Import Auto parts to Vietnam: Customs procedures; import duty and transportation 2024

Do you want to export Auto parts to Vietnam? Do you need to calculate freight from the export warehouse to Vietnam? You want to know about Vietnam’s procedure and import duties for importing Auto parts to Vietnam? Import procedures for Auto parts?

In this article, Logistics HP Global Vietnam, whose many years in providing freight and logistics services import Auto parts from many countries to Vietnam, will share knowledge and advice on the above issues.

HS code and import duty of Auto parts in Vietnam year 2024

HS Code, Duties, Taxes on importing Auto parts to Vietnam:

Auto parts include many types, made from many different materials, so HS of auto parts are also very diverse. In this article, we will take the specific HS code for your reference.

Car spare parts with HS codes:

| HS code | Description | VAT (%) | Preferential Import duty (%) | Normal import tax (%) |

| 27101944 | – – – – Lubricating greases | 10 | 5 | 7.5 |

| 39233090 | – – Other | 8 | 15 | 22.5 |

| 39263000 | – Fittings for furniture, coachwork or the like | 8 | 20 | 30 |

| 39269099 | – – – Other | 8 | 12 | 18 |

| 40091290 | – – – Other | 8 | 3 | 4.5 |

| 40093191 | – – – – Fuel hoses, heater hoses and water hoses, of a kind used on motor vehicles of heading 87.02, 87.03, 87.04 or 87.11 | 8 | 3 | 4.5 |

| 40101200 | – – Reinforced only with textile materials | 8 | 5 | 7.5 |

| 40101900 | – – Other | 8 | 5 | 7.5 |

| 40103100 | – – Endless transmission belts of trapezoidal cross-section (V-belts), V-ribbed, of an outside circumference exceeding 60 cm but not exceeding 180 cm | 8 | 15 | 22.5 |

| 40169320 | – – – Gaskets and o-rings, of a kind used on motor vehicles of heading 87.02, 87.03, 87.04 or 87.11 | 8 | 3 | 4.5 |

| 40169390 | – – – Other | 8 | 3 | 4.5 |

| 40169911 | – – – – For vehicles of heading 87.02, 87.03, 87.04 or 87.05, other than weatherstripping | 8 | 10 | 15 |

| 40169913 | – – – – Weatherstripping, of a kind used on motor vehicles of heading 87.02, 87.03 or 87.04 | 8 | 10 | 15 |

| 70071110 | – – – Suitable for vehicles of Chapter 87 | 8 | 20 | 30 |

| 70091000 | – Rear-view mirrors for vehicles | 8 | 25 | 37.5 |

| 70099200 | – – Framed | 8 | 30 | 45 |

| 73101091 | – – – Casting, forging or stamping, in the rough state | 10 | 12 | 18 |

| 73181100 | – – Coach screws | 10 | 5 | 7.5 |

| 73181510 | – – – Having a shank of an external diameter not exceeding 16 mm | 10 | 12 | 18 |

| 73181590 | – – – Other | 10 | 12 | 18 |

| 73181610 | – – – For bolts having a shank of an external diameter not exceeding 16 mm | 10 | 12 | 18 |

| 73181690 | – – – Other | 10 | 12 | 18 |

| 73181910 | – – – Having a shank of an external diameter not exceeding 16 mm | 10 | 12 | 18 |

| 73181990 | – – – Other | 10 | 12 | 18 |

| 73182100 | – – Spring washers and other lock washers | 10 | 12 | 18 |

| 73182200 | – – Other washers | 10 | 12 | 18 |

| 73182400 | – – Cotters and cotter-pins | 10 | 12 | 18 |

| 73182910 | – – – Having a shank of an external diameter not exceeding 16 mm | 10 | 12 | 18 |

| 73182990 | – – – Other | 10 | 12 | 18 |

| 73201011 | – – – Suitable for use on motor vehicles of heading 87.02, 87.03 or 87.04 | 10 | 10 | 15 |

| 73202090 | – – Other | 10 | 3 | 4.5 |

| 73209010 | – – Suitable for use on motor vehicles | 10 | 3 | 4.5 |

| 73259990 | – – – Other | 10 | 20 | 30 |

| 73269099 | – – – Other | 10 | 10 | 15 |

| 82060000 | Tools of two or more of the headings 82.02 to 82.05, put up in sets for retail sale | 10 | 20 | 30 |

| 82079000 | – Other interchangeable tools | 10 | 0 | 5 |

| 83011000 | – Padlocks | 10 | 25 | 37.5 |

| 83012000 | – Locks of a kind used for motor vehicles | 10 | 25 | 37.5 |

| 83017000 | – Keys presented separately | 10 | 25 | 37.5 |

| 83021000 | – Hinges | 10 | 20 | 30 |

| 83023090 | – – Other | 10 | 20 | 30 |

| 84082022 | – – – – Of a cylinder capacity exceeding 2,000 cc but not exceeding 3,500 cc | 8 | 20 | 30 |

| 84099119 | – – – – Other | 8 | 10 | 15 |

| 84099143 | – – – – Cylinder liners, with an internal diameter of 50 mm or more, but not exceeding 155 mm | 8 | 10 | 15 |

| 84099147 | – – – – Other pistons | 8 | 10 | 15 |

| 84099149 | – – – – Other | 8 | 10 | 15 |

| 84099925 | – – – – Cylinder heads and head covers | 8 | 10 | 15 |

| 84099926 | – – – – Pistons, with an external diameter of 50 mm or more, but not exceeding 155 mm | 8 | 10 | 15 |

| 84099929 | – – – – Other | 8 | 10 | 15 |

| 84099945 | – – – – Cylinder heads and head covers | 8 | 10 | 15 |

| 84099947 | – – – – Other pistons | 8 | 10 | 15 |

| 84099948 | – – – – Piston rings and gudgeon pins | 8 | 10 | 15 |

| 84099949 | – – – – Other | 8 | 10 | 15 |

| 84099979 | – – – – Other | 8 | 10 | 15 |

| 84122100 | – – Linear acting (cylinders) | 8 | 0 | 5 |

| 84132090 | – – Other | 8 | 20 | 30 |

| 84133030 | – – Fuel pumps of a kind used for engines of motor vehicles of heading 87.02, 87.03 or 87.04 | 8 | 3 | 4.5 |

| 84133040 | – – Water pumps of a kind used for engines of motor vehicles of heading 87.02, 87.03 or 87.04 | 8 | 3 | 4.5 |

| 84145199 | – – – – Other | 8 | 25 | 37.5 |

| 84145949 | – – – – – Other | 8 | 15 | 22.5 |

| 84145999 | – – – – – Other | 8 | 10 | 15 |

| 84148042 | – – – Of a kind used for automotive air conditioners | 8 | 7 | 10.5 |

| 84148049 | – – – Other | 8 | 5 | 7.5 |

| 84148090 | – – Other | 8 | 5 | 7.5 |

| 84149029 | – – – Other | 8 | 15 | 22.5 |

| 84152010 | – – Of a cooling capacity not exceeding 26.38 kW | 10 | 25 | 37.5 |

| 84159014 | – – – Evaporators or condensers for air conditioning machines for motor vehicles | 10 | 5 | 7.5 |

