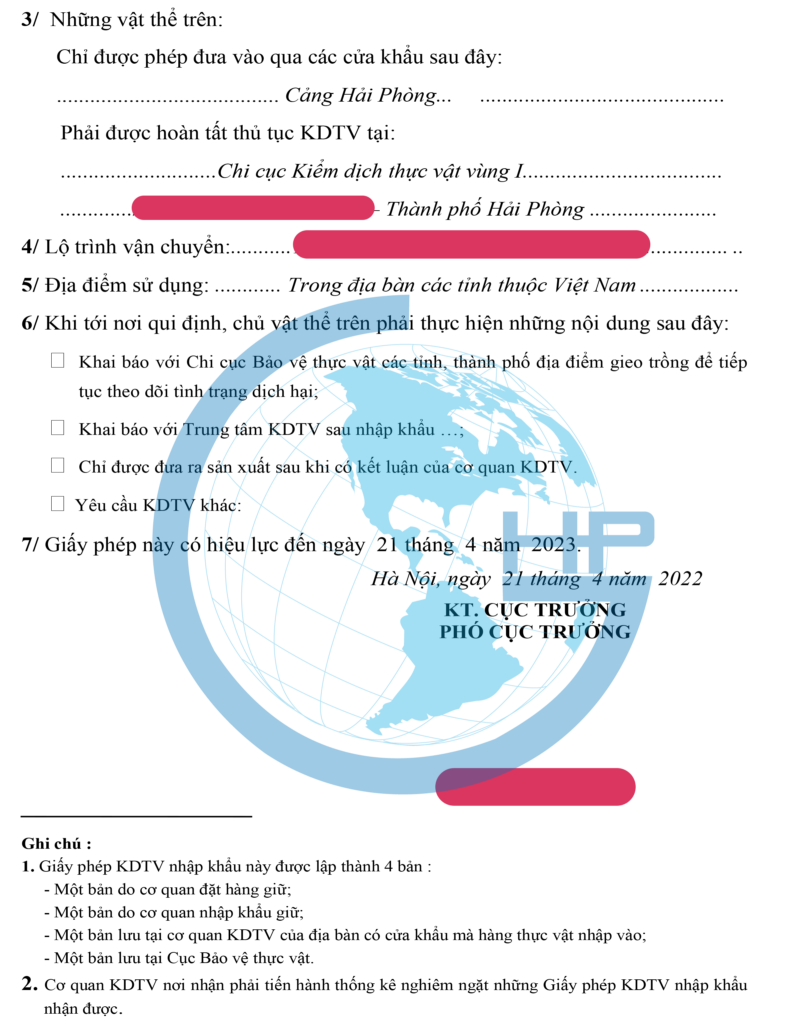

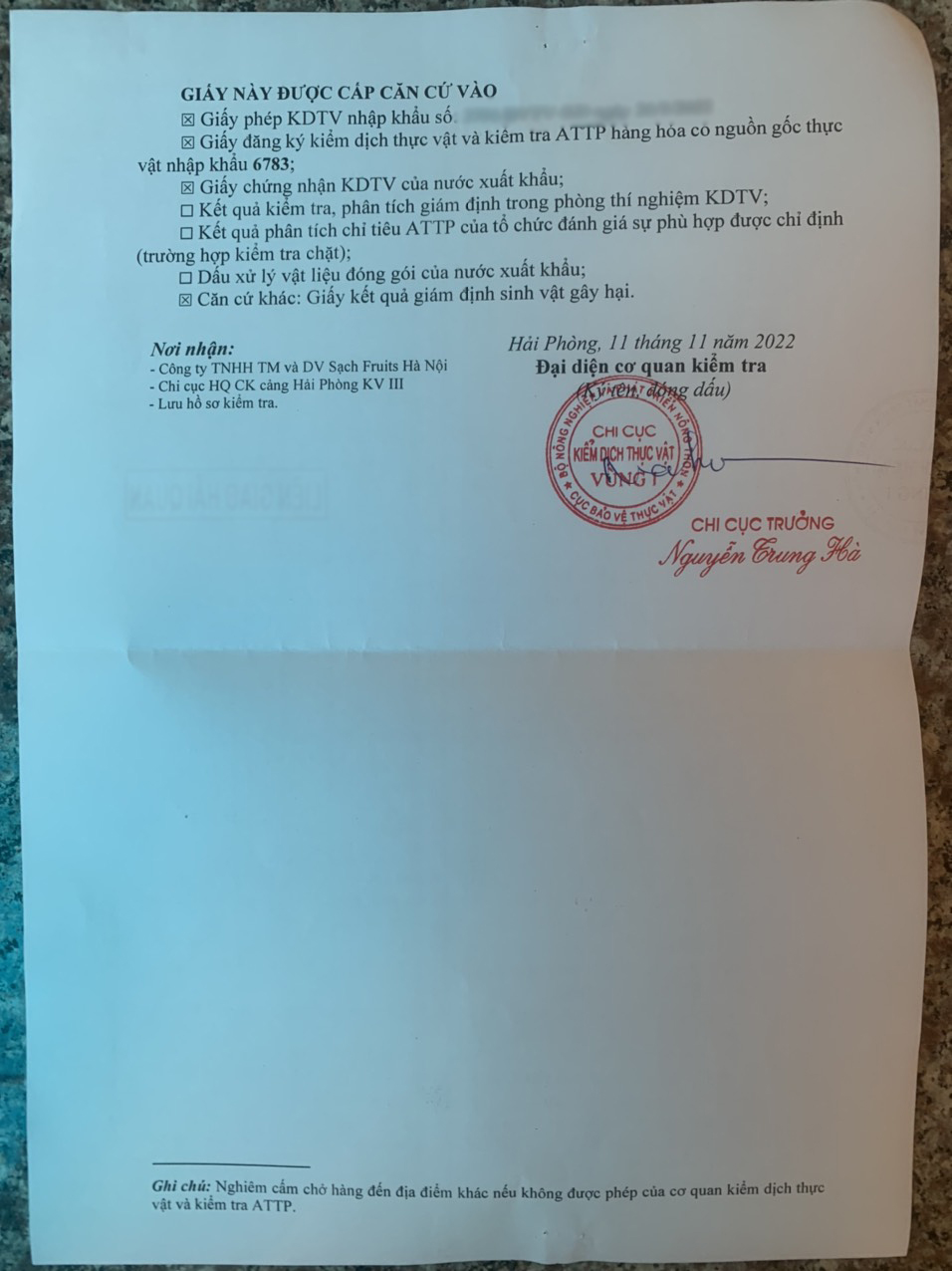

(iii) Have a phytosanitary inspection certificate before importing fresh fruits into Vietnam.

Fresh fruits imported into Vietnam must have a phytosanitary inspection certificate issued by the Plant Protection Department. This certificate is valid for one year.

HP Global provide logistics service in Vietnam -> Contact ++84 984870199, email info@hpgloballtd.com

