Export Coffee From Vietnam: Freight, Procedure And Export Duties In Vietnam 2026

Do you want to import Coffee from Vietnam? Do you need to calculate freight from Vietnam to your place? Do you want to know more about Vietnam’s procedure and export duties on exporting Coffee from Vietnam?

In this article, Logistics HP Global Vietnam, whose many years of freight and logistics services exports Coffee from Vietnam.

HS code and export duty of Coffee in Vietnam 2026

In importing/exporting any commodity, To properly determine duties, policies, and procedures of the commodity, one of the first things needed to determine is the HS code of the commodity

HS code and Customs duty of Coffee in Vietnam

Coffee under Chapter 09: Coffee, tea, Paragoay tea and spices

| HS Code | Descriptions | Export VAT (%) | Export duty(%) |

| 0901 | Coffee, whether or not roasted or decaffeinated; coffee husks and skins; coffee substitutes containing coffee in any proportion | ||

| – Coffee, not roasted: | |||

| 090111 | – – Not decaffeinated: | ||

| 09011120 | – – – Arabica | 0% | Not in the list of goods subject to export tax or tax rate |

| 09011130 | – – – Robusta | 0% | Not in the list of goods subject to export tax or tax rate |

| 09011190 | – – – Other | 0% | Not in the list of goods subject to export tax or tax rate |

| 090112 | – – Decaffeinated: | ||

| 09011220 | – – – Arabica or Robusta | 0% | Not in the list of goods subject to export tax or tax rate |

| 09011290 | – – – Other | 0% | Not in the list of goods subject to export tax or tax rate |

| – Coffee, roasted: | |||

| 090121 | – – Not decaffeinated: | ||

| – – – Unground: | |||

| 09012111 | – – – – Arabica | 0% | Not in the list of goods subject to export tax or tax rate |

| 09012112 | – – – – Robusta | 0% | Not in the list of goods subject to export tax or tax rate |

| 09012119 | – – – – Other | 0% | Not in the list of goods subject to export tax or tax rate |

| 09012120 | – – – Ground | 0% | Not in the list of goods subject to export tax or tax rate |

| 090122 | – – Decaffeinated: | ||

| 09012210 | – – – Unground | 0% | Not in the list of goods subject to export tax or tax rate |

| 09012220 | – – – Ground | 0% | Not in the list of goods subject to export tax or tax rate |

| 090190 | – Other: | ||

| 09019010 | – – Coffee husks and skins | 0% | Not in the list of goods subject to export tax or tax rate |

| 09019020 | – – Coffee substitutes containing coffee | 0% | Not in the list of goods subject to export tax or tax rate |

Note: The HS code and taxes mentioned above are for reference only.

Governmental management and export procedure of Coffee in Vietnam

What license does Coffee commodity need to export?

a, For unprocessed coffee products

Before carrying out export procedures, the exporter should contact the import partner to check whether the importing country requires service & fumigation inspection for this item or not, avoid the following question when exporting.

- In case the international goods sale and purchase contract requires inspection:

– Enterprises carry out epidemic inspection procedures with an inspection mechanism in accordance with the law on enforcement.

– Send verification verification Certificate to the purchaser according to the signed contract.

– The management agency does not require the enterprise to submit an inspection certificate when carrying out export procedures in this case.

- In case the sales contract does not require quarantine for the shipment:

– Enterprises carry out procedures for exporting goods according to current regulations and do not need to carry out quarantine for export shipments.

- For the export of goods, the country is required to check the epidemic:

The General Department of Customs is responsible for updating the list of countries with inspection requirements so that the application can automatically classify and check export shipments into the country with inspection requirements, which Vietnam is obliged to perform. Customs authorities only provide information on goods when enterprises submit quarantine certificates as service inspection agencies.

Vietnam is a member of the International Plant Protection Convention (IPPC) and the World Trade Organization (WTO). Vietnam and WTO member countries, IPPC all stipulate that shipments subject to actual quarantine must be inspected and have a certificate of inspection to act as an inspection agency for export services attached to the shipments.

Cooperation in the field of law: Vietnam has signed cooperation associations on protection and fact checking with the following countries: Cuba; Russia; Mongolia; Chile; Romanian; China; Belarus; Uzbekistan; Kazakhstan. In these associations, all consignments subject to quarantine moving from the other contracting territory must be inspected and accompanied by a certificate of quarantine of the exporting country’s family. So, if you are exporting coffee to the countries on this list, you need to check the service for shipments.

b, For processed coffee products

Before completing export procedures, exporters should contact the importing partner to check whether the importing country requires food hygiene/safety/quality inspection for this item or not. to prepare and avoid problems after exporting.