| 84159019 | – – – Other | 10 | 3 | 4.5 |

| 84189910 | – – – Evaporators or condensers | 10 | 0 | 5 |

| 84212321 | – – – – Oil filters | 8 | 15 | 22.5 |

| 84212329 | – – – – Other | 8 | 15 | 22.5 |

| 84213120 | – – – For motor vehicles of Chapter 87 | 8 | 10 | 15 |

| 84213190 | – – – Other | 8 | 0 | 5 |

| 84219930 | – – – Of goods of subheading 8421.31 | 8 | 0 | 5 |

| 84249099 | – – – Other | 8 | 0 | 5 |

| 84254290 | – – – Other | 8 | 0 | 5 |

| 84812090 | – – Other | 8 | 0 | 5 |

| 84813090 | – – Other | 8 | 0 | 5 |

| 84814090 | – – Other | 8 | 5 | 7.5 |

| 84818079 | – – – – Other | 8 | 5 | 7.5 |

| 84818099 | – – – – Other | 8 | 10 | 15 |

| 84821000 | – Ball bearings | 8 | 3 | 4.5 |

| 84828000 | – Other, including combined ball/roller bearings | 8 | 3 | 4.5 |

| 84829100 | – – Balls, needles and rollers | 8 | 0 | 5 |

| 84831025 | – – – – For vehicles of a cylinder capacity not exceeding 2,000 cc | 8 | 20 | 30 |

| 84831027 | – – – – For vehicles of a cylinder capacity exceeding 3,000 cc | 8 | 3 | 4.5 |

| 84831090 | – – Other | 8 | 20 | 30 |

| 84832030 | – – For engines of vehicles of Chapter 87 | 8 | 10 | 15 |

| 84833030 | – – For engines of vehicles of Chapter 87 | 8 | 10 | 15 |

| 84834040 | – – For engines of vehicles of Chapter 87 | 8 | 10 | 15 |

| 84834090 | – – Other | 8 | 10 | 15 |

| 84835000 | – Flywheels and pulleys, including pulley blocks | 8 | 10 | 15 |

| 84836000 | – Clutches and shaft couplings (including universal joints) | 8 | 0 | 5 |

| 84839015 | – – – For other goods of Chapter 87 | 8 | 5 | 7.5 |

| 84839099 | – – – Other | 8 | 10 | 15 |

| 84842000 | – Mechanical seals | 8 | 3 | 4.5 |

| 84849000 | – Other | 8 | 3 | 4.5 |

| 85012012 | – – – Of a kind used for the goods of heading 84.15, 84.18, 84.50, 85.09 or 85.16 | 8 | 3 | 4.5 |

| 85113049 | – – – Other | 8 | 10 | 15 |

| 85114021 | – – – For engines of vehicles of heading 87.02, 87.03, 87.04 or 87.05 | 8 | 10 | 15 |

| 85114032 | – – – For engines of vehicles of heading 87.02, 87.03 or 87.04 | 8 | 10 | 15 |

| 85114091 | – – – For engines of vehicles of heading 87.02, 87.03, 87.04 or 87.05 | 8 | 10 | 15 |

| 85115021 | – – – For engines of vehicles of heading 87.02, 87.03, 87.04 or 87.05 | 8 | 10 | 15 |

| 85115032 | – – – For engines of vehicles of heading 87.02, 87.03 or 87.04 | 8 | 10 | 15 |

| 85122020 | – – Unassembled lighting or visual signalling equipment | 8 | 25 | 37.5 |

| 85122099 | – – – Other | 8 | 25 | 37.5 |

| 85123010 | – – Horns and sirens, assembled | 8 | 25 | 37.5 |

| 85123020 | – – Unassembled sound signalling equipment | 8 | 25 | 37.5 |

| 85124000 | – Windscreen wipers, defrosters and demisters | 8 | 25 | 37.5 |

| 85334000 | – Other variable resistors, including rheostats and potentiometers | 10 | 0 | 5 |

| 85351000 | – Fuses | 8 | 0 | 5 |

| 85361093 | – – – Fuse blocks, of a kind used for motor vehicles | 8 | 25 | 37.5 |

| 85364140 | – – – Other, for a current of less than 16 A | 8 | 10 | 15 |

| 85364191 | – – – – Semiconductor or electro-magnetic relays of voltage not exceeding 28 V | 8 | 10 | 15 |

| 85364199 | – – – – Other | 8 | 10 | 15 |

| 85365059 | – – – Other | 8 | 0 | 5 |

| 85365099 | – – – Other | 8 | 10 | 15 |

| 85371012 | – – – Control panels fitted with a programmable processor | 8 | 5 | 7.5 |

| 85391010 | – – For motor vehicles of Chapter 87 | 10 | 20 | 30 |

| 85443012 | – – – – Of a kind used for vehicles of heading 87.02, 87.03, 87.04 or 87.11 | 10 | 20 | 30 |

| 85444232 | – – – – – For vehicles of heading 87.02, 87.03, 87.04 or 87.11 | 10 | 15 | 22.5 |

| 85452000 | – Brushes | 8 | 5 | 7.5 |

| 87079011 | – – – Driver’s cabin for vehicles of subheading 8701.21, 8701.22, 8701.23, 8701.24 or 8701.29 | 8 | 10 | 15 |

| 87079019 | – – – Other | 8 | 10 | 15 |

| 87081090 | – – Other | 8 | 25 | 37.5 |

| 87082100 | – – Safety seat belts | 8 | 20 | 30 |

| 87082918 | – – – – For vehicles of heading 87.02 or other vehicles of heading 87.04 | 8 | 15 | 22.5 |

| 87082919 | – – – – Other | 8 | 15 | 22.5 |

| 87082993 | – – – – – Interior trim fittings; mudguards | 8 | 15 | 22.5 |

| 87082995 | – – – – – Other | 8 | 15 | 22.5 |

| 87082996 | – – – – – Interior trim fittings; mudguards | 8 | 15 | 22.5 |

| 87082998 | – – – – – Other | 8 | 15 | 22.5 |

| 87082999 | – – – – Other | 8 | 15 | 22.5 |

| 87083010 | – – For vehicles of heading 87.01 | 8 | 15 | 22.5 |

| 87083030 | – – Brake drums, brake discs or brake pipes for vehicles of heading 87.02 or 87.04 | 8 | 10 | 15 |