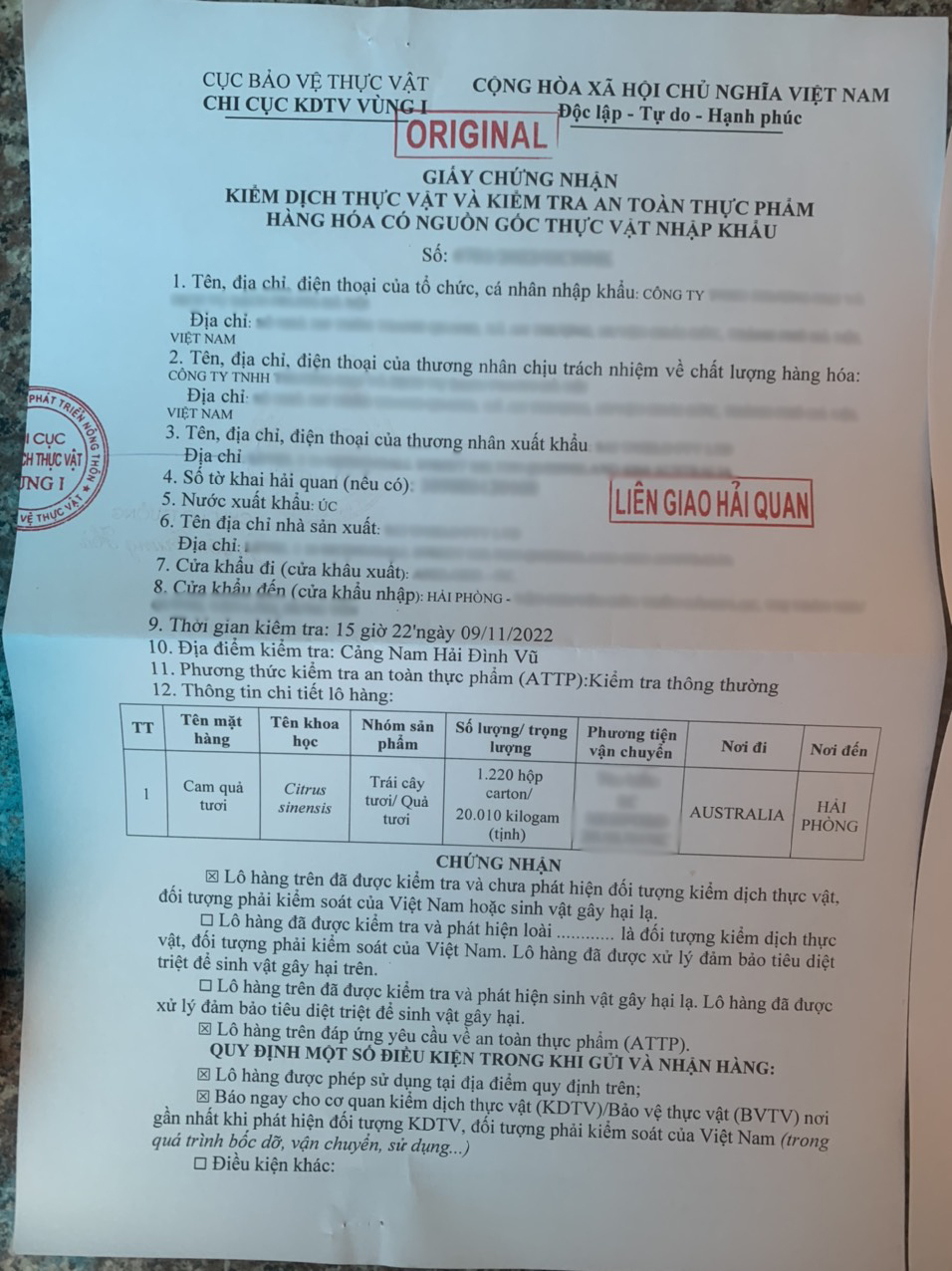

(iv) Inspection for each batch of imported fresh fruits

It is required to have a phytosanitary inspection certificate issued by the competent plant inspection authority of the exporting country or an equivalent valid confirmation document.

Additionally, a phytosanitary inspection certificate issued by the competent authority in Vietnam is required.

|

|

|

Based on legal documents:

- 30/2014/TT-BNNPTNT: Issuance of a list of objects subject to plant inspection, and the list of objects subject to plant inspection that must undergo a risk analysis before importation into Vietnam.

- 33/2014/TT-BNNPTNT: Regulations on the procedures and sequence of plant inspection for imports, exports, transit, and post-importation of objects subject to plant inspection.

- 30/2017/TT-BNNPTNT: Amendment and supplementation of 33/2014/TT-BNNPTNT

- 34/2018/TT-BNNPTNT: Amendment and supplementation of 33/2014/TT-BNNPTNT

HP Global provide service for in Vietnam -> Contact ++84 984870199, email info@hpgloballtd.com

Customs procedure of Export Fruits from Vietnam

Customs dossiers for export of Fruits normally include:

- Business registration (if exporting for the first time, no need for the next time)

- Commercial Invoice

- Letter of introduction

- With full container: Minutes of container handover

- For some branches: Add input documents for commercial goods

- With some branches: add the Agreement to develop the Customs – Enterprise Partnership

- Phytosanitary inspection certificate still valid

- Inspection certificate for the batch

→ Contact us for inbound and outbound shipment to / from Vietnam – Email: info@hpgloballtd.com

Certificate of Vietnam origin

Currently, Vietnam has signed FTA with more than 50 countries in the world, there is the possibility that you can enjoy special preferential import duty when you import Fruits commodities from Vietnam