Customs procedure of Export Coffee from Vietnam

Customs dossiers for export of Coffee normally include:

- Business registration (if exporting for the first time, no need for the next time)

- Commercial Invoice

- Letter of introduction

- With full container: Minutes of container handover

- Certificate of origin (CO). For example: C/O form D, B, E, v.v…depends on which country imports

- For some branches: Add input documents for commercial goods

- With some branches: add the Agreement to develop the Customs – Enterprise Partnership

- Certificate of fumigation (if any)

Certificate of Vietnam origin of Coffee:

Currently, Vietnam has signed FTA with more than 50 countries in the world, there is the possibility that you can enjoy special preferential import duty when you import Coffee commodities from Vietnam

→ To check whether your country and Vietnam have MFN (Most favored nation) and FTA (Free Trade Agreement), you can check at the article: Overview Of Trade Relations Between Vietnam And The World

→ To see List of FTA Vietnam joined, you can find at the article: List of FTA Vietnam Joined

→ Need service for applying C/O in Vietnam, contact for advice and quotation: +84 984 870 199 or +84 886 115 726

Export goods label – Shipping mark

For exported goods, when ensuring smooth transportation and customs procedures, businesses should affix shipping marks on the packages.

Shipping mark content normally includes the following:

- Product names in English

- Name of importing unit

- MADE IN VIETNAM

- Package number/total number of packages

- In addition, information such as contract/invoice number can be added on the shipping mark

- Notes on arrangement and transportation of goods (if any): eg: need to be placed vertically, fragile goods, etc.

Freight Shipping from Vietnam

| HP Global Vietnam – Freight Forwarder provide sea, air freight and customs brokerage, import – export license service for cargo transportation from Vietnam to the world and vice versa |

Currently, centers of international airports and sea ports of Vietnam are:

From the North of Vietnam:

Export by sea: from Hai Phong area (VNHPH, Lach Huyen VNCLH)

Export by air: from Ha Noi (VNHAN)

From middle of Vietnam:

Export by sea and air: from Da Nang (VNDAD, VNDTS)

From South of Vietnam:

Export by sea from Ho Chi Minh area (VNHCM HO CHI MINH; VNVUT VUNG TAU; VNCLI CAT LAI; VNCMT CAI MEP))

Export by air from Ho Chi Minh (VNSGN)

Most of all biggest airlines and shipping lines are having business in Vietnam, therefore, normally, it is convenient to find a shipping space.

→ For more information about this content, please refer to the article Overview of Vietnam Seaports and Overview of International Airports in Vietnam

Shipping time by sea and by air

Freight charges depend on many factors, both fixed and variable over time. Therefore, please provide specific or anticipated shipment details to HP Global Vietnam to receive a complete quote on all costs for the entire export process. – Contact: ++84 886115726 or ++84984870199, whatsapp: ++84 865996476, email: info@hpgloballtd.com

Procedures for Exporting Certain Similar Products

| Commodity | Related link |

| Pepper | Procedures for exporting pepper from Vietnam |

| Tea and tea products | Procedures for exporting tea and tea products from Vietnam |