| 87083090 | – – Other | 8 | 10 | 15 |

| 87084014 | – – – For vehicles of heading 87.01 | 8 | 15 | 22.5 |

| 87084019 | – – – Other | 8 | 10 | 15 |

| 87084092 | – – – For vehicles of heading 87.03 | 8 | 10 | 15 |

| 87084099 | – – – Other | 8 | 10 | 15 |

| 87085013 | – – – For vehicles of heading 87.04 or 87.05 | 8 | 7 | 10.5 |

| 87085015 | – – – For vehicles of heading 87.01 | 8 | 15 | 22.5 |

| 87085091 | – – – – Crown wheels and pinions | 8 | 10 | 15 |

| 87085092 | – – – – Other | 8 | 10 | 15 |

| 87085096 | – – – – Crown wheels and pinions | 8 | 5 | 7.5 |

| 87085099 | – – – – Other | 8 | 5 | 7.5 |

| 87087019 | – – – Other | 8 | 20 | 30 |

| 87087029 | – – – Other | 8 | 25 | 37.5 |

| 87087095 | – – – For vehicles of heading 87.01 | 8 | 25 | 37.5 |

| 87087096 | – – – For vehicles of heading 87.02 or 87.04 | 8 | 20 | 30 |

| 87087099 | – – – Other | 8 | 20 | 30 |

| 87088016 | – – – For vehicles of heading 87.03 | 8 | 20 | 30 |

| 87088019 | – – – Other | 8 | 7 | 10.5 |

| 87088091 | – – – For vehicles of heading 87.01 | 8 | 10 | 15 |

| 87088099 | – – – Other | 8 | 5 | 7.5 |

| 87089116 | – – – – For vehicles of heading 87.03 | 8 | 20 | 30 |

| 87089118 | – – – – – Other | 8 | 10 | 15 |

| 87089191 | – – – – For vehicles of heading 87.01 | 8 | 10 | 15 |

| 87089199 | – – – – Other | 8 | 10 | 15 |

| 87089210 | – – – For vehicles of heading 87.01 | 8 | 15 | 22.5 |

| 87089220 | – – – For vehicles of heading 87.03 | 8 | 20 | 30 |

| 87089251 | – – – – Silencers (mufflers) and exhaust pipes | 8 | 15 | 22.5 |

| 87089261 | – – – – Silencers (mufflers) and exhaust pipes | 8 | 15 | 22.5 |

| 87089262 | – – – – Parts | 8 | 15 | 22.5 |

| 87089290 | – – – Other | 8 | 15 | 22.5 |

| 87089350 | – – – For vehicles of heading 87.01 | 8 | 15 | 22.5 |

| 87089360 | – – – For vehicles of heading 87.03 | 8 | 20 | 30 |

| 87089370 | – – – For vehicles of heading 87.04 or 87.05 | 8 | 10 | 15 |

| 87089390 | – – – Other | 8 | 10 | 15 |

| 87089495 | – – – – For vehicles of heading 87.03 | 8 | 25 | 37.5 |

| 87089499 | – – – – Other | 8 | 15 | 22.5 |

| 87089510 | – – – Safety airbags with inflater system | 8 | 10 | 15 |

| 87089919 | – – – – Other | 8 | 15 | 22.5 |

| 87089921 | – – – – – Fuel tanks | 8 | 15 | 22.5 |

| 87089924 | – – – – – Lower half of the fuel tank; fuel caps; filler pipes; filler hose assembly; fuel tank bands | 8 | 15 | 22.5 |

| 87089925 | – – – – – Other parts | 8 | 15 | 22.5 |

| 87089930 | – – – – Accelerator, brake or clutch pedals | 8 | 20 | 30 |

| 87089940 | – – – – Battery carriers or trays and brackets therefor | 8 | 15 | 22.5 |

| 87089963 | – – – – – For vehicles of heading 87.04 | 8 | 10 | 15 |

| 87089970 | – – – – Engine brackets | 8 | 15 | 22.5 |

| 87089980 | – – – – Other | 8 | 15 | 22.5 |

| 87089999 | – – – – Other | 8 | 15 | 22.5 |

| 87163999 | – – – – Other | 8 | 20 | 30 |

| 87169019 | – – – Other | 8 | 15 | 22.5 |

| 90299010 | – – Of goods of subheading 9029.10; of stroboscopes of subheading 9029.20 | 8 | 0 | 5 |

| 94012010 | – – Of a kind used for vehicles of heading 87.02, 87.03 or 87.04 | 8 | 25 | 37.5 |

| 94017100 | – – Upholstered | 8 | 25 | 37.5 |

*Note: The HS code and taxes mentioned above are for reference only.

For more information about this content, please refer to the article:

HS code and Import Duty of Auto parts to Vietnam

Definition of HS code in Vietnam

Import duty on Auto parts into Vietnam from Major Markets in 2024

| HS Code | China | India | USA | Asean | Korea | Japan | UK | EU | Australia | ||||||

| ACFTA | RCEP | AIFTA | Preferential Import duty | ATIGA | AKFTA | VKFTA | RCEP | AJCEP | RCEP | CPTPP | UKFTA | EVFTA | AANZFTA | RCEP | |

| 27101944 | 5 | * | * | 15% | 0 | 0 | 0 | * | 0 | * | 7 | 2,7 | 2,7 | * | * |

| 39233090 | 0 | 0 | 0 | 20% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2,5 | 2,5 | 0 | 0 |

| 39263000 | 0 | 20 | * | 12% | 0 | 5 | 5 | 20 | 0 | 20 | 7,5 | 7,5 | 0 | 16 | |

| 39269099 | 0 | 8,4 | 23 | 3% | 0 | 0 | 0 | 8,4 | 0 | 8,7 | 0 | 2,3 | 2,3 | 0 | 8,4 |

| 40091290 | 0 | 0 | 0 | 3% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 40093191 | 0 | 0 | 0 | 5% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 40101200 | 0 | 0 | 0 | 5% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 40101900 | 0 | 0 | 0 | 15% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 40103100 | 0 | 0 | 0 | 3% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2,5 | 2,5 | 0 | 0 |

| 40169320 | 0 | 0 | 0 | 3% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 40169390 | 0 | 0 | 0 | 10% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 40169911 | 50 | 10 | * | 10% | 0 | 24 | 10 | 10 | 10 | 10 | 1,2 | 5,4 | 5,4 | 0 | 10 |

| 40169913 | 50 | 10 | * | 20% | 0 | 24 | 10 | 10 | 10 | 10 | 1,2 | 5,4 | 5,4 | 0 | 10 |

| 70071110 | 50 | 20 | * | 25% | 0 | 5 | 0 | 20 | 30 | 20 | 0 | 5,6 | 5,6 | 0 | 20 |

| 70091000 | 50 | 20 | * | 30% | 0 | 5 | 0 | 20 | 30 | 20 | 0 | 5,6 | 5,6 | 0 | 20 |

| 70099200 | 50 | 30 | * | 12% | 0 | 5 | 5 | 30 | 0 | 30 | 0 | 11,2 | 11,2 | 0 | 30 |

| 73101091 | 0 | 0 | 0 | 5% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1,6 | 1,6 | 0 | 0 |

| 73181100 | 0 | 0 | 0 | 12% | 0 | 0 | 0 | 0 | 0 | 0,8 | 0,8 | 0 | 0 | ||

| 73181510 | 5 | 12 | 19 | 12% | 0 | 5 | 0 | 9,6 | 0 | 9,8 | 1,2 | 5,4 | 5,4 | 0 | 9,6 |

| 73181590 | 0 | 12 | 15 | 12% | 0 | 5 | 0 | 9,6 | 0 | 9,8 | 0 | 5,4 | 5,4 | 0 | 9,6 |

| 73181610 | 0 | 8,4 | 19 | 12% | 0 | 0 | 0 | 8,4 | 0 | 8,7 | 0 | 5,4 | 5,4 | 0 | 8,4 |

| 73181690 | 0 | 8,4 | 15 | 12% | 0 | 5 | 5 | 8,4 | 0 | 8,7 | 0 | 5,4 | 5,4 | 0 | 8,4 |

| 73181910 | 5 | 12 | 19 | 12% | 0 | 5 | 0 | 9,6 | 0 | 9,8 | 1,2 | 5,4 | 5,4 | 0 | 9,6 |

| 73181990 | 0 | 12 | 15 | 12% | 0 | 5 | 0 | 9,6 | 0 | 9,8 | 0 | 5,4 | 5,4 | 0 | 9,6 |

| 73182100 | 0 | 0 | 0 | 12% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 5,4 | 5,4 | 0 | 0 |

| 73182200 | 0 | 8,4 | 0 | 12% | 0 | 0 | 0 | 8,4 | 0 | 8,7 | 0 | 5,4 | 5,4 | 0 | 8,4 |

| 73182400 | 0 | 8,4 | 19 | 12% | 0 | 0 | 0 | 8,4 | 0 | 8,7 | 0 | 5,4 | 5,4 | 0 | 8,4 |

| 73182910 | 0 | 12 | 19 | 12% | 0 | 0 | 0 | 9,6 | 0 | 9,8 | 0 | 5,4 | 5,4 | 0 | 9,6 |

| 73182990 | 0 | 12 | 15 | 10% | 0 | 0 | 0 | 9,6 | 0 | 9,8 | 0 | 5,4 | 5,4 | 0 | 9,6 |