→ To check whether your country and Vietnam have MFN (Most favored nation) and FTA (Free Trade Agreement), you can check at the article: Overview Of Trade Relations Between Vietnam And The World

→ To see List of FTA Vietnam joined, you can find at the article: List of FTA Vietnam Joined

→ Need service for applying C/O in Vietnam, contact for advice and quotation: +84 984 870 199 or +84 886 115 726

Freight Shipping from Vietnam

HP Global Vietnam – Freight Fowarder provide sea, air freight and customs brokerage, import – export license service for cargo transportation from Vietnam to the world and vice versa

Currently, centers of international airports and sea ports of Vietnam are:

From the North of Vietnam:

Export by sea: from Hai Phong (VNHPH)

Export by air: from Ha Noi (VNHAN)

From middle of Vietnam:

Export by sea and air: from Da Nang (VNDAD, VNDTS)

From South of Vietnam:

Export by sea and air: from Ho Chi Minh (VNSGN, VNHCM)

Most of all biggest airlines and shipping lines are having business in Vietnam, therefore, normally, it is convenient to find a shipping space.

→ For more informationabout this content, please refer to the article Overview of Vietnam Seaports and Overvew of International Airports in Vietnam

→ Contact us for freight and inbound and outbound services for shipments to / from Vietnam – Email: info@hpgloballtd.com

Select HP Global as the freight forwarder for your shipments import/export Fruits from Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

→ Contact us for freight and inbound and outbound services for shipments to / from Vietnam – Email: info@hpgloballtd.com

You may concern:

For consultation and quotation for cargo import to and export from Vietnam, contact us as below details

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984.870.199/ ++84 886.115.726

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

Tiếng Việt

Tiếng Việt  English

English  简体中文

简体中文