| Rice | Procedures for exporting rice from Vietnam |

| Cashew Nut | Procedures And Duty For Exporting Cashew Nut From Vietnam |

| Chili | Procedures for exporting chili from Vietnam |

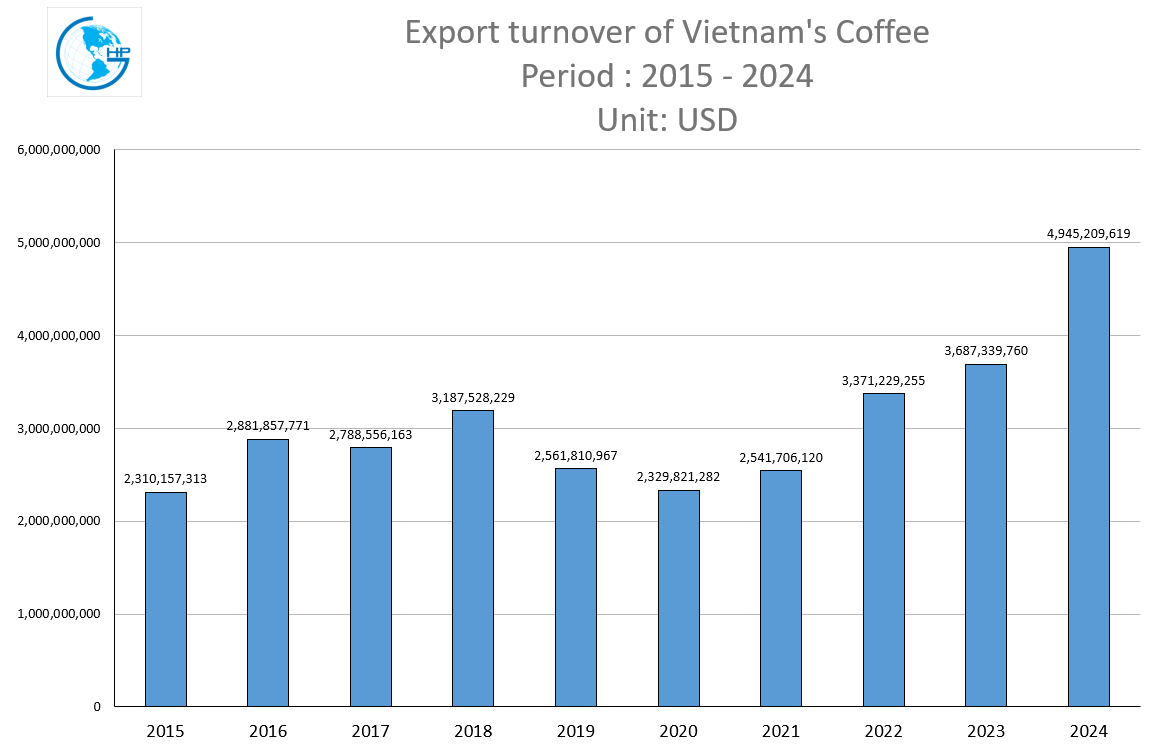

Export Turnover of Coffee from Vietnam

Export value of Coffee from Vietnam annually:

Updated Export value of Coffee from Vietnam per territories/countries:

Which countries does Vietnam export Coffee to?

| Market | Unit | December – 2024 | 2024 | ||

| Volume | Value (USD) | Volume | Value (USD) | ||

| Egypt | Ton | 1.728 | 8.976.671 | 13.051 | 51.774.017 |

| India | Ton | 12.750 | 38.835.512 | ||

| Algeria | Ton | 4.763 | 23.987.244 | 34.158 | 127.394.513 |

| United Kingdom | Ton | 1.898 | 11.394.339 | 28.054 | 132.648.564 |

| Poland | Ton | 1.154 | 10.377.250 | 11.515 | 80.658.349 |

| Belgium | Ton | 3.976 | 20.614.937 | 39.787 | 157.840.978 |

| Portugal | Ton | 746 | 3.795.421 | 12.731 | 50.569.415 |

| Cambodia | Ton | 207 | 772.544 | 2.231 | 7.961.400 |

| Canada | Ton | 614 | 3.259.726 | 6.085 | 24.678.216 |

| Chile | Ton | 41 | 312.913 | 1.799 | 8.124.478 |

| Denmark | Ton | 86 | 402.602 | 1.067 | 3.937.131 |

| Germany | Ton | 13.492 | 67.290.239 | 155.703 | 602.885.930 |

| Netherlands | Ton | 11.190 | 58.170.125 | 52.857 | 236.204.490 |

| Korea (Republic) | Ton | 2.669 | 14.476.877 | 37.678 | 141.977.154 |

| United States of America | Ton | 9.176 | 46.752.549 | 81.440 | 322.825.588 |

| Hungary | Ton | 545 | 4.914.673 | ||

| Greece | Ton | 551 | 2.848.310 | 7.765 | 32.441.270 |

| Indonesia | Ton | 1.090 | 9.515.152 | 47.493 | 212.858.542 |

| Italy | Ton | 11.091 | 56.903.581 | 124.541 | 459.601.410 |

| Israel | Ton | 688 | 5.954.314 | 4.979 | 37.522.296 |

| Laos | Ton | 10 | 69.786 | 138 | 780.549 |

| Malaysia | Ton | 3.536 | 20.289.887 | 34.382 | 160.559.899 |

| Mexico | Ton | 910 | 4.499.540 | 2.908 | 15.451.289 |

| Myanmar (Burma) | Ton | 62 | 642.777 | 2.314 | 10.722.481 |

| South Africa | Ton | 500 | 2.704.094 | 866 | 4.405.718 |

| New Zealand | Ton | 211 | 1.057.447 | 1.070 | 5.230.320 |

| Russian Federation | Ton | 8.020 | 42.503.518 | 70.566 | 306.229.726 |

| Japan | Ton | 9.797 | 54.817.907 | 93.902 | 417.089.475 |

| Australia | Ton | 684 | 4.673.729 | 13.906 | 63.619.362 |

| Finland | Ton | 281 | 962.827 | ||

| France | Ton | 1.458 | 7.420.034 | 17.695 | 72.621.391 |

| Philippines | Ton | 5.580 | 38.382.529 | 55.555 | 288.483.842 |

| Romania | Ton | 75 | 563.922 | 1.996 | 9.239.378 |

| Singapore | Ton | 109 | 708.764 | 1.418 | 7.533.423 |

| Spain | Ton | 6.905 | 34.936.924 | 102.099 | 444.841.051 |

| Thailand | Ton | 3.165 | 22.243.472 | 38.833 | 170.335.665 |

| China | Ton | 6.159 | 30.972.130 | 52.900 | 231.449.297 |

Source: Synthesized data from statistics of the General Department of Customs Vietnam

Select HP Global as the freight forwarder for your shipments import/export Coffee from Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

→ Contact us for freight and inbound and outbound services for shipments to / from Vietnam – Email: info@hpgloballtd.com

For consultation and quotation for cargo import to and export from Vietnam, contact us as below details

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984.870.199/ ++84 886.115.726

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

Tiếng Việt

Tiếng Việt  English

English  简体中文

简体中文