| 73201011 | 0 | 0 | 0 | 3% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 5,4 | 5,4 | 0 | 0 |

| 73202090 | 0 | 0 | 0 | 3% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 73209010 | 0 | 0 | 0 | 20% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1,1 | 1,1 | 0 | 0 |

| 73259990 | 0 | 0 | 0 | 10% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 3,3 | 3,3 | 0 | 0 |

| 73269099 | 0 | 0 | 15 | 20% | 0 | 5 | 0 | 0 | 0 | 0 | 2,5 | 2,5 | 0 | 0 | |

| 82060000 | 0 | 14 | 19 | 0% | 0 | 0 | 0 | 14 | 0 | 14,5 | 0 | 0 | 0 | 0 | 14 |

| 82079000 | 0 | 0 | 0 | 25% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 83011000 | 5 | 25 | * | 25% | 0 | 24 | 24 | 25 | 0 | 25 | 0 | 4,1 | 4,1 | 5 | 25 |

| 83012000 | 5 (-CN ) | * | * | 25% | 0 | 5 | 5 | 25 | 0 | 25 | 0 | 4,1 | 4,1 | 5 | 25 |

| 83017000 | 0 | 17,5 | 23 | 20% | 0 | 0 | 0 | 17,5 | 0 | 18,2 | 0 | 4,1 | 4,1 | 5 | 17,5 |

| 83021000 | 10 | 20 | * | 20% | 0 | 5 | 0 | 20 | 0 | 20 | 0 | 3,3 | 3,3 | 0 | 20 |

| 83023090 | 0 | 14 | * | 20% | 0 | 0 | 0 | 14 | 30 | 14,5 | 0 | 3,3 | 3,3 | 0 | 14 |

| 84082022 | 5 | 25 | * | 10% | 0 | 24 | 0 | 25 | 0 | 25 | 7,5 | 7,5 | 4 | 25 | |

| 84099119 | 0 | 7 | * | 10% | 0 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 0 | 7 | ||

| 84099143 | 50 | * | * | 10% | 0 | 16 | 10 | * | * | * | 0,3 | 3,7 | 3,7 | 5 | 10 |

| 84099147 | 50 | * | * | 10% | 0 | 16 | 0 | * | * | * | 0,3 | 3,7 | 3,7 | 5 | 10 |

| 84099149 | 50 | * | * | 10% | 0 | 16 | 0 | * | * | * | 0,3 | 3,7 | 3,7 | 5 | 10 |

| 84099925 | 0 | 7 | * | 10% | 0 | 0 | 0 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 0 | 7 |

| 84099926 | 0 | 7 | * | 10% | 0 | 0 | 0 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 0 | 7 |

| 84099929 | 0 | 7 | * | 10% | 0 | 0 | 0 | 7 | 0 | 7,3 | 3,7 | 3,7 | 0 | 7 | |

| 84099945 | 0 | 0 | * | 10% | 0 | 16 | 10 | 0 | * | 0 | 0 | 3,7 | 3,7 | 5 | 0 |

| 84099947 | 0 | 0 | * | 10% | 0 | 16 | 10 | 0 | * | 0 | 0 | 3,7 | 3,7 | 5 | 0 |

| 84099948 | 0 | 0 | * | 10% | 0 | 16 | 10 | 0 | * | 0 | 0 | 3,7 | 3,7 | 5 | 0 |

| 84099949 | 0 | 0 | * | 10% | 0 | 16 | 10 | 0 | 0 | 0 | 0 | 3,7 | 3,7 | 5 | 0 |

| 84099979 | 0 | 7 | * | 0% | 0 | 5 | 5 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 5 | 7 |

| 84122100 | 0 | 0 | 0 | 20% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84132090 | 0 | 14 | 23 | 3% | 0 | 5 | 5 | 14 | 0 | 14,5 | 0 | 3,3 | 3,3 | 0 | 14 |

| 84133030 | 0 | 0 | 3 | 3% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84133040 | 0 | 0 | 3 | 25% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84145199 | 15 | 25 | 23 | 15% | 0 | 40 | 25 | 25 | 0 | 25 | 0 | 4,1 | 4,1 | 0 | 25 |

| 84145949 | 10 | 15 | 15 | 10% | 0 | 0 | 0 | 12 | 0 | 12,2 | 0 | 2,5 | 2,5 | 0 | 12 |

| 84145999 | 0 | 7 | 7.5 | 7% | 0 | 0 | 0 | 7 | 0 | 7,3 | 0 | 1,6 | 1,6 | 0 | 7 |

| 84148042 | 0 | 0 | 7.5 | 5% | 0 | 24 | 5 | 0 | 0 | 0 | 0 | 1,8 | 1,8 | 0 | 0 |

| 84148049 | 0 | 3,5 | 6 | 5% | 0 | 0 | 0 | 3,5 | 0 | 3,6 | 0 | 0,8 | 0,8 | 0 | 3,5 |

| 84148090 | 0 | 3,5 | 3.5 | 15% | 0 | 0 | 0 | 3,5 | 0 | 3,6 | 0 | 0,8 | 0,8 | 0 | 3,5 |

| 84149029 | 10 | 15 | 23 | 25% | 0 | 5 | 5 | 15 | 0 | 15 | 0 | 2,8 | 2,8 | 0 | 15 |

| 84152010 | 15 (-PH, TH, CN ) | * | * | 5% | 0 | 40 | 25 | 25 | 0 | 25 | 0 | 4,1 | 4,1 | 0 | 25 |

| 84159014 | 0 | 0 | 0 | 3% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84159019 | 0 | 0 | 0 | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84189910 | 0 | 0 | 0 | 15% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84212321 | 0 | 0 | 0 | 15% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2,5 | 2,5 | 0 | 0 |

| 84212329 | 0 | 0 | 0 | 10% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2,5 | 2,5 | 0 | 0 |

| 84213120 | 0 | 7 | * | 0% | 0 | 5 | 5 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 0 | 7 |

| 84213190 | 0 | 0 | * | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84219930 | 0 | 0 | 0 | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84249099 | 0 | 0 | 0 | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84254290 | 0 | 0 | 0 | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84812090 | 0 | 0 | 0 | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84813090 | 0 | 0 | 0 | 5% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84814090 | 0 | 0 | 0 | 5% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0,8 | 0,8 | 0 | 0 |

| 84818079 | 0 | 0 | 3.5 | 10% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0,8 | 0,8 | 0 | 0 |

| 84818099 | 0 | 7 | 7.5 | 3% | 0 | 0 | 0 | 7 | 0 | 7,3 | 0 | 1,6 | 1,6 | 0 | 7 |

| 84821000 | 0 | 0 | 0 | 3% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84828000 | 0 | 0 | 0 | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84829100 | 0 | 0 | 0 | 20% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84831025 | 5 | 20 | * | 3% | 0 | 0 | 0 | 20 | 0 | 20 | 7,5 | 7,5 | 5 | 20 | |

| 84831027 | 5 | 3 | * | 20% | 0 | 0 | 0 | 3 | 0 | 3 | 1,1 | 1,1 | 5 | 3 | |

| 84831090 | 5 | 20 | * | 10% | 0 | 16 | 16 | 20 | 0 | 20 | 0 | 3,3 | 3,3 | 0 | 20 |

| 84832030 | 0 | 7 | * | 10% | 0 | 0 | 0 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 3 | 7 |

| 84833030 | 0 | 7 | * | 10% | 0 | 0 | 0 | 7 | 0 | 7,3 | 3,7 | 3,7 | 0 | 7 | |

| 84834040 | 5 | 10 | * | 10% | 0 | 0 | 0 | 8 | 0 | 8,1 | 1,6 | 1,6 | 0 | 8 | |

| 84834090 | 0 | 10 | * | 10% | 0 | 0 | 0 | 8 | 0 | 8,1 | 0 | 1,6 | 1,6 | 0 | 8 |

| 84835000 | 0 | 7 | 7.5 | 0% | 0 | 0 | 0 | 7 | 0 | 7,3 | 0 | 1,6 | 1,6 | 0 | 7 |

| 84836000 | 0 | 0 | 0 | 5% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84839015 | 0 | 3,5 | * | 10% | 0 | 5 | 0 | 3,5 | 0 | 3,6 | 0 | 1,8 | 1,8 | 0 | 3,5 |

| 84839099 | 0 | 7 | * | 3% | 0 | 0 | 0 | 7 | 0 | 7,3 | 0 | 1,6 | 1,6 | 0 | 7 |

| 84842000 | 0 | 0 | 0 | 3% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 84849000 | 0 | 0 | 0 | 3% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 85012012 | 0 | 0 | * | 10% | 0 | 5 | 0 | 0 | 30 | 0 | 0 | 0 | 0 | 0 | 0 |

| 85113049 | 0 | 7 | 0 | 10% | 0 | 0 | 0 | 7 | 0 | 7,3 | 0 | 1,6 | 1,6 | 0 | 7 |

| 85114021 | 0 | 7 | 0 | 10% | 0 | 0 | 0 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 0 | 7 |

| 85114032 | 0 | 7 | 0 | 10% | 0 | 0) | 0 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 0 | 7 |

| 85114091 | 0 | 7 | 0 | 10% | 0 | 0 | 0 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 0 | 7 |

| 85115021 | 0 | 7 | 0 | 10% | 0 | 0 | 0 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 0 | 7 |

| 85115032 | 0 | 7 | 0 | 25% | 0 | 0 | 0 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 0 | 7 |

| 85122020 | 50 | 25 | * | 25% | 0 | 24 | 24 | 25 | 0 | 25 | 0 | 4,1 | 4,1 | 5 | 25 |

| 85122099 | 5 | 25 | * | 25% | 0 | 24 | 24 | 25 | 25 | 25 | 0 | 4,1 | 4,1 | 5 | 25 |

| 85123010 | 0 (-PH, CN ) | * | 0 | 25% | 0 | 0 | 0 | 25 | 0 | 25 | 0 | 4,1 | 4,1 | 0 | 25 |

| 85123020 | 0 (-PH, CN ) | * | 0 | 25% | 0 | 0 | 0 | 25 | 0 | 25 | 0 | 4,1 | 4,1 | 0 | 25 |

| 85124000 | 0 (-CN ) | * | 0 | 0% | 0 | 0 | 0 | 25 | 0 | 25 | 0 | 9,3 | 9,3 | 0 | 25 |

| 85334000 | 0 | 0 | 0 | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 85351000 | 0 | 0 | 0 | 25% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 85361093 | 0 | 17,5 | * | 10% | 0 | 24 | 24 | 17,5 | 30 | 18,2 | 0 | 4,1 | 4,1 | 0 | 17,5 |

| 85364140 | 0 | 7 | 23 | 10% | 0 | 5 | 5 | 7 | 0 | 7,3 | 0 | 1,6 | 1,6 | 0 | 7 |

| 85364191 | 0 | 7 | 23 | 10% | 0 | 5 | 5 | 7 | 0 | 7,3 | 0 | 1,6 | 1,6 | 0 | 7 |

| 85364199 | 0 | 7 | 23 | 0% | 0 | 5 | 5 | 7 | 0 | 7,3 | 0 | 1,6 | 1,6 | 0 | 7 |

| 85365059 | 0 | 0 | 5 | 10% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0,8 | 0,8 | 0 | 0 |

| 85365099 | 0 | 7 | 5 | 5% | 0 | 5 | 0 | 7 | 0 | 7,3 | 0 | 1,6 | 1,6 | 0 | 7 |

| 85371012 | 0 | 0 | 0 | 20% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 85391010 | 50 | 20 | * | 20% | 0 | 5 | 5 | 20 | 0 | 20 | 0 | 7,5 | 7,5 | 0 | 20 |

| 85443012 | 0 (-MY, PH, TH, CN ) | * | * | 15% | 0 | 5 | 5 | 20 | 0 | 20 | 0 | 7,5 | 7,5 | 0 | 20 |

| 85444232 | 0 ( | 10,5 | * | 5% | 0 | 5 | 5 | 10,5 | 0 | 10,9 | 0 | 5,6 | 5,6 | 0 | 10,5 |

| 85452000 | 0 | 0 | 0 | 10% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0,8 | 0,8 | 0 | 0 |

| 87079011 | 0 | 8,5 | * | 10% | 0 | 0 | 0 | 8 | 0 | 8,1 | 3,6 | 3,7 | 3,7 | 0 | 8 |

| 87079019 | 0 | 8,5 | * | 25% | 0 | 0 | 0 | 8 | 0 | 8,1 | 3,6 | 3,7 | 3,7 | 0 | 8 |

| 87081090 | 0 | 14 | * | 20% | 0 | 5 | 5 | 14 | 3 | 14,5 | 7,5 | 7,5 | 0 | 14 | |

| 87082100 | 0 | 20 | * | 15% | 0 | 0 | 0 | 20 | 0 | 20 | 7,2 | 7,5 | 7,5 | 0 | 16 |

| 87082918 | 0 (-ID, PH, CN ) | * | * | 15% | 0 | 24 | 15 | * | * | * | 5,6 | 5,6 | 0 | 15 | |

| 87082919 | 0 (-ID, PH, CN ) | * | * | 15% | 0 | 24 | 15 | * | * | * | 5,6 | 5,6 | 0 | 15 | |

| 87082993 | 0 (-ID, PH, CN ) | * | * | 15% | 0 | 24 | 0 | * | * | * | 6,9 | 5,6 | 5,6 | 0 | 15 |

| 87082995 | 0 (-ID, PH, CN ) | * | * | 15% | 0 | 24 | 15 | * | * | * | 6,9 | 5,6 | 5,6 | 0 | 15 |

| 87082996 | 0 (-ID, PH, CN ) | * | * | 15% | 0 | 24 | 15 | 15 | 3 | 15 | 5,6 | 5,6 | 0 | 15 | |

| 87082998 | 0 (-ID, PH, CN ) | * | * | 15% | 0 | 24 | 0 | 15 | 3 | 15 | 5,6 | 5,6 | 0 | 15 | |

| 87082999 | 0 (-ID, PH, CN ) | * | * | 15% | 0 | 24 | 0 | 15 | 3 | 15 | 5,6 | 5,6 | 0 | 15 | |

| 87083010 | 0 (-ID, PH, TH, CN ) | * | * | 10% | 0 | 0 | 0 | 12 | 0 | 12,2 | 9,8 | 5,6 | 5,6 | 0 | 12 |

| 87083030 | 0 (-ID, PH, TH, CN ) | * | * | 10% | 0 | 5 | 5 | 10 | 3 | 10 | 3,7 | 3,7 | 0 | 10 | |

| 87083090 | 0 (-ID, PH, TH, CN ) | * | * | 15% | 0 | 5 | 5 | 10 | 3 | 10 | 3,7 | 3,7 | 0 | 10 | |

| 87084014 | 0 | 12,8 | * | 10% | 0 | 0 | 0 | 12 | 0 | 12,2 | 9,8 | 5,6 | 5,6 | 0 | 12 |

| 87084019 | 0 | 7 | * | 10% | 0 | * | 10 | 7 | 3 | 7,3 | 3,7 | 3,7 | 0 | 7 | |

| 87084092 | 0 | 7 | * | 10% | 0 | 5 | 5 | 7 | 0 | 7,3 | 3,6 | 3,7 | 3,7 | 0 | 7 |

| 87084099 | 0 | 7 | * | 7% | 0 | 5 | 5 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 0 | 7 |

| 87085013 | 0 (-PH, TH, CN ) | * | * | 15% | 0 | 5 | 5 | 7 | 3 | 7 | 2,6 | 2,6 | 0 | 7 | |

| 87085015 | 0 | 12,8 | * | 10% | 0 | 0 | 0 | 15 | 0 | 15 | 9,8 | 5,6 | 5,6 | 0 | 12 |

| 87085091 | 0 | 8,5 | * | 10% | 0 | 0 | 0 | 8 | 0 | 8,1 | 3,7 | 3,7 | 0 | 8 | |

| 87085092 | 0 | 8,5 | * | 5% | 0 | 0 | 0 | 8 | 0 | 8,1 | 3,7 | 3,7 | 0 | 8 | |

| 87085096 | 0 | 4,3 | * | 5% | 0 | 0 | 0 | 4 | 0 | 4,1 | 0 | 1,8 | 1,8 | 0 | 4 |

| 87085099 | 0 | 4,3 | * | 20% | 0 | 0 | 0 | 4 | 0 | 4,1 | 0 | 1,8 | 1,8 | 0 | 4 |

| 87087019 | 0 | 14 | * | 25% | 0 | 24 | 20 | 14 | 3 | 14,5 | 7,5 | 7,5 | 0 | 14 | |

| 87087029 | 0 | 25 | * | 25% | 0 | 5 | 0 | 25 | 3 | 25 | 9,3 | 9,3 | 0 | 20 | |

| 87087095 | 0 | 25 | * | 20% | 0 | 0 | 0 | 25 | 0 | 25 | 9 | 9,3 | 9,3 | 0 | 20 |

| 87087096 | 0 | 20 | * | 20% | 0 | 0 | 0 | 20 | 3 | 20 | 7,5 | 7,5 | 0 | 16 | |

| 87087099 | 0 | 14 | * | 20% | 0 | 5 | 5 | 14 | 3 | 14,5 | 7,5 | 7,5 | 0 | 14 | |

| 87088016 | 0 | 14 | * | 7% | 0 | 5 | 5 | 14 | * | 14,5 | 8 | 7,5 | 7,5 | 0 | 14 |

| 87088019 | 0 | 6 | * | 10% | 0 | 5 | 0 | 7 | 3 | 7 | 2,6 | 2,6 | 0 | 5,6 | |

| 87088091 | 0 | 7 | * | 5% | 0 | 5 | 5 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 0 | 7 |

| 87088099 | 0 | 3,5 | * | 20% | 0 | 5 | 5 | 3,5 | 0 | 3,6 | 0 | 1,8 | 1,8 | 0 | 3,5 |

| 87089116 | 0 | 14 | * | 10% | 0 | 5 | 5 | 14 | * | 14,5 | 0 | 7,5 | 7,5 | 0 | 14 |

| 87089118 | 0 | 8,5 | * | 10% | 0 | 5 | 0 | 8 | 3 | 8,1 | 0 | 3,7 | 3,7 | 0 | 8 |

| 87089191 | 0 | 8,5 | * | 10% | 0 | 5 | 0 | 8 | 0 | 8,1 | 7,2 | 3,7 | 3,7 | 0 | 8 |

| 87089199 | 0 | 7 | * | 15% | 0 | 5 | 5 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 0 | 7 |

| 87089210 | 0 | 12,8 | * | 20% | 0 | 0 | 0 | 15 | 0 | 15 | 5,6 | 5,6 | 0 | 12 | |

| 87089220 | 0 | 14 | * | 15% | 0 | * | 20 | 14 | 0 | 14,5 | 7,5 | 7,5 | 0 | 14 | |

| 87089251 | 0 | 10,5 | * | 15% | 0 | * | 15 | 10,5 | 0 | 10,9 | 5,6 | 5,6 | 0 | 10,5 | |

| 87089261 | 0 | 10,5 | * | 15% | 0 | * | 15 | 10,5 | 0 | 10,9 | 5,6 | 5,6 | 0 | 10,5 | |

| 87089262 | 0 | 10,5 | * | 15% | 0 | 5 | 5 | 10,5 | 0 | 10,9 | 0 | 5,6 | 5,6 | 0 | 10,5 |

| 87089290 | 0 | 10,5 | * | 15% | 0 | 10,5 | 0 | 10,9 | 5,6 | 5,6 | 0 | 10,5 | |||

| 87089350 | 0 | 12,8 | * | 20% | 0 | 0 | 0 | 15 | 0 | 15 | 9,8 | 5,6 | 5,6 | 0 | 12 |

| 87089360 | 0 | 14 | * | 10% | 0 | 5 | 5 | 14 | * | 14,5 | 7,2 | 7,5 | 7,5 | 0 | 14 |

| 87089370 | 0 | 8,5 | * | 10% | 0 | 5 | 0 | 8 | 3 | 8,1 | 3,7 | 3,7 | 0 | 8 | |

| 87089390 | 0 | 7 | * | 25% | 0 | 5 | 5 | 7 | 3 | 7,3 | 3,7 | 3,7 | 0 | 7 | |

| 87089495 | 0 | 17,5 | * | 15% | 0 | 5 | 5 | 17,5 | 0 | 18,2 | 7,2 | 9,3 | 9,3 | 0 | 17,5 |

| 87089499 | 0 | 12,8 | * | 10% | 0 | 5 | 0 | 15 | 0 | 15 | 5,6 | 5,6 | 0 | 12 | |

| 87089510 | 0 (-ID, PH, TH, CN ) | * | * | 15% | 0 | 5 | 0 | 8 | 0 | 8,1 | 3,6 | 3,7 | 3,7 | 0 | 8 |

| 87089919 | 0 | 12,8 | * | 15% | 0 | 5 | 0 | 15 | 0 | 15 | 5,6 | 5,6 | 0 | 12 | |

| 87089921 | 0 | 12,8 | * | 15% | 0 | 5 | 0 | 15 | 0 | 15 | 5,6 | 5,6 | 0 | 12 | |

| 87089924 | 0 | 10,5 | * | 15% | 0 | 5 | 5 | 10,5 | 0 | 10,9 | 5,6 | 5,6 | 0 | 10,5 | |

| 87089925 | 0 | 10,5 | * | 20% | 0 | 5 | 5 | 10,5 | 0 | 10,9 | 5,6 | 5,6 | 0 | 10,5 | |

| 87089930 | 0 | 10,5 | * | 15% | 0 | 5 | 5 | 10,5 | 0 | 10,9 | 5,6 | 5,6 | 0 | 10,5 | |

| 87089940 | 0 | 10,5 | * | 10% | 0 | 5 | 5 | 10,5 | 0 | 10,9 | 5,6 | 5,6 | 0 | 10,5 | |

| 87089963 | 0 | 7 | * | 15% | 0 | 5 | 5 | 7 | 0 | 7,3 | 0 | 3,7 | 3,7 | 0 | 7 |

| 87089970 | 0 | 12,8 | * | 15% | 0 | 5 | 0 | 15 | 0 | 15 | 5,6 | 5,6 | 0 | 12 | |

| 87089980 | 0 | 12,8 | * | 15% | 0 | 5 | 0 | 15 | 0 | 15 | 5,6 | 5,6 | 0 | 12 | |

| 87089999 | 0 | 10,5 | * | 20% | 0 | 5 | 5 | 10,5 | 0 | 10,9 | 0 | 5,6 | 5,6 | 0 | 10,5 |

| 87163999 | 0 | 14 | 0 | 15% | 0 | 0 | 0 | 14 | 0 | 14,5 | 0 | 10,9 | 10,9 | 0 | 14 |

| 87169019 | 0 | 0 | 0 | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 8,1 | 8,1 | 0 | 0 |

| 90299010 | 0 | 0 | 0 | 25% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 94012010 | 50 | 25 | * | 25% | 0 | 0 | 0 | 25 | 0 | 25 | 0 | 0 | 0 | 0 | 25 |

Note the symbol: “*” denotes imported goods that are not eligible for preferential import tax rates at the corresponding time.

Ban on import, export

According to the current regulation, Auto Parts (New 100%) is not in the List of prohibited imports into Vietnam, so the enterprise can do the import procedure pursuant to current stipulations.

For more information, read the article List of prohibited imports into Vietnam

Governmental management on importing Auto parts to Vietnam

What certificates are required in importing Auto parts to Vietnam?

Auto parts are under the management of the Ministry of Transport. Some kinds of auto parts under no quality management; some kinds of auto parts under quality management when importing into Vietnam.

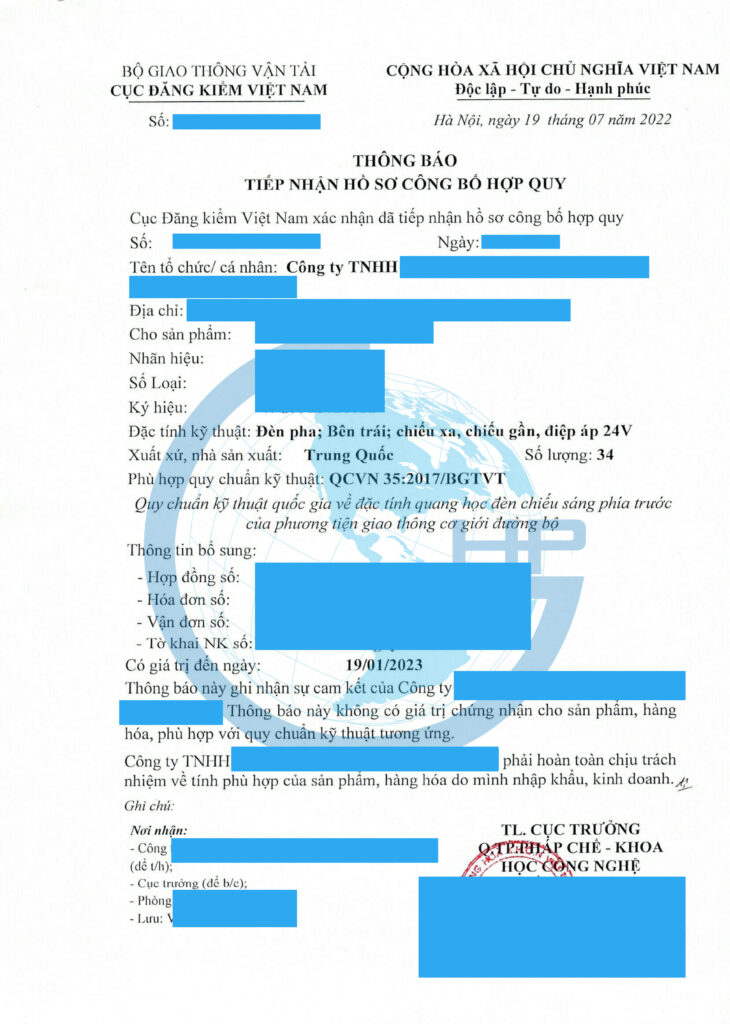

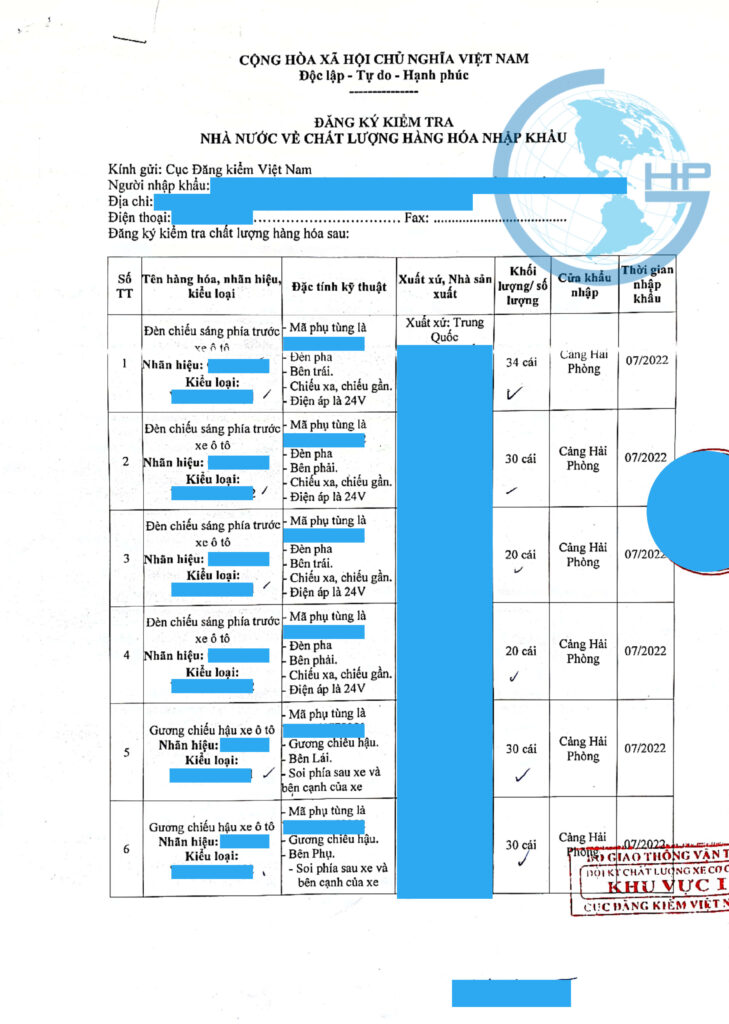

On July 30, 2018, the Ministry of Transport issued Circular No. 41/2018/TT-BGTVT regulating the list of products and goods likely to cause unsafe under the State management responsibility of the Ministry of Transport. transportation, effective from September 15, 2018, lists a number of auto parts in Appendix II: “Imports must be certified or declared conformable with corresponding national technical regulations and standards. The inspection and certification shall be carried out after customs clearance and before marketing”.

With these products, when making clear customs procedures, enterprises must submit to customs offices a written registration certified by quality inspection agencies (guided in Official Dispatch No. 6489 / TCHQ-GSQL of November 05 / 2018 by the General Department of Customs)

|

|

Management on declaration value

Auto Parts is in the list of management on declaration value. In some cases, the customs officers will request importer for audit of value.

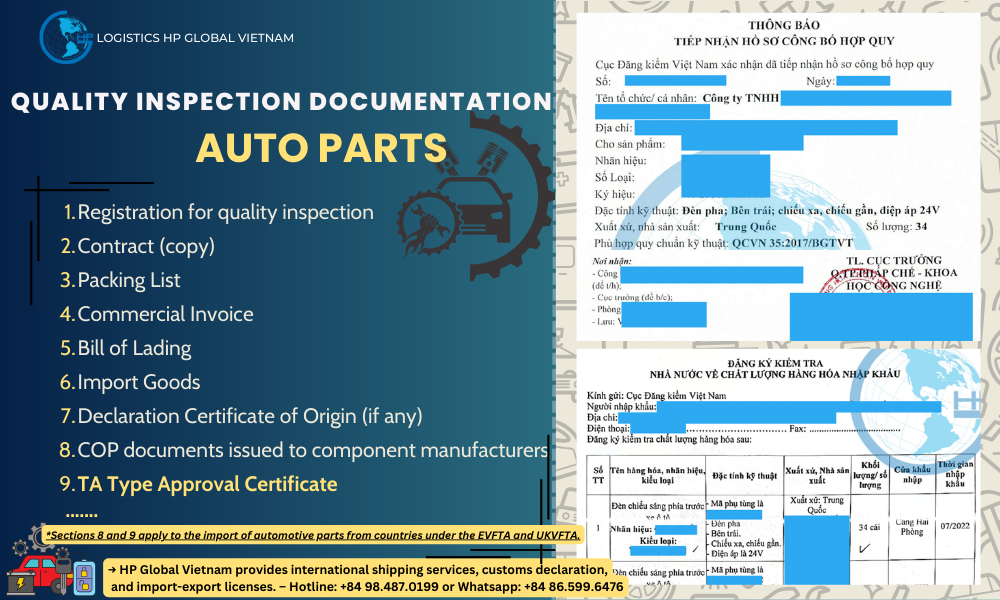

The documentation required to conduct quality, technical safety, and environmental protection inspections for auto parts

The documentation required to conduct quality, technical safety, and environmental protection inspections for automotive components and parts includes:

- a) Registration for quality, technical safety, and environmental protection inspections of imported components according to the template specified in Appendix II attached to Decree 60/2023/NĐ-CP.

- b) Information about the components according to the template specified in Appendix XII attached to Decree 60/2023/NĐ-CP; photographs of each type of component (overall product photos on both sides and labels, symbols on the product).

- c) COP documents issued to component manufacturers.

- d) Type Approval Certificate (TA).

- e) Certificate of Origin (C/O).

- f) Commercial invoice with a list of goods.

- g) Import goods declaration for paper-based submissions; number, date, and month of the import goods declaration for electronic submissions.

…

*Note: The documents specified in points c, d, e, and g must be certified copies with the importer’s confirmation.

Customs procedure of import Auto Parts into Vietnam

Case 1:For items not listed in the state-managed quality control category, customs clearance procedures are carried out like regular goods (Invoice, Bill of Lading, Packing List, Certificate of Origin).

Case 2: For items covered by the regulations of Circular 12/2022/TT-BGTVT, in addition to the usual documents, when undergoing customs procedures, it is required to submit to the customs authorities a Registration Form confirmed by the quality inspection agency. Then, the inspection results need to be submitted to complete the customs clearance process.

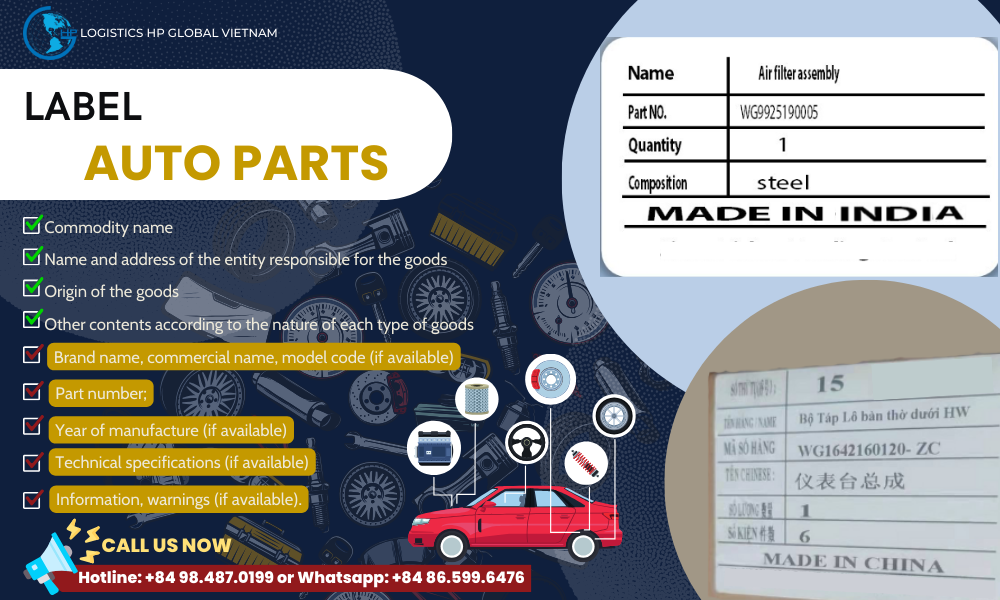

Label for import Auto Parts

According to current stipulation, cargo imported into Vietnam need to have sufficient label

Imported goods must have complete labeling according to current regulations.

Specifically, mandatory labeling for goods must include the following information:

- a) Commodity name;

- b) Name and address of the organization or individual responsible for the goods;

- c) Origin of the goods;

- d) Other content according to the nature of each type of goods.

*Note: In addition to the current regulations for labeling imported goods above, labeling for imported automotive spare parts also needs to include additional content:

- a) Brand name, commercial name, model code (if available);

- b) Part number;

- c) Year of manufacture (if available);

- d) Technical specifications (if available);

- e) Information, warnings (if available).

Regulations in Decree 111/2021/NĐ-CP apply to “Vehicle Spare Parts”

Freight Shipping For Auto parts To Vietnam

Shipping time by sea and by air

To check the specific international shipping times by port or airport, you can send a message or call the phone/Zalo number ++84 886115726 – ++84 984870199, whatsapp: ++84 865996476; email: info@hpgloballtd.com

List of main markets where Vietnam has a significant Auto parts import volume

Shipping freight

Freight charges depend on many factors, both fixed and variable over time. Therefore, please provide specific or anticipated shipment details to HP Global Vietnam to receive a complete quote on all costs for the entire import process. – Contact: ++84 886115726 or ++84 984870199, whatsapp: ++84 865996476, email: info@hpgloballtd.com

Procedures for Importing Certain Similar Products

| Commodity | Related link |

| Air conditioning fan | Import Procedures for air conditioning fan to Vietnam |

| Knives | Procedures and Tax Import Knives |

| Oil filter | Procedures and Tax Import Oil Filter |

| Ball bearings | Procedures and Tax Import Ball Bearings |

| Windscreen wipers | Import Procedures for Windscreen wipers to Vietnam |

Select HP Global as the freight forwarder/customs broker for your shipments import Auto parts into Vietnam

HP Global is a freight forwarder with a top reputation in Vietnam.

→ Contact us for freight and inbound and outbound services for shipments to/from Vietnam – Email: info@hpgloballtd.com

You can continue reading or watch the video:

Logistics HP Global Vietnam

Freight forwarder, Customs Broker and Vietnam Import/export license

Building No. 13, Lane 03, N003, Van Khe, La Khe, Ha Dong, Hanoi

Website: hpgloballtd.com / hptoancau.com

Email: info@hpgloballtd.com

Phone: ++84 24 73008608 / Hotline: ++84 984870199/ ++84 8 8611 5726

Note:

– The article is for reference only, prior to using the content, it is suggested that you should contact HP Global for whether any update

– HP Global keep it full right copy right of the article. No copy for commercial purpose is approved.

– Any copy without approval by HP Global (even note quote from website hpgloballtd.com/hptoancau.com) can cause to our claim to google and related agencies.

Tiếng Việt

Tiếng Việt  English

English  简体中文

简体中文